Benchmark indices closed in the red for the fourth consecutive session on February 18 as investors continued to feel the jitters from the impact of the coronavirus outbreak.

The Sensex fell 161.31 points to close at 40,894.38 while Nifty fell 53.30 points to end at 11,992.50.

"The short term trend of Nifty continues to be weak. Tuesday's smart upside recovery from the lows could be a cheering factor for bulls to make a comeback. But, the underlying trend remains weak and any further upside bounce could be short lived," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

According to him, if the Nifty fails to sustain above 12,030-12,050 levels in the next 1-2 sessions, then one may expect continuation of weakness in the market.

"Immediate support is now at 11,900 and the key upside resistance is placed at 12,050," he said.

Shrikant Chouhan, Senior Vice-President, Equity Technical Research at Kotak Securities, said 11,900 will play an important support level. "If 11,900 is broken then we could see a steeper fall as the next major support exists at 11,800."

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11,923.4, followed by 11,854.3. If the index continues moving up, key resistance levels to watch out for are 12,046.2 and 12,099.9.

Nifty Bank

Nifty Bank closed 0.39 percent down at 30,562.50. The important pivot level, which will act as crucial support for the index, is placed at 30,312.34, followed by 30,062.17. On the upside, key resistance levels are placed at 30,752.74 and 30,942.97.

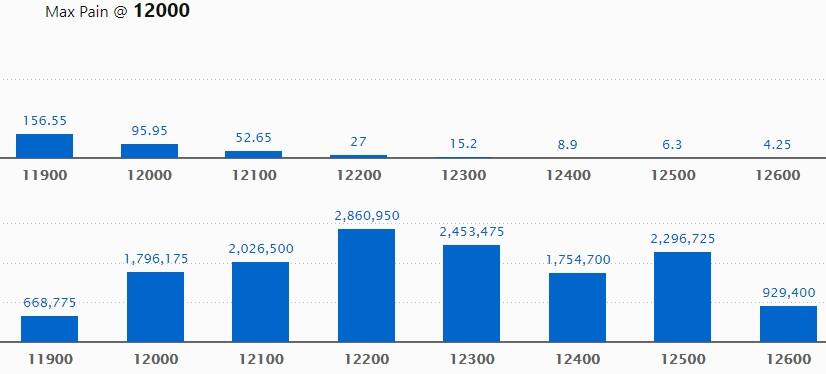

Call options data

Maximum Call open interest (OI) of 28.60 lakh contracts was seen at the 12,200 strike price. It will act as a crucial resistance level in the February series.

This is followed by 12,300 strike price, which holds 24.53 lakh contracts in open interest, and 12,500, which has accumulated 22.96 lakh contracts in open interest.

Significant call writing was seen at the 12,000 strike price, which added 7.44 lakh contracts, followed by 12,200 strike price that added 5 lakh contracts and 12,100 strike price, which added 3.4 lakh contracts.

Call unwinding was witnessed at 12,400 strike price, which shed 3.7 lakh contracts, followed by 12,500 which shed 3.29 lakh contracts.

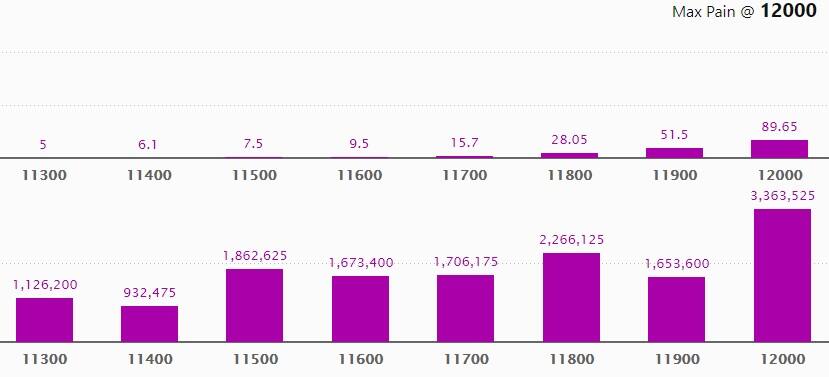

Put options data

Maximum Put open interest of 33.63 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the February series.

This is followed by 11,800 strike price, which holds 22.66 lakh contracts in open interest, and 11,500 strike price, which has accumulated 18.62 lakh contracts in open interest.

Put writing was seen at the 11,600 strike price, which added 1.19 lakh contracts, followed by 11,500 strike, which added 0.87 lakh contracts.

Put unwinding was seen at 11,900 strike price, which shed 3.66 lakh contracts, followed by 12,100 strike price which shed 3.63 lakh contracts.

