Jitendra Kumar GuptaMoneycontrol Research

After a long time, Coal India (CIL) has reported a decent set of numbers. It posted a 7 percent year-on-year growth in coal offtake and spurt in realisations that led to 10 percent YoY growth in sales during FY18.

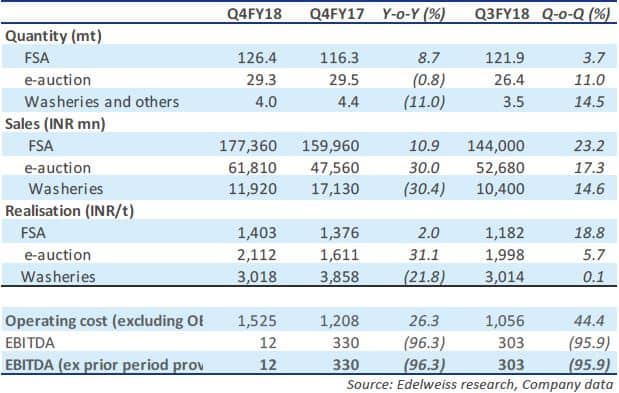

Thanks to higher production and better realisations, operating margin expanded by about 460 basis points, which led to a strong 28.3 percent YoY growth in adjusted earnings. The company undertook a price hike in January, the impact of which was seen in the March quarter, whereby blended realisation came at about Rs 1,550 per tonne as against Rs 1,359 a tonne in Q3 FY18. During the year, the company delivered close to 580 million tonne of coal led by demand recovery from the industrial and power generation.

Further headroom for growth

The company’s future prospects remain bright. For FY19, the management has set high targets, guiding volumes of about 630 million tonne, which translates in a YoY growth of about 9 percent. The fiscal would also see the full impact of recent price revisions implemented by CIL and higher prices for e-auction coal, which translates to about Rs 6,000 crore of benefits on an annualised basis.

Full impact of the levy of coal evacuation and transport charges would be seen in FY19, thus adding to overall sales and realisations. Growth would be driven by both volume and higher realisations. In terms of evacuation, the company has been able to secure additional rakes from the railways to achieve its targeted volume growth.

Valuations attractive

Concerns over wage revision and gratuity are now easing as most of these expenses, including past arrears, have been provided for in FY18. Absence of these expenses in FY19 should result in better earnings.

CIL is looking to invest about Rs 13,000 crore for a 1,600 megawatt (MW) pit-head power plant along with NTPC. This is expected to provide better yield on its cash reserves of Rs 30,000 crore, which is parked with banks. Low risk and high yield on its cash reserve would result in better returns and improvement in cash flows, thereby improving its earnings profile.

The company is expected to report an earnings per share (EPS) of about Rs 27 a share in FY19. At the current market price of Rs 289 a share, the price-to-earnings works out to 11 times, which is quite reasonable and offers scope for appreciation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!