Anubhav Sahu

Moneycontrol research

Highlights:

- Market leader in varied aromatic chemicals and key chemistry processes

- Technical prowess in benzene and toluene based chemistry

- A beneficiary of easternisation of chemical manufacturing

- Robust capex program (Rs 1700 crore) over the next two years

-------------------------------------------

Aarti Industries (market cap: Rs 11,821 crore) is the leading aromatic chemicals manufacturer of India which has executed strong operational results in recent times aided by trends like easternisation of chemical manufacturing and supply-side reforms in China. Structural improvement in cost competitiveness and technical prowess extending from benzene to toluene chemistry has helped Aarti to cater to the improving demand outlook. In order to optimally capitalise the opportunity. The company is undergoing a huge capex programme and also bagged multi-year mega contracts from global players.

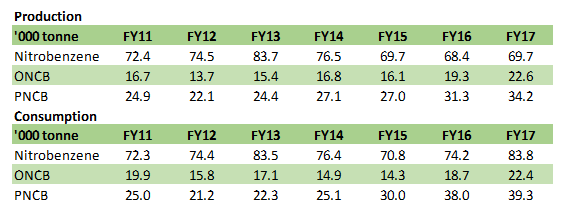

Table: Improving consumption trends for Nitrochloro benzene derivatives

Source: Ministry of Chemicals, GOI

Note: PNCB - Para Nitro Chloro Benezne; ONCB - Ortho Nitro Chloro Benezne

Leadership across varied aromatic chemicals

Aarti industries is among the top four manufacturers in the world for three-fourth of its product portfolio commanding market share in the range of 25-40 percent. While the company has three divisions, a significant chunk of the operating profit (90 percent share) comes from the Specialty chemicals. The company has positioned itself among the top five in key chemistry processes such as chlorination, nitration, ammonolysis, hydrogenation, and halex chemistry.

As far geographical mix is concerned, 45 percent of revenue comes from export market of which 50 percent comes from North America and Europe.

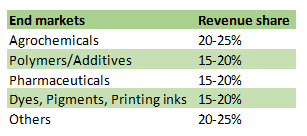

Aarti industries end markets exposure

Source: Company

Diversified to nitrotoluene value chain – revenue potential Rs 400 crore

The company commissioned its nitro toluene plant in FY18 which has already achieved utilization of 45 percent. Management guides ramp up in capacity utilisation of the nitro-toluene plant to 80-85 percent by the end of FY20.

Foray into toluene value chain was preceded by investment into ethylene-based chemistry (Rs 110 crore investment) which in turn is fed by toluene value chain products. Together this marks the production of a set of import substitution products catering to agro-chemicals, dyes, optical brightener and explosives.

Multiyear contracts – Valued at Rs 14,000 crore over the tenure

In last one year company has bagged multiyear contracts from a global agrichemical company (valued at Rs 4000 crore) and a chemical conglomerate (Rs 10000 crore), positioning company as a partner of choice for sourcing chemical intermediates. In the contract with global agrichemical company, Aarti would supply agrochemical intermediate for 10 years starting from H1 FY20. In the later contract, company would provide chemical intermediate for a period of 20 years starting from FY21.

Pharma division – improving operating performance

Other major division for the company is Pharma (15 percent of sales) which is involved in the production of active pharmaceutical ingredients (APIs) and intermediates with the applications for asthma, hypertension and cancer. It is mainly known for its capabilities to produce xanthine derivatives used for the key product Caffeine. In the quarter gone by, Pharma division exhibited improving operating performance - 40 percent growth in revenue with a focus on off‐patented generics and a relatively higher share of exports (45 percent of division’s sales).

Multiyear Capex program

Management guides for a capital expenditure of Rs 700 -1,000 crore annually over the next two years. The company has already raised a resolution to raise funds by Rs 750 crore for the same. This includes upfront investment towards the multiyear contracts with the global agro-chemical companies, capacities debottlenecking and investment in downstream products. Expected capex in the pharma division is of the order of Rs 200 crore for the next three years

The company is also setting up an R&D centre (Navi Mumbai) which is expected to start by Q1 FY20.

Outlook

In the next three years, the company expects double-digit volume growth (~15 percent) for the speciality chemicals partially aided by ramp up in the utilisation of nitrotoluene facility. Further, in the case of pharma segment, the company expects ~25 percent sales growth in FY19. Here, earnings are expected to expand by 40 percent, in the current fiscal, on the back of operating leverage.

Margins are expected to sustain on account of operating leverage as the utilization improves for both pharma and speciality chemicals divisions and receding competition from China.

Overall, product pricing is expected to remain elevated due to improved demand in segments like dyes and pigments, herbicides, engineering polymers and pharma intermediates.

The dtock of Aarti industries is trading at reasonable multiples (23x/19x FY20e & FY21e earnings respectively) factoring in earnings CAGR (FY18-21e) of more than 23 percent. Higher multiple assigned by market participants takes account of the global scale of operations, wider product offerings and stable revenue visibility on account multi-year contracts with some of the global chemical companies. Additionally, decision to hive off (by end of FY19) loss-making Home & Personal Care segment (5 percent of sales) also augurs well for the valuation. Follow @anubhavsays

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!