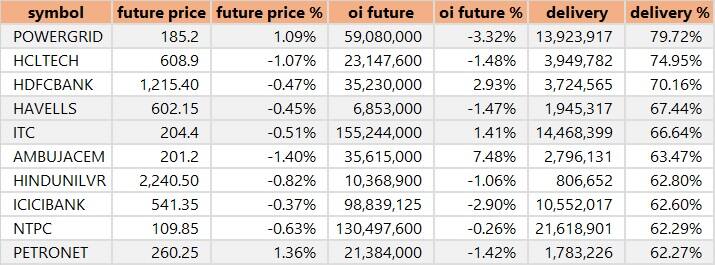

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

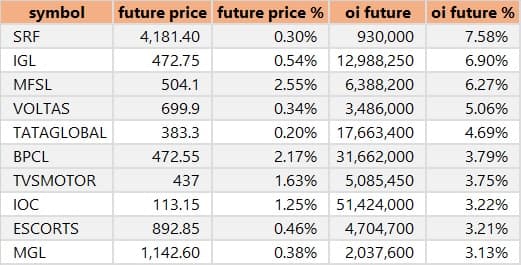

25 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

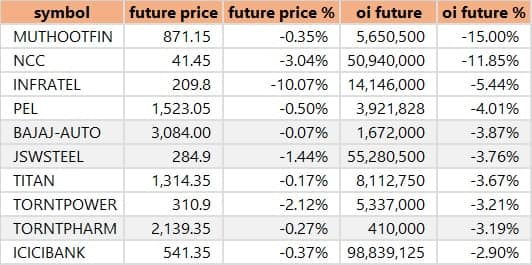

38 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

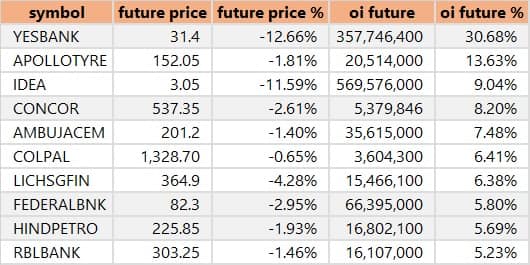

51 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

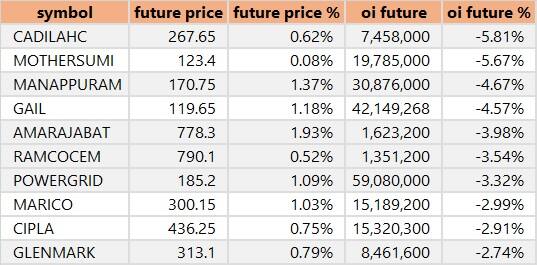

27 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short-covering was seen.

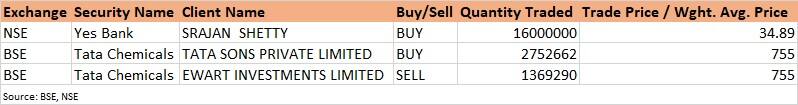

Bulk deals

(For more bulk deals, click here)

Analysts and Board Meetings

PI Industries: Company's officials will be meeting with investors namely CX Partners on February 19 and JM Financial on February 25.

Speciality Restaurants: Company's officials will meet Dron Capital Advisors LLP on February 20.

Veeram Securities: Board meeting is scheduled to be held on February 26 to consider the issue of bonus share.

Carborundum Universal: Board meeting is scheduled to be held on February 26 for considering an interim dividend proposal for the year ending March 31, 2020.

NOCIL: Investors / Analysts will be visiting company's plant at Dahej on February 19.

Speciality Papers: Board meeting is scheduled on February 24 to review the performance of the Chairperson of the company, taking into account the views of executive directors and non-executive directors.

Mahindra Lifespace Developers: Company's officials will meet Locus Investments on February 19.

Manappuram Finance: Board meeting is scheduled on February 27 to consider declaration of interim dividend.

Ashoka Buildcon: Company will be attending the Investor Conference organised by HDFC Securities on February 20.

Sundram Fasteners: Board meeting is scheduled on February 26 to consider second interim dividend for the financial year ending March 31, 2020.

Stocks in the news

Shree Cement: Shree Cement to replace Yes Bank in Nifty 50 w.e.f March 27

Oil India: Stock will stop trading in Futures & Options segment with effect from May 4.

SBI: SBI Cards IPO to be launched on March 2, offer price likely to be Rs 745-775 per share - CNBC-TV18 sources

Balkrishna Industries: HDFC MF sold 2.07 percent stake in company on February 17.

Gayatri Projects: Promoter created pledge on 60 lakh shares (3.21 percent equity) on February 17.

GE T&D: ICRA downgraded company's long-term rating to A+ from AA-, revised outlook to stable from negative.

Adhunik Metaliks: Liberty House completed acquisition of Adhunik Metaliks in all cash deal of Rs 435 crore.

IDFC First Bank: CRISIL assigned AA/Stable rating to bank's Tier-II bonds.

HCL Technologies: Company received order from Stanley Black & Decker for digital services.

Tata Chemicals: Tata Coffee sold 1,59,850 equity shares of company (constituting 0.06 percent of paid-up capital) to Tata Sons.

Tata Chemicals: Tata Global Beverages sold 7,05,522 equity shares of company (constituting 0.28 percent of paid-up share capital) to Tata Sons.

Jaiprakash Associates: Company received letter from Yamuna Expressway Industrial Development Authority on its decision to cancel land allotment to JPSK Sports.

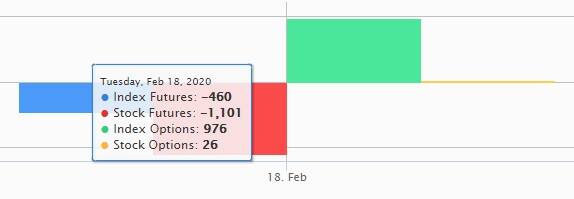

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 74.39 crore, and domestic institutional investors (DIIs) sold shares of worth Rs 309.43 crore in the Indian equity market on February 18, provisional data available on the NSE showed.

Fund flow

Stocks under F&O ban on NSE

Yes Bank and NCC are under the F&O ban for February 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!