Sachin PalMoneycontrol Research

Mahindra Logistics and Future Supply Chain Solutions, two of the largest third party logistics (3PL) players in the country, reported strong quarterly results for the second quarter of FY19. While the financial performance of FSCS was aided by addition of non-anchor clients, MLL’s strong quarterly earnings was driven by an improvement in operating margins.

These companies merit attention of long-term investors as the consistency in their quarterly performance indicates at a secular growth trend in the 3PL sector.

Future Supply Chain Solutions (FSCS)

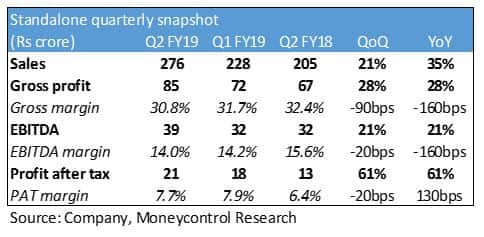

Revenues from operations increased by 35 percent to Rs 276 crore in Q2 FY19, compared to last year's revenue of Rs 205 crore. On sequential basis revenues rose 21 percent. Strong performance from the Contract Logistics segment, which contributes more than 60 percent of total revenues, drove the overall topline growth. Revenues from this segment surged to Rs 221 Crores in Q2 FY19 from Rs 151 Crores in Q2 FY18, which translates to a year-on-year (YoY) growth of 46 percent. Express logistics segment revenues grew by 11 percent whereas the temperature controlled logistics reported a flat topline.

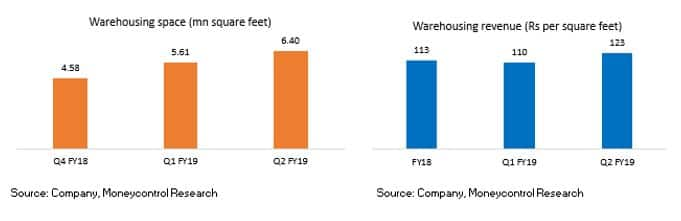

Overall gross profit margins and operating margins declined as fixed costs increased due to addition of new distribution centres as well as new warehousing space. During the quarter gone by, FSC added ~0.8 million square feet of warehousing space for its contract logistics segment. The total warehousing space at the end of the quarter stood at 6.4 mn sq. ft. During Q2, the company reported a significant improvement in average warehousing revenue to Rs 123 per square feet, which translates to an increase of 12 percent on a sequential basis.

FSCS’s integration with Vulcan Express, logistics subsidiary of Snapdeal, which the company acquired in Feb 2018 for Rs 35 crores, remains well on track. At the end of Q2, FSCS integrated 7 Vulcan warehouses with itself and also initiated a pilot project for delivery of food and grocery. The management continues to focus on rationalising Vulcan’s cost structure. Efforts appear to be bearing fruits, as the subsidiary reported an improvement in financial performance on a sequential basis. Vulcan’s revenues for Q2 FY19 stood at Rs 37.2 crores (vs 31.2 crores in Q1 FY19) while the gross profit came in at Rs 3.7 crores (vs 1.5 crores in Q1 FY19).

The company continues to diversify its revenue stream by adding non-anchor customers. In the first half of this fiscal year, FSCS has added Haldirams, Crompton Greaves and Voltbek Home Appliances (JV between Voltas and Turkey-based Arçelik) and JK Helene Curtis (Raymond Group Company) to its list of clientele. The revenue visibility for the business continues to remain strong considering the sales pipeline of Rs 400-500 Crores.

The management expects the operating margins to remain at current levels as the new warehousing facilities would take some time to reach the optimum level. Addition of new clients will lead to an improvement in capacity utilisation and aid the margin expansion over the long run.

Mahindra Logistics (MLL)

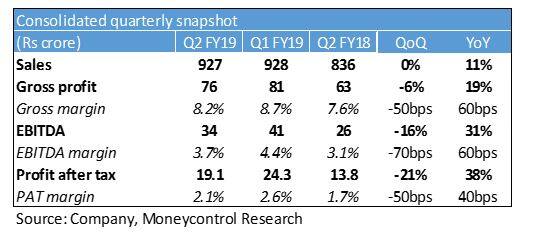

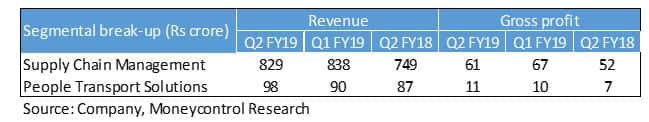

In Q2 FY19, MLL posted a revenue growth of 11 percent at Rs 927 crore. Strong performance from Mahindra Supply Chain Management (SCM) vertical as well as warehousing & other value-added segments drove the revenue growth. EBITDA jumped 31 percent to reach Rs 34 crore as operational efficiencies along with nil strategic consulting fees boosted the margin profile.

Revenue from SCM (supply chain management) segment grew by 11 percent to Rs 829 crore. Riding on the demand from auto cycle, revenues from Mahindra group clients increased by 11 percent to Rs 519 crores while the revenue from non-Mahindra clients came in flat at Rs 310 crores. Revenue from People Transport Solutions segment witnessed a growth of 13 percent during the quarter.

Revenue from Non-Mahindra clients has stagnated in the past 2 quarters as some of its clients are still evaluating business impact from Goods & Services Tax (GST) implementation and are taking longer than usual time to sign new contracts. Also, the competitive intensity has increased with the emergence of technology driven logistics start-ups. PE-backed logistic companies such as Rivigo and Delivery are disrupting the pricing in certain pockets in order to gain market share.

As growth drivers for the business, the company continues to focus on warehousing and value added services to drive revenue and expand margins. During Q2 FY19, the company signed up new clients including power equipment and aviation part manufacturer, India-based lubricant company and textile player for a range of business of business services from warehousing to distribution. The company is increasingly investing in technology and acquired strategic stake in Transtech Logistics (ShipX) to bring operational efficiencies in the SCM business. MLL has also received board approval to further increase its stake in Lords Freight subsidiary (international freight forwarding business) to 84 percent from 79 percent.

Outlook and Recommendation

The growth of logistics sector (1.5-2x GDP growth) has direct correlation with the overall economic growth. There are growing concerns about a slowdown in the economy due to a combination of macro (crude oil and rupee devaluation) and micro factors (tight liquidity scenario). While FSCS’s presence in consumption space (food, apparel, footwear etc.) makes it largely insulated from the current credit environment, MLL business could see some tapering as it has high correlation with more cyclical automotive sector which appears to be topping out. High crude oil, rising interest rates and insurance costs seems to be weighing in on demand for the automotive sector.

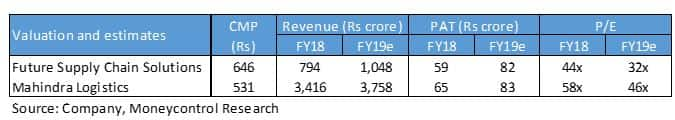

Based on FY19 estimated earnings, FSCS trades at a price-earnings multiple of 32x compared to MLL which trades at a price-earnings multiple of 46x. FSCS is expected to grow faster than MLL (owing to its consumer-centric service offering and small revenue base) and trades at significant discount to the latter. We remain confident of the growth prospects of FSCS and expect the margins and return ratios to improve as the asset utilisation moves higher from current levels. We therefore advise long-term investors should look to accumulate FSCS on corrections.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!