The market snapped two-day gains with the benchmark indices losing six-tenth of a percent on May 16 as the selling was seen in auto, banking & financial services, select metal, pharma and FMCG stocks.

The BSE Sensex plummeted 413 points to 61,932, while the Nifty50 dropped 112 points to 18,286 and formed a Bearish Belt Hold and Bearish Engulfing patterns on the daily scale, indicating the possibility of a bearish trend.

"A long bear candle was formed on the daily chart, which indicates the formation of a Bearish Engulfing pattern, not a classical one. Presently, the market is repeatedly testing the hurdle of around 18,300-18,400 levels and not able to break decisively above it so far," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Having moved up swiftly from the higher lows of 17,553 on April 21 and the placement of key overhead resistance at the highs, he feels the chances of a sizable downward correction are likely in the short term.

"Immediate supports are placed around 18,100-18,050 levels. Any sharp up move above 18,400 levels is expected to bring bulls back into the action," Shetti said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 18,264, followed by 18,224 and 18,160. If the index advances, 18,392 would be the initial key resistance level to watch out for, followed by 18,432 and 18,496.

The Bank Nifty has seen a correction for the first time in the last five consecutive sessions, falling 168 points to 43,904. The index has formed a bearish candlestick pattern on the daily charts.

"The index, if sustains below 44,000, can witness further correction towards 43,500 where the highest open interest is built up on the Put side. The momentum indicator RSI (relative strength index) is showing negative divergence which confirms the bearishness," Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said.

As per the pivot point calculator, the Bank Nifty may take support at 43,829, followed by 43,752 and 43,626. Key resistance levels are expected to be 44,080 along with 44,157 and 44,283.

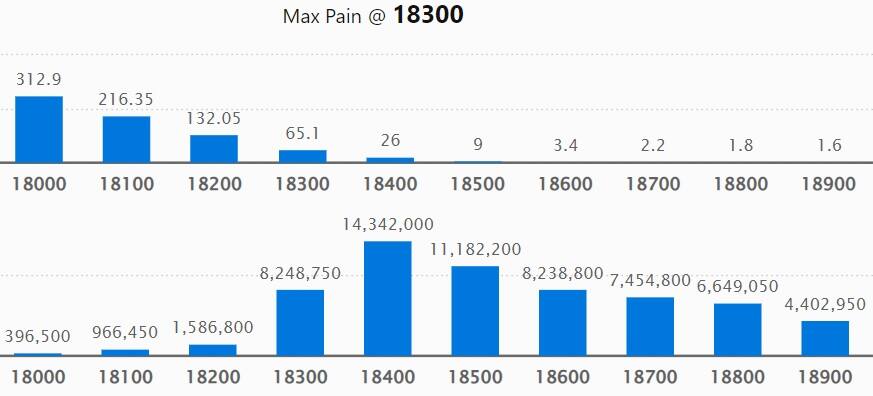

Per the weekly options front, the maximum Call open interest (OI) was at 18,400 strike, with 1.43 crore contracts, which is expected to be a crucial resistance level for the Nifty in the coming sessions.

This was followed by 18,500 strike comprising 1.11 crore contracts, and 18,300 strike with more than 82.48 lakh contracts.

Call writing was at 18,400 strike, which added 81.95 lakh contracts, followed by the 18,500 strike, which added 46.12 lakh contracts, and 18,300 strike, which added 44.61 lakh contracts.

Meaningful Call unwinding was at 18,000 strike, which shed 32,400 contracts, followed by 17,800 strike, which shed 29,000 contracts, and 17,900 strike, which shed 24,700 contracts.

