Nitin Agrawal

Moneycontrol Research

Highlights:

- Decline in volume and realisation led to decline in topline

- M&HCV segment continues to remain weak

- Operating margin maintained above 10 percent

- Near term business outlook sluggish, positive for the long term

- Valuation attractive

--------------------------------------------------

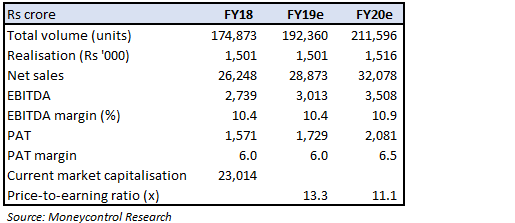

In a very weak industry environment, Ashok Leyland (AL) posted a decent set of Q3 FY19 earnings. Though the company witnessed a decline in its volume and net revenue, it could maintain its operating profitability above 10 percent. The industry outlook for both domestic and export markets remains weak in the short term. However, the long-term outlook remains positive. Strong position in the market, bringing forward of buying ahead of rollout of Bharat Stage VI norms, scrappage policy and attractive valuations make it a long term buy.

Quarter at a glance

Key highlights

In terms of quarterly performance, the company has posted a 12 percent fall in net revenue, led by volume and realisation decline of 6.1 percent and 6.3 percent, respectively.

The fall in volume was led by a 16.5 percent decline in medium and heavy commercial vehicle (M&HCV) segment volumes, but was partially offset by a 27.7 percent increase in light commercial vehicle (LCV) volumes. Weakness in realisation was due to intense competitive intensity leading to rampant discounts and weaker product mix.

AL continues to maintain its profitability above 10 percent due to higher spares and LCV sales. Its operating profit margin contracted 140 basis points (100 bps=1 percentage point). The management expects cost savings of 150 bps due to modularity programme in FY21.

Outlook

Strong market presence

On the back of superior technology and products, the company continues to have a strong market presence. This also led to market share gains for the company. AL, however, witnessed a 140 bps year-on-year (YoY) contraction in its market share due to aggressive pricing by its competitor. We believe that it would continue to maintain and/or gain market share going forward.

Industry opportunities to continue

The domestic market has been facing challenges on the back of weakening macroeconomic environment leading to muted sentiments for automobile sector, including CV and PV segments. Subdued market sentiments are on account of liquidity problems, financing issues, rising interest rates and slowdown in economic activity. This was, further, aggravated by the lag impact of new axle load norms in the CV segment.

We expect demand to remain weak in the short term, but our long-term growth outlook remains promising on the back of economic growth, rising income levels, lower penetration, government’s thrust on increasing rural income and its focus towards infrastructure and construction.

Upcoming BS-VI emission norms is the near term driver for the company. This is expected to lead to bringing forward of buying as new BS VI compliant vehicles would be more expensive than current ones. Additionally, the government’s scrappage policy would potentially lead to replacement of 200,000-300,000 trucks, which are over 20 years old. This should also augur well for the company.

Focus on the international market

The company is facing challenges in some export markets, like Sri Lanka and the Middle East, due to political uncertainty and volatility in oil prices, respectively, whereas Bangladesh continues to perform well. The management expects the export market to be the next leg of growth for the company. It said that AL initially used to export only buses but now they export their entire product range, which would help it gain market share. In fact, it has started focusing and manufacturing more left-hand driven vehicles.

Strong position in defence

The company had identified defence as one of the key growth drivers for the future and continues to focus in that direction. The management believes that the government’s increasing focus on defence is very positive for the long-term prospects of the sector.

Attractive valuationAmid market volatility and the departure of its MD and CEO, Vinod Dasari, the stock has corrected quite significantly making valuations attractive, thereby giving investors an opportunity to accumulate. At the current price, the stock trades at an attractive valuation of 13.3 times and 11.1 times FY19 and FY20 estimated earnings, respectively.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!