The benchmark indices significantly cut down intraday losses and closed moderately lower on January 8. The market breadth was also weak, with a total of 1,719 shares declining against 792 shares rising on the NSE. The consolidation is expected to continue as long as the frontline indices trade below all key moving averages. Below are some trading ideas for the near term:

Jatin Gedia, Technical Research Analyst at Mirae Asset SharekhanBajaj Finserv | CMP: Rs 1,697

Bajaj Finserv has been consolidating over the last four trading sessions after a sharp run-up. It has now reached the support zone of Rs 1,680–1,660, which coincides with key hourly moving averages, and is witnessing buying interest. We believe this consolidation is a brief pause in the overall uptrend, and we expect the stock to resume its next leg of upward movement. On the upside, we expect the stock to target levels of Rs 1,777–1,795. A stop-loss of Rs 1,640 should be maintained for long positions.

Strategy: Buy

Target: Rs 1,777, Rs 1,795

Stop-Loss: Rs 1,640

Tata Motors | CMP: Rs 795

Tata Motors has broken out of a falling channel and has started to form higher tops and higher bottoms on the daily charts, suggesting a trend reversal. The daily momentum indicator has triggered a positive crossover after showing a positive divergence, which is a bullish sign and a buy signal. We expect a sharp upmove in the stock over the next few trading sessions. One can go long in the stock with a target of Rs 845–882 over the next few trading sessions. A stop-loss of Rs 745 should be maintained for long positions.

