Benchmark indices snapped a six-day winning streak and ended in the red on October 22. The Nifty slipped below 11,600 and Sensex closed below 39,000 level.

At close, the Sensex was down 334.54 points at 38,963.84, while Nifty was down 73.50 points at 11,588.40.

BSE Midcap index ended flat, while BSE smallcap index gained 0.5 percent.

Ajit Mishra Vice President, Research, Religare Broking said he expects the market to remain volatile in the near term. Going forward, the trend will be dictated by the on-going earning season, the outcome of the state election, US-China trade deal and development on the Brexit deal, he said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11536.57, followed by 11484.83. If the index starts moving up, key resistance levels to watch out for are 11677.17 and 11766.03.

Nifty Bank

Nifty Bank closed with a gain of 290.9 points at 29,411.20 on October 22. The important pivot level, which will act as crucial support for the index, is placed at 29198.27, followed by 28985.33. On the upside, key resistance levels are placed at 29657.07 and 29902.93.

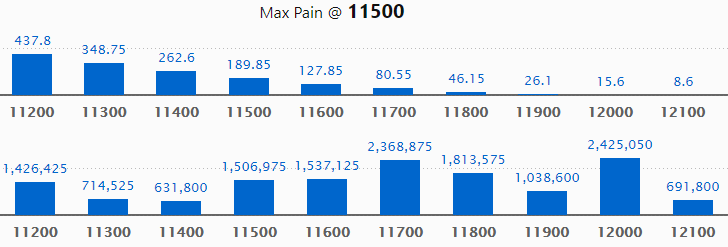

Call options data

Maximum call open interest (OI) of 24.25 lakh contracts was seen at 12,000 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11,700 strike price, which holds 23.68 lakh contracts in open interest; and 11,800, which has accumulated 18.13 lakh contracts in open interest.

Call writing was seen at the 11,800 strike price, which added 5.56 lakh contracts, followed by 12,000 strike that added 5.54 lakh contracts.

Call unwinding was seen at the 11,500 strike price, which shed 1.68 lakh contracts, followed by 11,400 strike which shed 1.43 lakh contracts and 11,600 which shed 69,000 contracts.

Put options data

Maximum put OI of 28.07 lakh contracts was seen at 11,000 strike price, which will act as crucial support in October series.

This is followed by 11,500 strike price, which holds 18.73 lakh contracts in open interest; and 11,400 strike price, which has accumulated 17.58 lakh contracts in OI.

Put writing was seen at the 11,700 strike price, which added 1.11 lakh contracts, followed by 11,800 strike price, which added 1.02 lakh contracts and 11,600 which added 86,475 contracts.

Put unwinding was seen at 11,300 strike price, which shed 4.24 lakh contracts, followed by 11,400 strike that shed 3.97 lakh contracts and 11,500 that shed 1.61 lakh contracts.

