Nitin Agrawal

Moneycontrol Research

Tata Motors’ domestic business continues to perform better than market expectations and reported a strong set of Q1 FY19 numbers. However, Jaguar & Land Rover (JLR) continues to post subdued performance. In the near future, JLR is expected to face challenges from the rapidly evolving automotive technology, uncertainty in the UK and Europe and change in import duty structure in China.

Challenges galore in JLR

JLR wholesale volumes declined 7.7 percent year-on-year (YoY), leading to a 6.7 percent decline in net revenue. Volumes in China, Europe, the UK and North America declined 25.4 percent, 16.3 percent, 14.8 percent and 6.4 percent, respectively. Fall in China volumes was on the back of import duty change. In the UK and Europe, the same was primarily due to concerns over additional restrictions on diesel vehicles. JLR’s European and UK portfolios are predominantly diesel.

It posted a record low earnings before interest, tax, depreciation and amortisation (EBITDA) margin of 6.2 percent, down from 7.9 percent in the same quarter last year. Margin was hit due to change in import duties in China leading to subdued sales, higher marketing expenses and employee cost and negative operating leverage. The company reported a loss of £210 million for the first time since FY10 as compared to a profit of £105 million YoY.

Over £1.1 billion in investments, coupled with working capital outflow towards re-launches, resulted in negative free cash flow of £1.7 billion in Q1. Major technology changeovers and portfolio rejig would warrant higher investment for the long term. This will add to existing pressure from tough market conditions and continue to hurt operating margin. The management has projected £4.5 billion of investments for FY19.

It remains optimistic about 7-9 percent long term EBIT margin (currently at -3.7 percent) from a changed product mix, benefits of operating leverage and cost optimisation. We do not see this panning out over the next couple of years. But JLR has a strong product pipeline and an excellent track record of innovation, which should give investors enough confidence about its ability to weather the storm. It has launched its first ever electric car: the Jaguar I-Pace.

Tata Motors’ five star performance

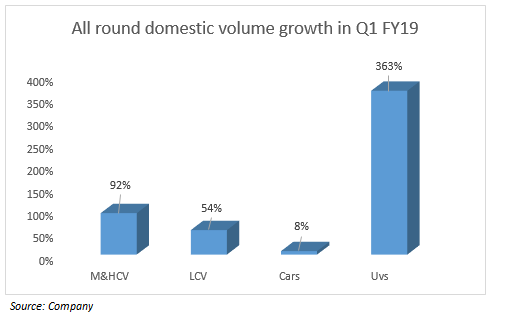

Performance of the Indian business was a big positive. Attention of the group’s senior management and implementation of the turnaround strategy is finally reflecting in the numbers. Volume growth of 61 percent YoY was broad-based and on the back of low base. Realisation improved 15 percent YoY on a favourable product mix. EBITDA margin for the domestic business witnessed significant (910 bps) expansion.

In the commercial vehicle (CV) market, demand for higher tonnage vehicles, increased government funding, growth in e-commerce and acceptance of the company’s selective catalytic reduction (SCR) technology has helped. It could gain market share after seven years. EBITDA margin for the CV business expanded 620 bps YoY driven by better product mix and operating leverage.

Launches like Nexon, Tiago, Tigor and Hexa in the passenger vehicle (PV) segment have been received well by customers. The new product launches helped it gain market share as well. Its EBITDA is near break-even (-0.7 percent). During the June quarter, it reported a pre-tax profit of Rs 1,464 crore as against a pre-tax loss of Rs 463 crore.

ValuationGiven the divergent near-term outlook, we have revised our estimates downwards. The stock is down 45 percent from its 52-week high due to continuous weakness in the business. The management has reiterated its focus on domestic CVs, PVs and technology-based investments in JLR as their key priorities going forward. We recommend avoiding the stock for the time being, pending clarity on the turnaround of the JLR business.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!