Strategy: Buy

Target: Rs 845, Rs 882

Stop-Loss: Rs 745

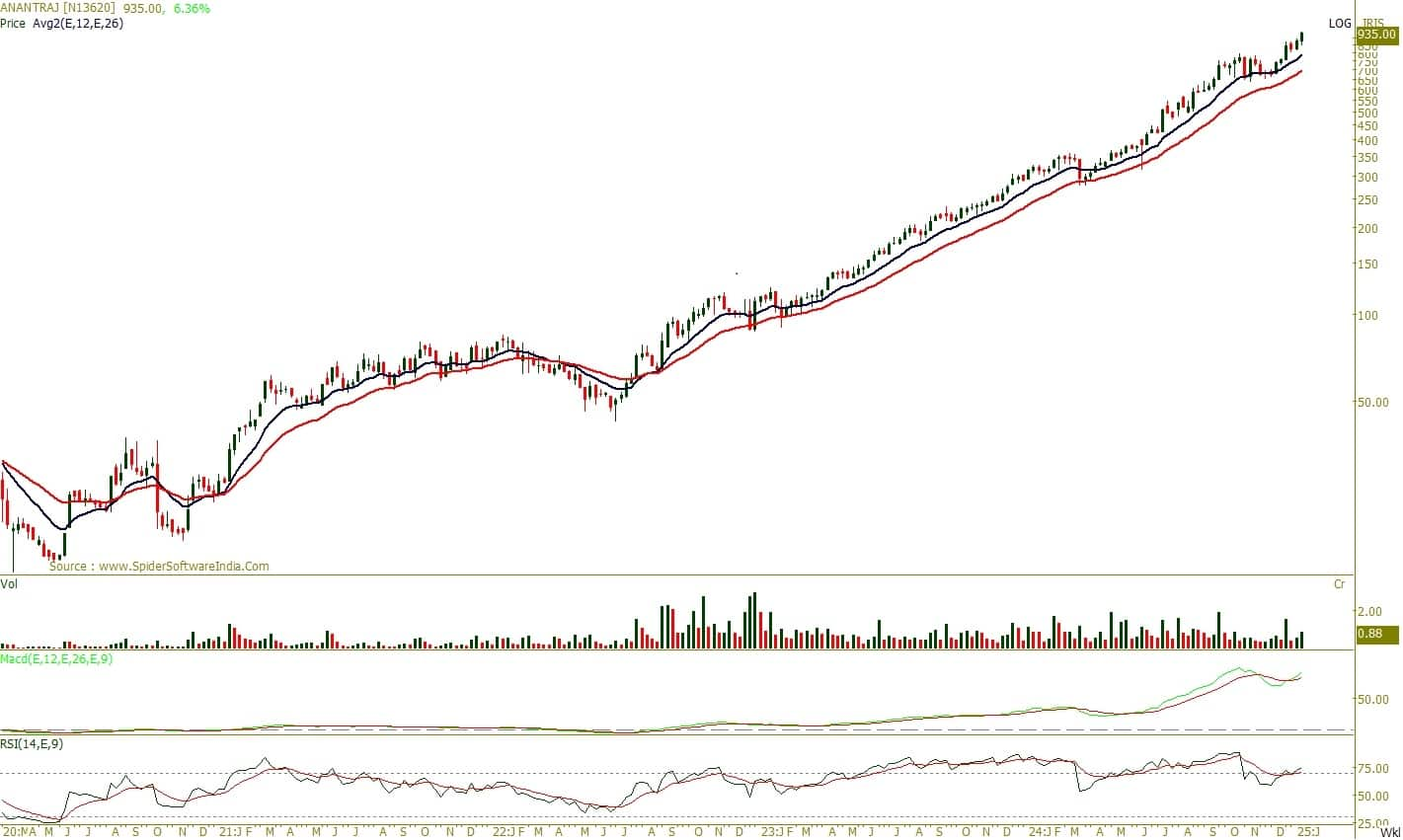

Vidnyan S Sawant, Head of Research at GEPL CapitalAnant Raj | CMP: Rs 935.55

Anant Raj has displayed a strong price structure since 2022 and recently broke above a three-week high, indicating a likely continuation of its upward trajectory. On the daily chart, the stock remains well-supported above its 12-day EMA (Exponential Moving Average), demonstrating resilience and a strong trend despite current market volatility. A surge in volume above the 10-week average highlights increased buying interest, while a MACD (Moving Average Convergence Divergence) bullish crossover and RSI (Relative Strength Index) above 70 confirm the continuation of positive momentum.

