Recent PMI numbers for China may not spring a big surprise to the market given ongoing US-Sino trade war and WTO trade outlook downgrade. However, trade war has emerged as a headline risk factor as the weak global trade scenario can drag the global growth trajectory. Unlike earlier times, this time trade slowdown is likely to be led by supply concerns rather than demand. This eventually also means remapping of the supply chain in a few industries which may have positive implications for India.

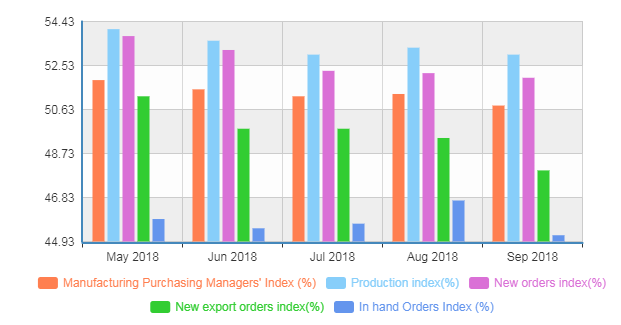

China PMI: New export orders downA leading indicator for business sentiment, Caixin manufacturing PMI for China has been below consensus estimates, with concerning lows in recent times for new export orders. The report highlights stagnant operating conditions at the end of Q3 2018 after an improvement in the previous 15 months. China’s official PMI (National Bureau of Statistics) numbers show new export orders are down to 48. A reading below 50 signifies contraction in the survey participant’s expectation for export orders.

Chart: National Bureau of Statistics PMI components

Source: National Bureau of Statistics, China

Caixin report mentions that new export orders declined steeply (since February 2016) amid reports that the China-US trade war and subsequent tariffs had impacted foreign sales. Other details paint a grimmer picture; suppliers delivery time has lengthened (strict environmental policy), purchasing cost has risen (price hikes for raw materials) and there has been a shrinkage in the workforce.

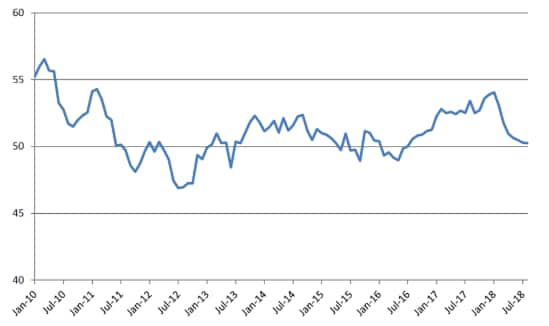

WTO downgrades outlook for world tradeWeak data for export orders were broadly anticipated, as WTO’s World trade outlook indicator (WTOI) suggested a slowdown in trade momentum since Q1 2018. It is noteworthy that WTOI combines various relevant leading indicators like container port throughput, air freight shipments, export orders, automobile sales, electronic components trade and raw materials.

Chart: Global PMI new export orders have declined to levels seen in early 2016

Source: IHS Markit

As a culmination of such traction so far this year, WTO last week downgraded the global trade outlook for both current and next year. WTO has recently adjusted its trade volume growth outlook for 2018 to 3.9 percent YoY (from 4.4 percent) and for 2019 to 3.7 percent (from 4 percent). Multilateral body cited rising trade tensions pose the biggest risk to the forecast along with monetary policy tightening and associated financial volatility.

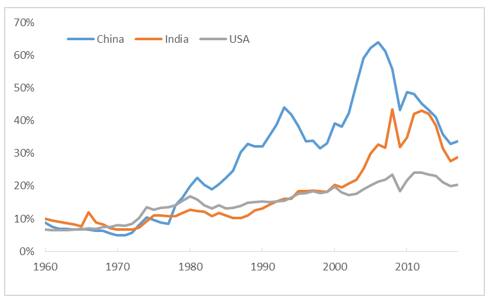

Trade turnover remains a significant factorSince the early eighties, in dollar terms, growth in trade turnover (exports plus imports) has been higher than that of GDP growth rate for the major nations of the world. In a way, this captures the impact of prevailing globalisation. Between the year 1980-2007, trade turnover CAGR has been higher than GDP growth rate by 4.7 percent and 1 percent, respectively for China and the US. While the trade turnover momentum has been impacted by global financial crises of 2008, in recent years it has seen improvement on account of synchronised recovery in the Eurozone, the US and select emerging markets.

Last two financial market crises -- the dot com bubble (2000-01) and subprime crises (2008-09) witnessed coincidental movement in trade slowdown along with GDP slowdown for both China and the USA. Given this context, trade outlook downgrade needs to be tracked closely.

Chart: Trend for trade turnover (as a % of GDP)

Source: WTO

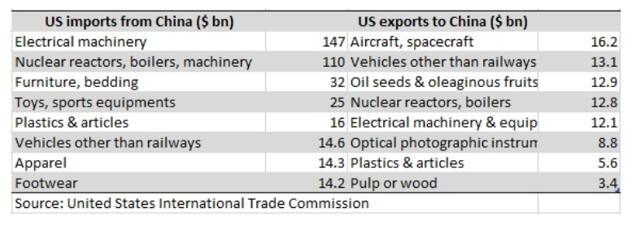

Re-mapping of supply chainWhile demand slowdown is the pivotal factor to track, trade slowdown in the immediate future is also guided by remapping of the supply chain. In our earlier note, we highlighted how some of the India chemical companies could benefit as the sourcing of chemicals are directed to India.

In the ongoing trade war, some of the US exports to China could emerge as a potential opportunity for India. Latest in news is that China is set to resume import of oil meal from India (mainly rapeseed) used as an animal feed. It is noteworthy that import of rapeseed was banned by China in the year 2012. Now, oil meal is amongst the major imports from the US, which in light of higher tariffs and improved demand needs to be sourced from an alternate destination. News report suggest, China’s potential import for rapeseed from India could be double the quantity already exported by India (5 lakh tonne in H1 FY19) to rest of the world. Companies which could benefit include Adani Wilmar, Gujarat Ambuja Exports and Nafed.

Table: US-China import-export

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.