Banking stocks constitute a large part of the Nifty’s weight, and rightly so, given that they are the backbone of any economy. However, in the last three years, they have not performed as investors would have liked them to.

In the meantime, valuations have also taken a beating amid worries over recession in the economy and the risk of growth in bad loans due to the pandemic. This happened when most of the market was outperforming.

So, what is the best time to invest in bank stocks so that investors can make the most of their money? Money managers believe it is not right to time the market, but you can definitely get guidance from history.

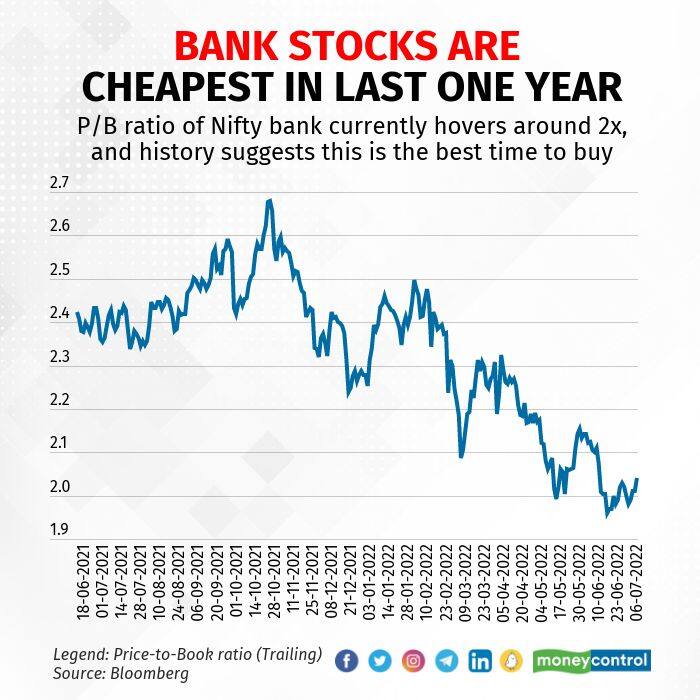

“Historically, if you were to keep investment in Bank Nifty in periods when it is trading below 2 times trailing price to book (PB) value, it delivers exciting returns over the next few years,” said DSP Mutual Fund.

The money manager said in such periods the 1-year, 2-year and 3-year CAGR turned out to be 39 percent, 24 percent, and 20 percent, respectively. As of Wednesday, Bloomberg data shows the PB value of Nifty Bank to be at 2.04 times. It was below 2 times in June 2022.

“We don’t know what will happen in the next few years, but history says buy banking sector stocks when they are cheap. And they are!” said DSP Mutual Fund in a note.

The fund manager, which has assets under management (AUM) of Rs 1.06 lakh crore as of May 2022, said India’s banking credit growth is recovering after a long time.

India’s banking sector has faced multiple headwinds since the global financial crisis. The years of credit growth post the global financial crisis of 2008 resulted in huge non-performing assets (NPAs) which took years to get resolved.

The introduction of demonetisation, Goods and Services Tax (GST), Insolvency and Bankruptcy Code (IBC), and then the COVID-19 shock delayed the banking sector clean-up and recovery. Now things have improved a lot, it seems. As per RBI estimates, the banking sector will have one of the lowest gross NPA ratios in over two decades in FY23.

“At this time, most of these (headwinds) are accounted for. What’s interesting is credit growth revival and cleaner bank balance sheets are available at a time when banking sector stocks haven’t done well. A bullish set-up for banking sector stocks,” said DSP Mutual Fund.

In the long term, the performance of PSU banks has been worse than private banks as they had most of the bad loans in their books. Nifty PSU Bank is down 26 percent in the last five years, while Nifty Private Bank is up 32 percent in the same period. Nifty Bank has registered a growth of 46 percent. In the near term, though, the index has seen selling pressure. Year-to-date, Nifty Bank is trading down nearly 6 percent, while in the last one year it has fallen about 4 percent.

Madhu Kela, Founder of MK Ventures, and a veteran investor, also believes this is the best time to buy banking stocks. He believes some of the mid-cap banks including Canara Bank and Karur Vysya Bank (in which he is invested) have surpassed their own guidance of growth and credit cost. They have high provision coverage, which keeps them prepared for any contingencies, going ahead.

According to him, what is also working for many banks is recovery from assets that they have either written off or are fully provisioned for. Canara Bank, for instance, has guided for recovery of around Rs 15,000 crore this financial year.

Bank and financial stocks are also where the analyst community is the most bullish. According to Bloomberg data, ICICI Bank, State Bank of India (SBI), and Housing Development Finance Corp (HDFC) have only ‘buy’ ratings and no ‘hold’ or ‘sell’ calls. ICICI Bank and SBI have 50 ‘buy’ calls each, while HDFC has 29 ‘buy’ calls.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.