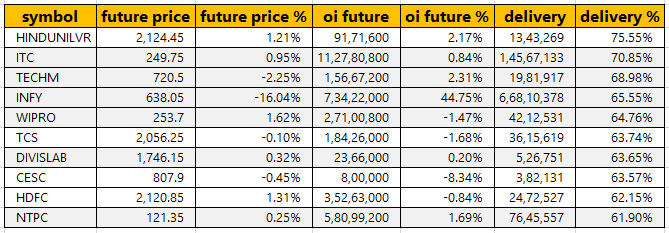

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

38 stocks saw long buildup

35 stocks witnessed short-covering

As per available data, 35 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

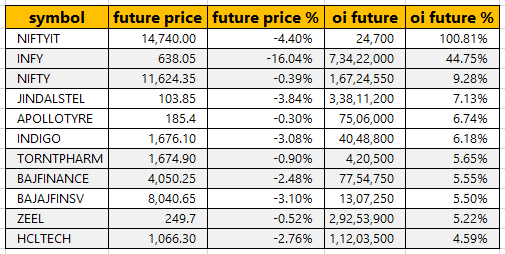

46 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

29 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

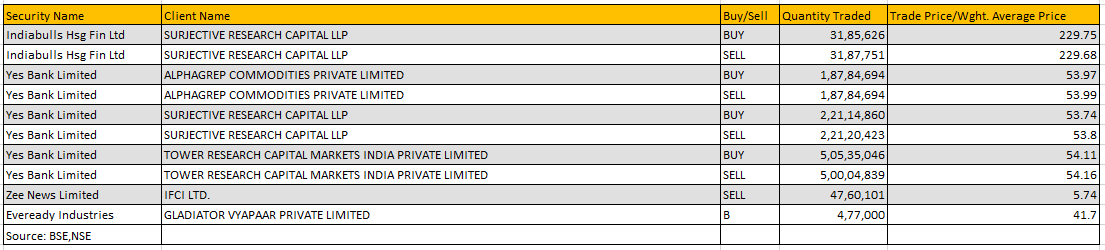

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Rushil Decor - Board meeting on November 11 to consider fundraising along with other agenda

Infibeam Avenues - board meeting on October 25 to consider interim dividend

Birla Corporation - board meeting on November 5 to consider and approve the financial results for the period ended September 30, 2019

Bank Of India - board meeting on November 1 to consider and approve the financial results for the period ended September 30, 2019

Petronet LNG - board meeting on October 29 to consider and approve the financial results for the period ended September 30, 2019, and dividend

UCO Bank - board meeting on October 24 to consider the issue of Tier II bonds aggregating to Rs 500 crore

Stocks in news

Results on October 23: L&T, Bajaj Auto, Hero MotoCorp, HDFC Life, Biocon, Aarti Drugs, Havells, Hexaware, JSW Steel, Praj Industries, Texmaco Rail, Shoppers Stop, Zee Media, Texmaco Infra, HCL Technologies, JM Financial, KPIT Technologies, NIIT Technologies

Axis Bank Q2: Net loss at Rs 112.1 crore versus profit at Rs 789.6 crore, NII up 16.6 percent to Rs 6,102 crore versus Rs 5,232.1 crore YoY

RBL Bank Q2: Profit falls 73 percent to Rs 54 crore versus Rs 204.6 crore, NII rises 47 percent to Rs 869 crore versus Rs 593 crore YoY

OBC Q2: Net profit up 23.8% at Rs 125.9 crore versus Rs 101.7 crore, NII up 14.7% at Rs 1,455.5 crore versus Rs 1,269.2 crore, YoY

Swaraj Engines Q2: Net profit at Rs 25.4 crore versus Rs 25.4 crore, revenue down 9.8% at Rs 222.7 crore versus Rs 247 crore, YoY

Coromandel International Q2: Consolidated net profit up 37.8% at Rs 504 crore against Rs 365.6 crore, revenue down 3% at Rs 4,858 crore versus Rs 5,008.3 crore, YoY

ICICI Securities Q2: Net profit up at Rs 135.1 crore against Rs 134.2 crore, revenue down 8.8% at Rs 417 crore versus Rs 457.3 crore, YoY

Ceat Q2: Net profit down 12.5% at Rs 65.9 crore versus Rs 75.3 crore, revenue down 5.2% at Rs 1,645.3 crore versus Rs 1,735.7 crore, YoY

Bajaj Consumer: IDBI Trust sold entire stake (23.68 percent equity) in the company from October 18-22

Infosys: Rosen Law firm announced the filing of securities claims against the company

JMC Projects bags new orders of Rs 1,059 crore

SpiceJet's independent director Harsha Vardhana Singh resigns

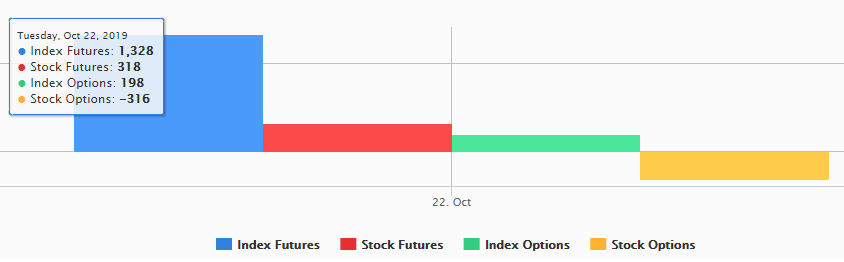

FII & DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 557.5 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 985.47 crore in the Indian equity market on October 22, as per provisional data available on the NSE.

Fund Flow

No stock under ban period on NSE

For October 23, no stock is under F&O ban.

In the F&O segment, companies in which the security has crossed 95 percent of the market-wide position limit are put under a ban for a certain period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!