Madhuchanda DeyMoneycontrol Research

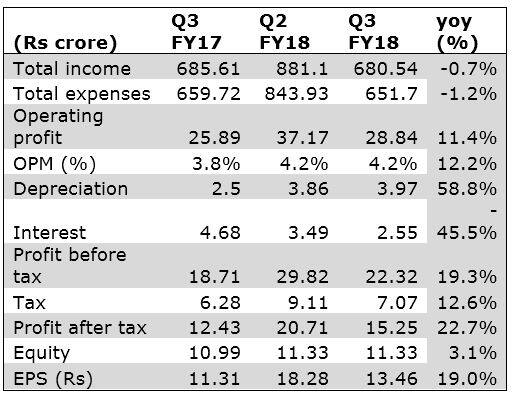

Dixon Technologies’s December quarter numbers were subdued, as the stellar performance of the lighting products division was offset to a large extent by weakness in other segments. However, the management is confident of a revival and does not expect too many headwinds.

Weakness in the consumer electronics business weighed on topline. An early Diwali affected demand; in the mobile phone business, trouble with one of its key clients Gionee continues to hurt numbers.

While overall sales were lower, margins were maintained because of the strong performance of the lighting division. The company repaid some of its debts with the funds raised from the initial public offering. Lower interest costs, as a consequence, helped profitability despite higher capital expenditure on expanding capacity and upgrading infrastructure.

Consumer electronics not only suffered from a lower top-line, but margins were weaker too on account of site transfer from Dehradun to the new Tirupati facility. So, margins could rise at least 100 basis points in the final quarter of FY18. The offtake from a key client Panasonic has picked up in recent times and the company has started production for a leading LED TV brand Skyworth.

The strength in the lighting products business continued with the company substantially ramping up production especially of LED bulbs and deepening relationship with its marquee clientele. Imposition of customs duty on luminaires (downlights and batten) should encourage more domestic manufacturing. Hence, the momentum in this business should sustain.

There has been a decline in the ODM (original design manufacturing) share in this business as the second tier brands which are typically the ODM clients, are yet to see a demand revival. The management expects the ODM share to touch double-digits in FY19.

The home appliance business is at a tipping point according to the management and it expects margin to increase by at least 200 basis points in FY19. Dixon added Lloyd as a customer in November-17 and Micromax in January-18.

The mobile phone business continued to suffer from low capacity utilisation. The company is diversifying into new areas like manufacturing of feature phone, adding new clients (like Blaupunkt in Q3) to improve capacity utilisation. The management maintained that it is in advanced stage of discussion with a large client that should fructify in the coming quarters. The company expects the government to impose customs duty on PCBA (printed circuit board assembly) that should give a push to domestic manufacturing.

The Reverse Logistics business was negatively impacted on account of saturation in digital set top boxes. However, the company’s offerings in this space - repair and refurbishment services of set top boxes, mobile phones and LED TV panels--is a key differentiator that helps in on-boarding clients for its core OEM (original equipment manufacturers) or ODM (original design manufacturing) businesses. Few EMS (Electronic Manufacturing Service) companies provide end-to-end solution that encompasses repair and refurbishment services.

Dixon’s latest facility at Tirupati is manufacturing new products like security systems – CCTVs and Digital Video Recorders under the trademark “CP Plus”. The higher customs duty on security equipment should encourage indigenous manufacturing. This new business should contribute to 5-7% of revenue in FY19.

We feel Dixon has unique moats that will translate into secular earnings going forward

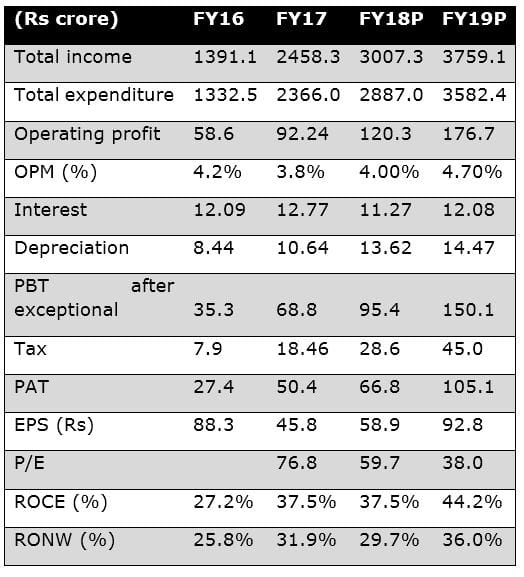

Dixon has an asset-light business model. On a total fixed asset base of Rs 139 crore, the company generated a turnover of Rs 2457 crore in FY17. In fact, the new facility that it is setting up in Tirupati has been leased to the company at a very nominal rate and enjoys SGST (state Goods & Service Tax) benefits.

Presently OEM contributes to close to 80% of revenue of Dixon, but at single-digit margins. ODM contributes 20% of the revenue but earns high single-digit margins. Going forward, the company wants to expand its presence as an ODM that should be a key driver of margin.

Dixon has backward integration in major manufacturing processes that improves cost efficiency, reduces dependency on third party suppliers and gives better control on production time and quality.

It has long and well-established relationship with marquee clients. Most of the client-relationship are long-term and therefore sticky. Globally, big brands focus energy on brand building and distribution, leaving manufacturing to trusted partners.

Government is encouraging indigenisation of electronics manufacturing. For instance, the Union Budget has made a beginning with increase in the customs duty of a number of products.

The company is continuously looking at expanding in contiguous product categories and we believe its smart execution strategy would result in decent earnings growth.

The stock trades at 38 times FY19 projected earnings and deserves attention for gradual accumulation in the post earnings correction.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!