Nitin Agrawal Moneycontrol Research

Highlights - Leadership position in respective markets - Raw material prices continues to be a concern - Demand sluggish in the near term, long term outlook positive - Deserves premium valuations given strong fundamentals

--------------------------------------------------

In our endeavour to find auto ancillaries having strong fundamentals as well as long term prospects, we have chosen Wabco India (Wabco) and Bosch. Both of these are sound long term portfolio candidates, primarily, due to their leadership positions in the respective markets, and positive long term end market outlook. On the back of their strong financial track record, they deserve premium valuations.

Following are the key growth drivers for the companies, going forward:

Leadership stature Both Bosch and Wabco enjoy leadership position in their product segments. Bosch has garnered 75 percent market share in diesel injection systems and Wabco has 85 percent market share in air braking system. Wabco continues to remain preferred supplier to its parent as well. Bosch, on the other hand, has technological leadership among auto ancillary companies and its technological prowess makes it one of the few companies that have bargaining power with original equipment manufacturers.

Industry opportunities sluggish in the near term The fortunes of both Wabco and Bosch are directly correlated to growth in the commercial vehicle (CV) segment. CV demand has been strong and is outperforming industry growth. Domestic CV volumes grew 19.9 percent YoY in FY18, much higher than overall industry growth of 14.2 percent.

However, the near term outlook for the CV segment is subdued on account of macroeconomic challenges led by slower growth, liquidity concerns and rising interest rate. Demand in the near term is expected to be sluggish, but the long term outlook continues to be positive on the back of economic growth, rising income levels, lower penetration, government’s thrust on increasing rural income and focus towards infrastructure and construction.

Bharat Stage VI emission norms, to be implemented from April 2020, are expected to lead to pre-buying. This is due to the fact that the new BS-VI compliant vehicles would be more expensive. Moreover, BS-VI emission norms are expected to open new avenues for Bosch in 2W space as carburettors would be replaced by an injection system.

Additionally, the government’s scrappage policy would potentially lead to replacement of 200,000-300,000 trucks which are over 20 years old. This would generate additional demand for the company's products.

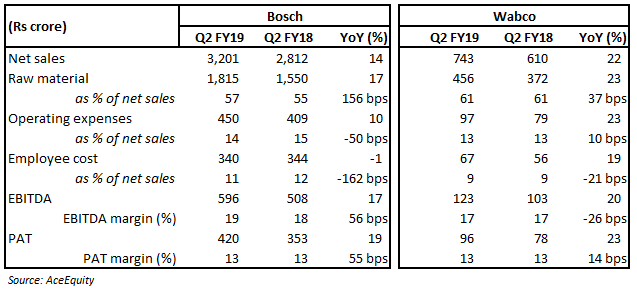

Positive recent quarter performance  Mirroring strong growth in the commercial vehicle (CV) segment, Wabco posted a 21.8 percent year-on-year (YoY) growth in its net sales aided by impressive domestic demand in medium & heavy commercial vehicles (M&HCV) segment and higher content per vehicle that led to revenue growth of 32.1 percent in the domestic business. Export business, however, grew 1.7 percent due to discontinuation of models by its major customer.

Mirroring strong growth in the commercial vehicle (CV) segment, Wabco posted a 21.8 percent year-on-year (YoY) growth in its net sales aided by impressive domestic demand in medium & heavy commercial vehicles (M&HCV) segment and higher content per vehicle that led to revenue growth of 32.1 percent in the domestic business. Export business, however, grew 1.7 percent due to discontinuation of models by its major customer.

Bosch posted a 13.8 percent growth in net sales led by healthy growth in the automotive segment. Revenue for the latter was supported by strong demand for power train and aftermarket division, which grew 20.9 percent. Non-mobility segment saw healthy growth (16.3 percent) driven by energy and power tool division.

Higher raw material (RM) prices marred operating profitability for both companies. Earnings before interest, tax, depreciation and amortisation (EBITDA) margin contracted 26 bps for Wabco.

Bosch, on the other hand, expanded its EBITDA margin by 56 bps. This was led by the reduced operating and employee costs.

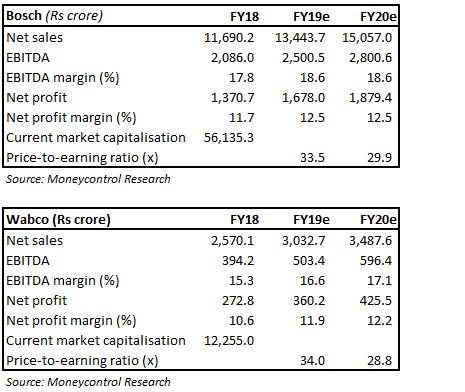

Deserve premium valuation Recent correction in stock prices have made valuations more comfortable. Bosch/Wabco are trading at valuations of 33.5/29.9 and 34/28.8 times FY19 and FY20 projected earnings, respectively. Given the very strong financial performance, these companies deserve a premium valuation. We, therefore, advise investors to buy these businesses in a staggered manner with an eye on the long term.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!