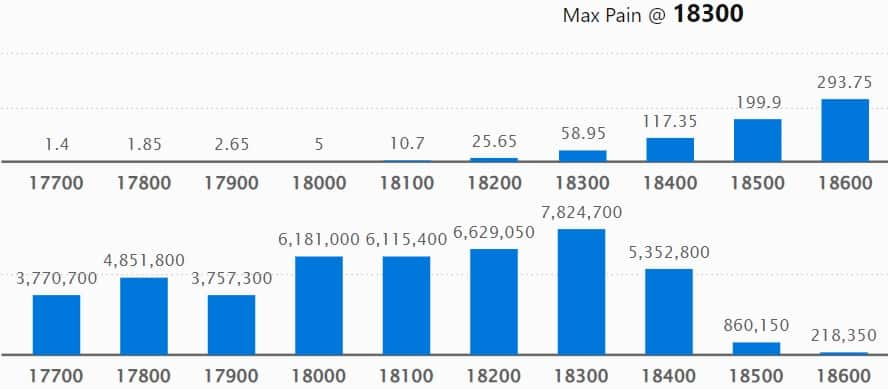

The maximum Put open interest was at 18,300 strike with 78.24 lakh contracts, which is expected to act as an important level in the coming sessions.

This was followed by the 18,200 strike, comprising 66.29 lakh contracts, and the 18,000 strike where we have 61.81 lakh contracts.

Put writing was seen at 18,100 strike, which added 4.18 lakh contracts, followed by 17,500 strike, which added 3.87 lakh contracts, and 18,400 strike which added 2.46 lakh contracts.

We have seen Put unwinding at 17,800 strike, which shed 12.54 lakh contracts, followed by 18,300 strike, which shed 8.32 lakh contracts, and 18,000 strike, which shed 7.57 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Power Grid Corporation of India, Container Corporation of India, Infosys, Hindustan Unilever, and Bharat Forge among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 36 stocks, including Manappuram Finance, Max Financial Services, LIC Housing Finance, Bank of Baroda, and Indus Towers saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 52 stocks including Hero MotoCorp, Tata Motors, Syngene International, Punjab National Bank, and Container Corporation of India saw a long unwinding.

66 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 66 stocks, including Balrampur Chini Mills, REC, Alkem Laboratories, Ashok Leyland, and Jindal Steel & Power saw a short build-up.

