Despite huge coal reserves at its disposal, Coal India’s massive size is fast turning out to be a limiting factor to ramp up production. Like in the past, the pressure to increase production output stays. Absence of adequate supporting infrastructure has become a key hindrance to growth.

Last fiscal, the company produced close to 600 million tonnes of coal. That’s huge in terms of scale, which is equal to 50 percent of India's total coal requirements. Even an increase of 10 percent or close to 60 million tonne of additional coal on such a base requires a large supporting infrastructure to evacuate and transport coal through railways and road to end users.

Now, if it cannot grow organically, investor pressure is mounting to return the excess cash or deploy it in activities that can be equally remunerative.

Unfortunately, CIL’s capital allocation policy leaves a lot to be desired. Over the past 13 years, the company has generated an average return on capital at close to 50 percent, which includes treasury income on cash deposited in banks.

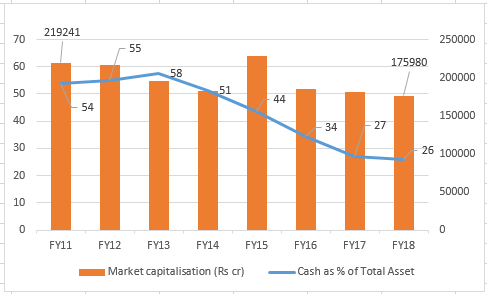

Despite an impressive core return, the company has been sitting tight on cash. On an average, during these years, its cash stood at 43 percent of total assets, pretty high compared to the prudent capital allocation practices followed globally.

It essentially means close to half of investors' gain comes from the treasury income generated by the cash in banks.

To give due credit, CIL has made a course correction by going in for a higher dividend and buyback of shares. However, the company is still under immense pressure to deal with the burgeoning cash load in the books. It is sitting on a cash and cash equivalent of about Rs 30,000 crore.

To deploy this money, in the past, it formed a JV with NTPC to develop power generation projects. The funds also found their way to revival of a few PSU fertiliser plants and development of about 1,000 mw solar power in partnership with a government agency.

The coal producer has pumped in a significant amount of money in many of these projects, but the fact of the matter is their contribution has been zero and some of them are even running up losses.

Coal India is now turning to Australia, with an eye on acquiring the sub-continent’s coal assets for nearly Rs 6,000 crore. Here again, this could be a risky proposition, considering the company's limited expertise and understanding of international markets. Notably, those which tried their luck in Australia in the past have run into a rough weather because of unpredictable government policies and local opposition to such projects.

The instances, in fact, are many. Even after about a decade of acquisition of coal mines in Australia, the Adani Group finds the going tough to start work for its $2 billion project. Finally, on June 13, Adani Enterprises received the go-ahead for the controversial coal mine after a state government approved a final permit on ground water management. Adani has said it's ready to start construction "within days" of receiving the permit for its Carmichael mine.

Earlier, Lanco had to go through a similar ordeal and fought a legal battle after it won coal assets in Australia. The GVK Group is no better as its coal acquisition in Australia in 2011 for $1.2 billion is going nowhere. After a long wait, it took impairment on these assets, citing reasons such as lack of infrastructure and breach of other agreements.

The bottomline is despite intensive due diligence, Indian private players have burnt cash in Australia. Their experience is far from pleasant and investors had to bear the brunt of it.

So, that makes it imperative for Coal India to critically assess these opportunities and get a full grasp on the risks associated with these assets.

India sources bulk of its coal requirements from Australia. Acquiring coal assets is in the interest of the country in terms of coal security and saving foreign exchange in case prices go up in future.

However, considering the not so pleasant past experience and other associated risks, it needs to be seen if Coal India can reap economic dividends in the long run. It needs to answer if the risk is worth taking, or returning the cash back to investors is a better option.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!