Strategy: Buy

Target: Rs 1,075

Stop-Loss: Rs 865

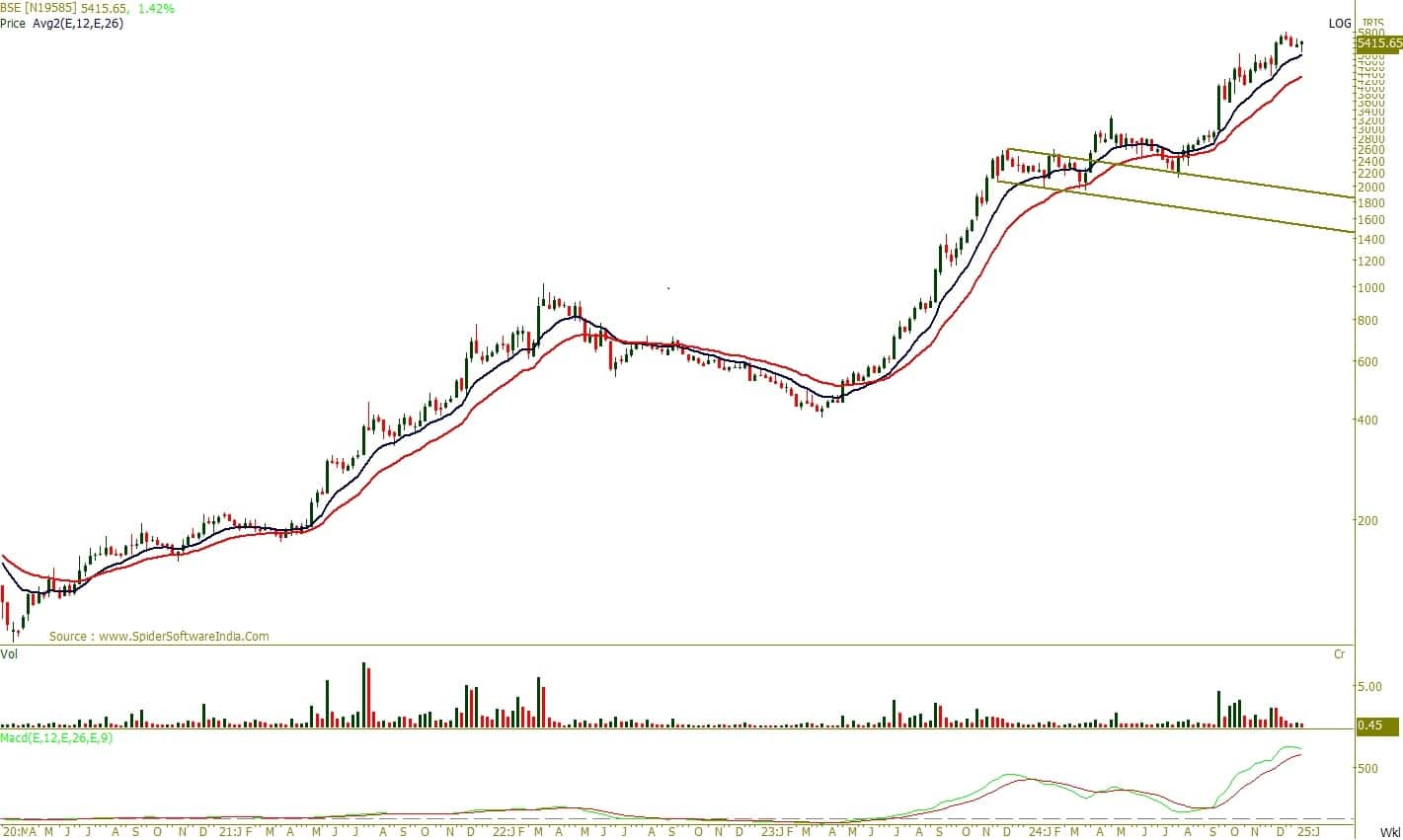

BSE | CMP: Rs 5,400.4

BSE has been maintaining a bullish structure, continuing its upward trajectory after experiencing polarity from the channel on the weekly scale. The stock remains well above its key 12-week and 26-week EMAs, highlighting a strong trend, with the MACD further confirming bullish momentum. On the daily chart, a bullish mean reversion from the 40-day EMA signals a likely continuation of the uptrend.

Strategy: Buy

Target: Rs 6,335

Stop-Loss: Rs 5,030

Kirloskar Brothers | CMP: Rs 2,225.6

Kirloskar Brothers continues its upward trajectory, forming higher bottoms and consistently trading above the 12-week and 26-week EMAs, reinforcing its bullish momentum. The weekly RSI remains in buy mode, reflecting strong bullish sentiment. On the daily chart, the stock recently recorded a single-day volume exceeding the 4-year average, signaling the potential for sustained momentum ahead.

Strategy: Buy

Target: Rs 2,670

Stop-Loss: Rs 2,070

Oberoi Realty | CMP: Rs 2,282.4

Oberoi Realty is in a rising trend on the weekly scale, maintaining strong support above its 12-week and 26-week EMAs. On the daily scale, the stock shows bullish mean reversion signals, indicating a likely continuation of its upward trajectory. The MACD remains in buy mode, further confirming the positive momentum.

Strategy: Buy

Target: Rs 2,660

Stop-Loss: Rs 2,100

Shitij Gandhi, Senior Technical Research Analyst at SMC Global SecuritiesOil India | CMP: Rs 491.7

Oil India has been maintaining its downtrend, as prices have witnessed a series of declines from the Rs 750 level towards the Rs 420 level over the months. Recently, the stock recovered from the Rs 420 level and gained fresh momentum above its 200-day EMA on the daily charts after forming a rounding bottom pattern. On broader charts, the stock has also given a breakout above the falling trendline of the declining channel. Therefore, one can accumulate the stock in the range of Rs 480–490 for the expected upside of Rs 575–585 levels.

Strategy: Buy

Target: Rs 575, Rs 585

Stop-Loss: Rs 420

Concord Biotech | CMP: Rs 2,262.9

Concord Biotech has been consolidating within a broader range of Rs 2,050–2,250, with prices sustaining well below its 200-day EMA on the daily charts. Technically, the stock has formed a rectangle pattern on the daily charts, with a breakout seen above the key resistance of Rs 2,250, accompanied by marginally higher volumes. Therefore, one can accumulate the stock in the range of Rs 2,250–2,260 for the expected upside of Rs 2,575–2,590 levels.

Strategy: Buy

Target: Rs 2,575, Rs 2,590

Stop-Loss: Rs 2,050

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.