Krishna Karwa

Moneycontrol Research

Government’s ambition to achieve rural electrification and provide affordable housing, rising disposable incomes, growing demand for electrical products and shorter replacement cycles have been the key drivers for companies like Crompton Greaves Consumer Electricals in recent times.

GST, that facilitates the transition of business from unorganised entities (roughly 60-70 percent of the industry size at the moment) to organised players like Crompton, may also bring some much-needed relief to a sector that has borne the brunt of pricing pressure over the years.

Crompton, with a market cap of Rs 15,653 crore, is one of India’s leading manufacturers of electrical consumer durables (covering fans, pumps, geysers, mixer grinders, toasters, irons) and lighting products.

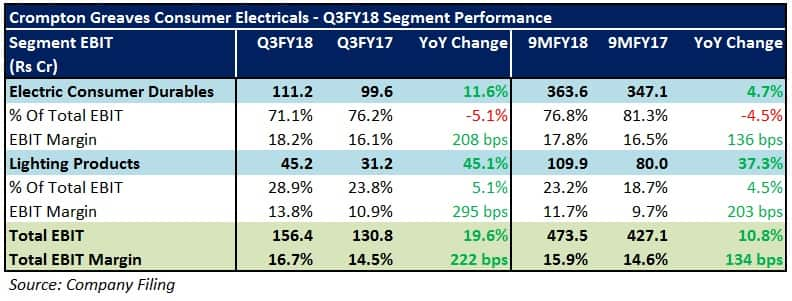

The company reported a decent set of numbers in Q3FY18 despite a soft revenue performance.

Even as teething issues related to GST implementation eased to some extent in the quarter gone by, sales of Crompton’s electric consumer durables segment de-grew marginally year on year (YoY), thereby suggesting that restocking is far from complete in the wholesale channel.

Traction in the lighting division, in stark contrast, was pretty robust due to higher contribution of LED variants to the segment’s revenue (70 percent in Q3FY18 versus 55 percent in Q3FY17).

Going forward, what may work for the company?

Product repositioning

Crompton intends to focus more on air coolers and water heaters. While the former will cater to the mass market, the latter will enable the company to gain market share in a space with immense growth potential.

Marketing

Crompton aims to continue expanding its existing distribution reach of approximately 1,00,000 touch points pan-India. It will undertake aggressive promotional activities to boost the sale of premium fans, LED lighting devices, air coolers, and water heaters.

Fans

Gradual revival of India’s housing sector augurs well for Crompton’s fans portfolio, which can grow by 6-8 percent. Moreover, the company will emphasize more on high-quality fans (that presently constitute 20 percent of the total fans turnover), while simultaneously retaining leadership in ceiling fans.

Lighting

Given the favourable prospects of LEDs in India, Crompton, the second-largest lighting company in the country after Philips, is shifting its attention towards this segment with the objective of increasing the contribution of LEDs to the lighting segment’s top-line from the current level of 70 percent.

Tie-up

Crompton partnered with Future Supply Chain Solutions to leverage the benefits of GST, reduce logistical overheads, and improve its delivery capabilities through the hub-and-spoke model (one large distribution centre will supply goods across various states to retailers).

What’s the outlook ahead?Crompton’s earnings visibility may improve by virtue of a strong order book (orders for 4,00,000 fans to be executed in 6 months, lighting orders worth Rs 50 crore to be executed in the near-term), a shift towards product premiumisation, and higher advertisement spends.

However, Crompton’s competitors seem to be upping the ante (especially in relation to geysers and residential pumps) quite a bit. Unlike Havells and V-Guard, the company hasn’t been able to pass on most of the hike in commodity prices to customers.

Crompton hopes to accelerate growth with the introduction of coolers in its target markets in the next few months, supplying pumps in the mid-price range (especially in northern and eastern India), and launching new varieties of geysers in the first half of next year.

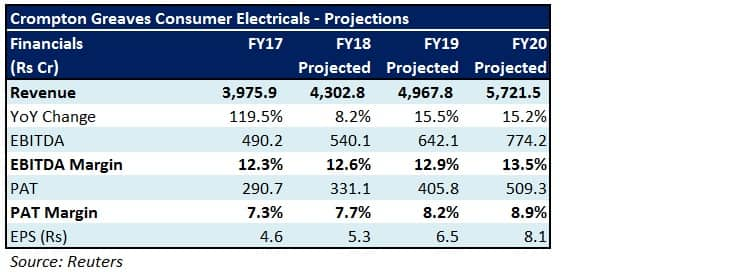

However, at 30x FY20 projected earnings, the valuation factors in most of the tailwinds. Investors should wait for weakness to accumulate the stock.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.