Neha Dave

Moneycontrol Research

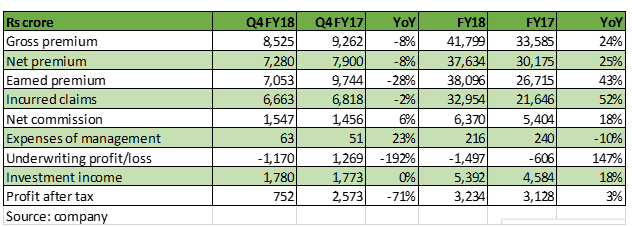

GIC Re, India’s largest reinsurance company, reported a 24% growth in consolidated gross premium income for financial year 2017-18. Full year earnings would have been even better, but for the weak performance in the final quarter. On the whole, it was a difficult year for global reinsurers because of natural disasters across the globe.

While there is inherent volatility in the core risk-underwriting business, GIC Re is the only listed reinsurer, making it a stock worth looking at.

India’s largest reinsurer

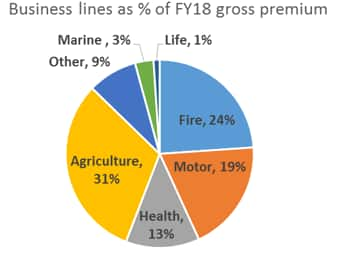

GIC Re accounted for close to 60 percent of the premiums passed on by Indian insurers to reinsurers during FY17. With growing international presence (29 percent of total premium now), the company is the 12th largest reinsurer in the world and the third-largest in Asia in terms of gross premiums accepted. Though the exposure is in non-life insurance segment, the product portfolio is well diversified across business lines.

Source: Company

Being the leader in reinsurance in India, GIC has competitive strengths in the domestic market in terms of strong underwriting and actuarial capabilities. That said, the recent change in regulations enabled foreign reinsurance companies to compete in India following which 10 foreign players opened their branches in the country.

Despite this change, we expect GIC Re to continue to retain its dominant position because of two factors. First, it has built strong relationships with insurers companies and has superior data from 44 years of underwriting. Secondly, current regulations mandate that GIC Re be given first preference by Indian insurers wanting to reinsure risks. There have been recommendations that this rule be scrapped to allow for competition from foreign reinsurers. However, IRDA is yet to consider the same. Indian non-life insurers are compelled by regulation to cede 5% of premiums on every policy to GIC Re.

FY18 earnings at glance

GIC Re’s gross premium from domestic markets grew 27 percent year-on-year and international business recorded a growth of 18 percent. The growth in domestic premium was driven by a 35 percent increase in crop insurance premium. This is now the largest product line for the reinsurer. GIC Re substantially increased its exposure to the agricultural segment in FY17 by reinsuring crop insurance under the Indian government’s Pradhan Mantri Fasal Bima Yojana (PMFBY) scheme.

Financial snapshot

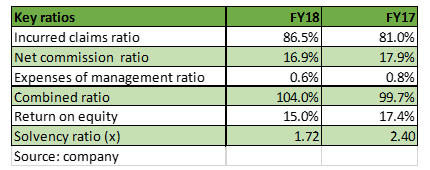

Despite good premium growth, the reinsurer reported an underwriting loss for FY18. The combined ratio, measure of insurance company’s profitability expressed as total cost to total revenue, weakened to 104 percent for FY18 from 99.7 percent in FY17. The deterioration in combined ratio was mainly on the back of increase in the claims/loss ratio from 81 percent in FY17 to 86.5 percent in FY18 while the commission and expense ratio was slightly better for the year.

The combined ratio of domestic business came in at 98 percent despite the poor performance in crop insurance. The overall performance was dragged down by losses due to global catastrophes. The international business saw combined ratio deteriorate to 116% due to huge losses in Harvey, Irma and Maria hurricanes in the USA and the Caribbean alongside Mexican earthquake and California wildfires.

Despite the underwriting loss, the solvency ratio at 172 percent was comfortably above the regulatory requirement of 150 percent. The management sounded confident of maintaining growth for next couple of years before having to raise fresh capital.

It expects 16-18 percent growth in premium for FY19 driven by health and motor insurance. Further, it intends to bring down the combined ratio below 100 percent by reducing commissions in the crop segment.

Sectoral tailwinds to drive growth

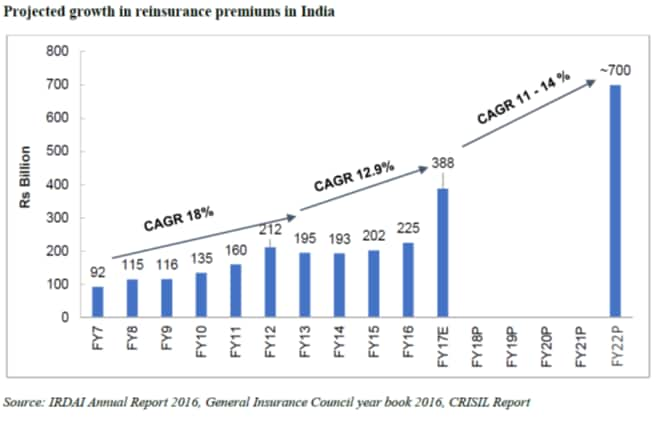

The Indian reinsurance market, estimated to be around Rs 388 billion, has witnessed compounded annual growth rate (CAGR) of 15 percent in the past 10 years. Given that most reinsurance premiums written in India comes from the non-life segment (an average 95 percent in the past five years), future growth in reinsurance premiums will be driven by growth in the non-life insurance segment as well as percentage of premiums passed on to reinsurers.

There are several growth levers that will drive the high-teen growth of non –life insurance premium over next few years. India continues to be a grossly underpenetrated market with non-life penetration at one fourth of the global average in 2016. The insurance density (non-life insurance premium per capita) also remains significantly lower than other developed and emerging market economies. Further, we see multiple tailwinds for the underlying segments as well. Higher cost of healthcare and rising incidences of critical illness will likely increase health insurance penetration. Increase in new vehicle sales will be a key growth driver for motor insurance segment.

This will increase the insurance premium ceded to reinsurers, and retention ratios could also increase from 70 percent observed in FY2017. Accordingly, reinsurance premiums in India is expected to increase by 11-14 percent CAGR over the next four years to Rs 700 billion by FY2022 as per Crisil.

Premium valuations to sustain

GIC Re is well poised for growth with an increase in insurance penetration, focus on profitable segments and improvement in operating efficiency. Though we are comfortable about GIC Re in the long run, owing to inherent volatility in the core risk-underwriting business, the stock could be volatile in near term. The stock is already down by around 19% since its listing in October 2017.

The current valuation looks slightly expensive as the stock is currently trading at 3 times its trailing book with return on equity at 15 percent. We have seen that leading companies in sectors with consistent growth tend to trade at a higher multiples for long periods. So, in the absence of a comparable listed peer, GIC Re trades as a proxy for the sector and commands a premium. While valuation could remain expensive, stock performance will react to underwriting performance.

Nevertheless, for investors with long term horizon and wanting to participate in the growth in the reinsurance sector, the stock is worth a consideration.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!