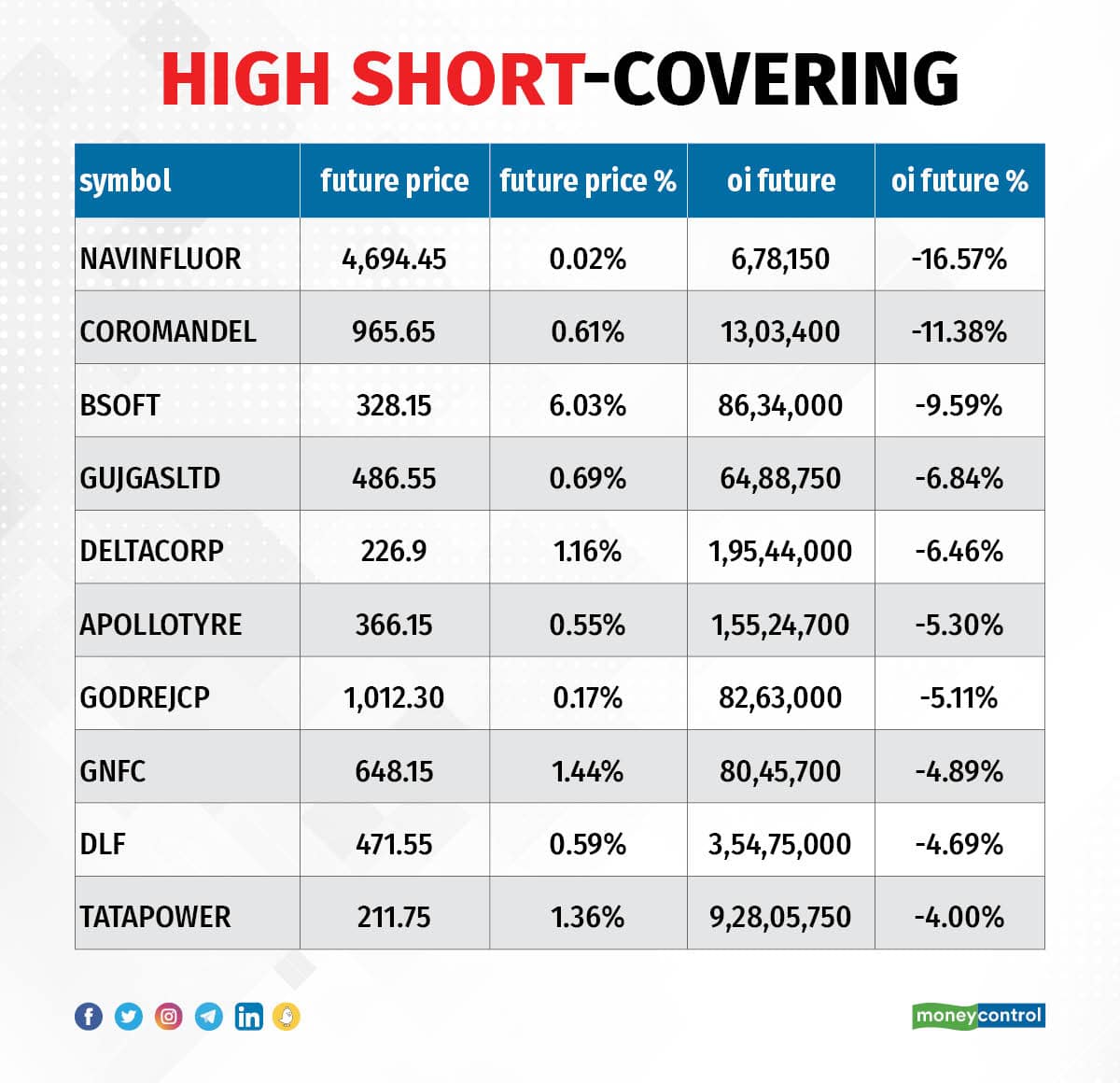

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 36 stocks were on the short-covering list. These included Navin Fluorine International, Coromandel International, Birlasoft, Gujarat Gas, and Delta Corp.

