Several unlisted stocks, which had witnessed a sharp rally since the beginning of 2025, have undergone a steep correction from their June highs as investors turned cautious after a series of initial public offerings (IPOs) were priced significantly below grey-market levels.

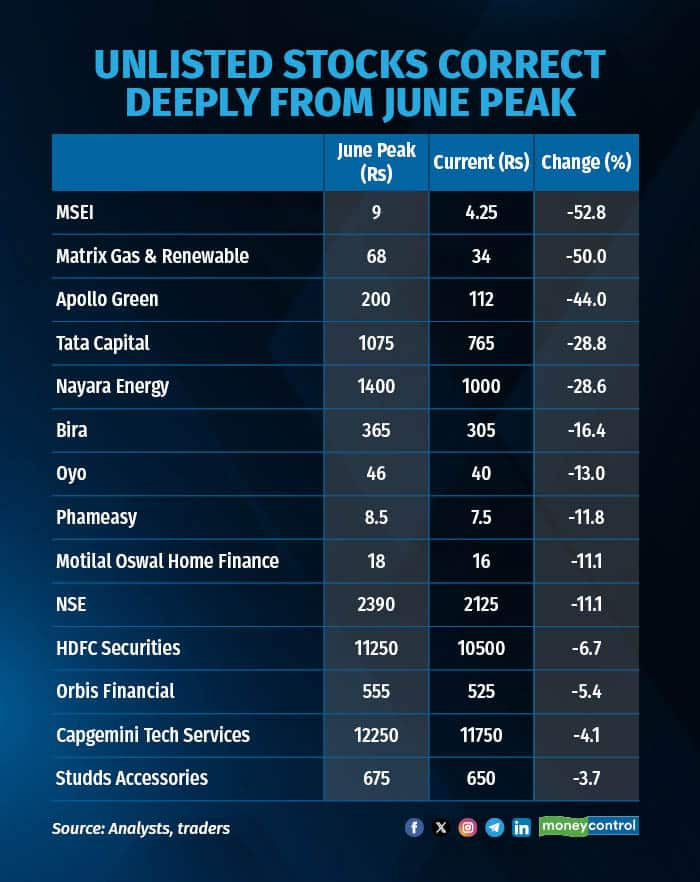

Among the worst hit, Metropolitan Stock Exchange of India (MSEI) and Matrix Gas Renewable have lost more than 50 percent from their June peaks. MSEI, which was trading at around Rs 9 in June, has slipped to Rs 4.25 a share, while Matrix Gas Renewable has halved to nearly Rs 34 from Rs 68. Apollo Green Energy, too, has corrected sharply—sliding 44 percent from Rs 200 to Rs 112 a share.

Blue-chip names were not spared either. Tata Capital and Nayara Energy fell by nearly 29 percent from their June highs, with prices dropping to Rs 765 and Rs 1,000 per share, compared with Rs 1,075 and Rs 1,400 respectively.

According to analysts, the slide began after HDB Financial announced its IPO price band at nearly 40 percent below grey-market expectations and Tata Capital valued its rights issue 2.75 times lower than its share price in the unlisted market, triggering fears that premium listings might not materialize. This spooked investors, leading to widespread panic selling in the unlisted market.

Sentiment further worsened as other IPOs, such as Vikram Solar and NSDL, were priced 15 percent and 22 percent below their unlisted values. The decline was also attributed to subdued listings, despite IPO subscriptions having drawn huge interest from retail, high networth, and other institutional investors.

Market experts attribute the correction to excessive speculation and overvaluation during the earlier rally, with several stocks priced on sentiment rather than earnings. Hoarding and manipulation further fuelled the hype, they added. Unlike listed shares, offloading unlisted stocks is difficult, adding to investor unease. Regulatory oversight by SEBI on unlisted and pre-IPO deals has also cooled speculative activity.

Other prominent names such as Bira and Oyo have fallen by 16 percent and 14 percent respectively from their June peaks. Pharmeasy, Motilal Oswal Home Finance, and the National Stock Exchange have corrected by over 11 percent.

Wakefit, Groww, and Meesho have filed confidential draft papers with SEBI for upcoming IPOs, though none are active in the unlisted market. Meanwhile, Lenskart and Pine Labs continue to trade flat in the unlisted space, holding steady at around Rs 300 and Rs 375 a share respectively since last year.

Analysts caution that the unlisted market carries far higher risk than listed equities. While multibagger returns are possible, investments require strong due diligence. “One must evaluate fundamentals, IPO clarity, and realistic valuations before taking exposure,” an analyst noted.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.