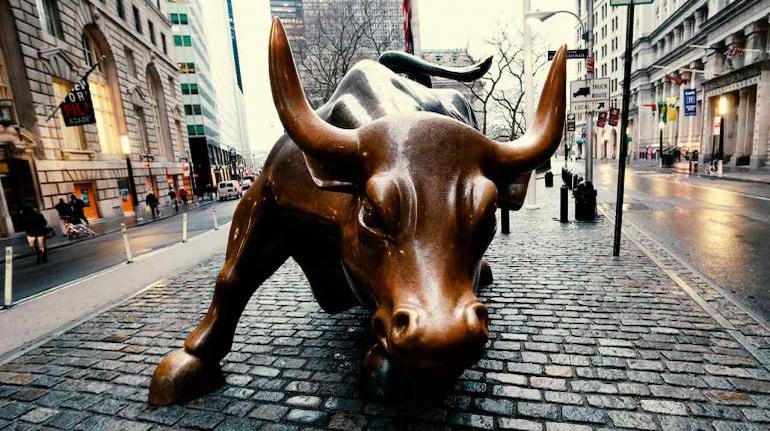

Wall Street stocks opened lower Monday, joining a selloff that began on European bourses as the latest wave of western sanctions targeting Russia added to worries about inflation.

The United States over the weekend announced punishing sanctions on Russia that touched on its central bank and the ability of some financial institutions to access the SWIFT financial messaging system.

ALSO READ: Wall Street rallies as West hits Russia with new sanctions

As trading began in New York, investors retreated from riskier assets while seeking out precious metals, Treasury bonds and other safe-haven investments.

"The impression coming off the weekend is that Russia, and all those that oppose Russia's invasion of Ukraine, are digging in for a longer and more damaging battle on the military, financial and economic fronts," said Briefing.com analyst Patrick O'Hare.

"Not surprisingly, the risk-off trade is back on this morning."

About 15 minutes into trading, the Dow Jones Industrial Average was down 1.2 percent at 33,657.92.

The broad-based S&P 500 dropped one percent to 4,340.69, while the tech-rich Nasdaq Composite Index shed 0.9 percent to 13,574.60.

This week's calendar includes congressional appearances by Fed Chair Jerome Powell expected to focus on the central bank's efforts to counter inflation, as well as several key economic reports, including February jobs data.

Among individual companies, First Horizon jumped 29.4 percent after it agreed to be acquired by TD Bank for $13.4 billion. TD fell 1.3 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!