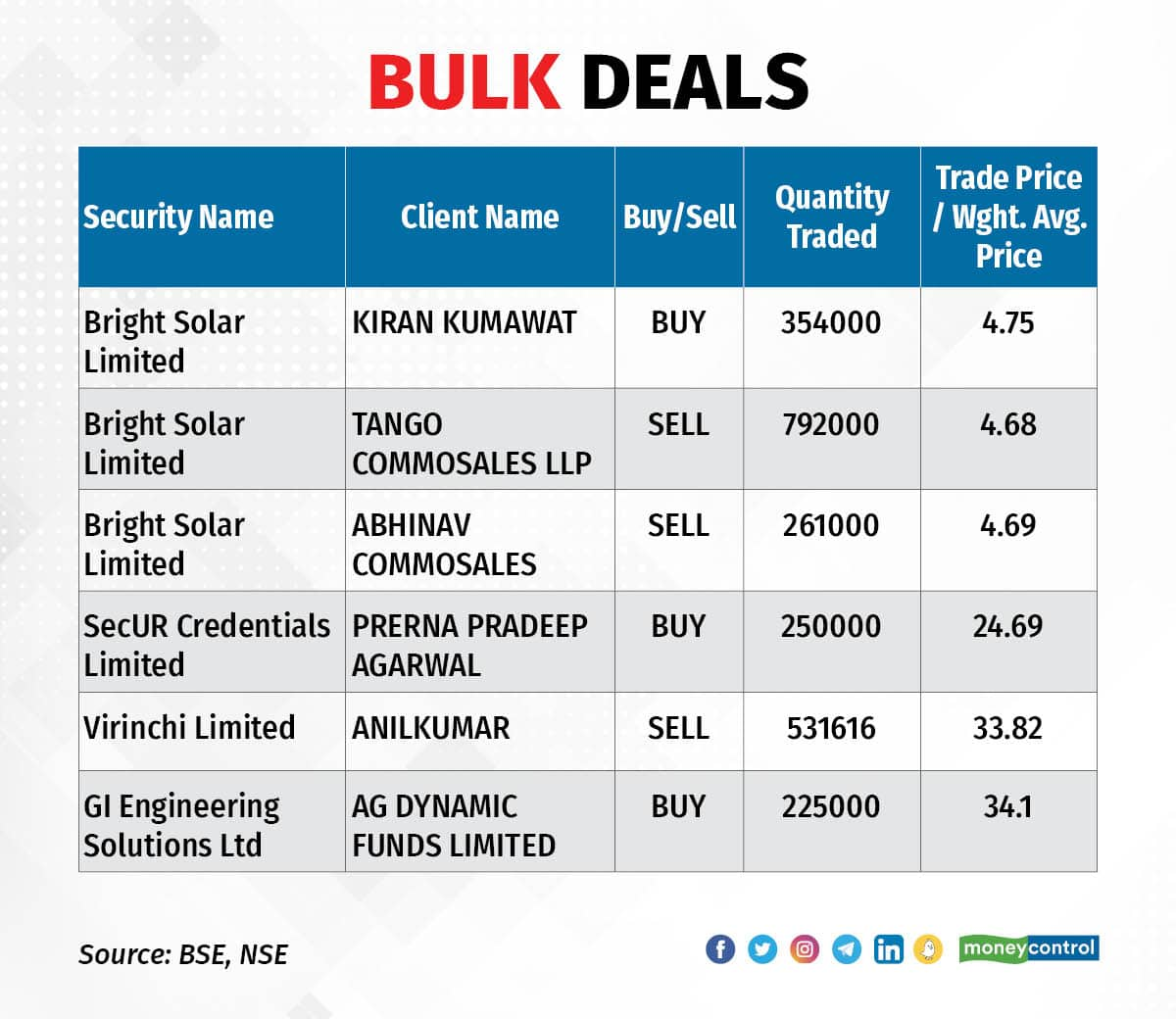

(For more bulk deals, click here)

Stocks in the news

Bharti Airtel: The telecom operator has recorded a massive 89.2 percent sequential growth in consolidated profit at Rs 3,005.6 crore for the quarter ended March FY23 due to lower tax cost. Profit in the previous quarter was impacted by an exceptional loss of Rs 669.8 crore. Revenue from operations for the quarter at Rs 36,009 crore grew by 0.6 percent over the previous quarter.

Jindal Steel & Power: The steel producer has reported a 69.5 percent year-on-year decline in consolidated profit at Rs 465.66 crore for the March FY23 quarter, impacted by weakness in operating performance and a one-time loss of Rs 153 crore during the quarter. Revenue from operations for the quarter at Rs 13,692 crore declined by 4.5 percent compared to the same period last fiscal.

JK Paper: The paper & packaging board company has registered a 15 percent year-on-year decline in consolidated profit at Rs 283.52 crore for the quarter ended March FY23, dented by dismal operating numbers. Revenue from operations for the quarter grew by 4.6 percent to Rs 1,719.4 crore compared to the corresponding period last fiscal.

Bharat Petroleum Corporation: The oil marketing company has received board approval for the ethylene cracker project at Bina refinery including downstream petrochemical plants and expansion of refinery with capital expenditure of approximately Rs 49,000 crore. The company will also be setting up two 50 MW wind power plants for captive consumption one at Bina Refinery in Madhya Pradesh and another at Mumbai Refinery in Maharashtra, with a total project cost of Rs 978 crore.

Oberoi Realty: The Mumbai-based real estate developer has recorded a 106.7 percent year-on-year growth in consolidated profit at Rs 480.3 crore for the quarter ended March FY23, backed by healthy topline and tax writeback, but the operating margin was weak. Revenue grew by 16.8 percent to Rs 961.4 crore compared to the year-ago period.

Amber Enterprises India: The air conditioners and its component manufacturer has recorded an 82 percent year-on-year growth in consolidated profit at Rs 104 crore for the quarter ended March FY23. Revenue from operations for the quarter grew by 55 percent to Rs 3,002.6 crore compared to the same period last year.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,406.86 crore, whereas domestic institutional investors (DII) sold shares worth Rs 886.17 crore on May 16, provisional data from the National Stock Exchange showed.

Stocks under F&O ban on NSE

The National Stock Exchange has added Balrampur Chini Mills and Manappuram Finance, and retained Delta Corp, GNFC, and Punjab National Bank on its F&O ban list for May 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!