The market ended a rangebound session in the negative on June 24 with the Nifty 50 closing a tad below 11,700 levels. However, the index managed to hold the lows made multiple times near 11,630-11,640 levels.

The broader markets also participated in the fall with the Nifty Midcap and Smallcap indices declining 0.3-0.4 percent. About three shares declined for every two shares rising on the NSE.

The BSE Sensex slipped 71.53 points to 39,122.96, continuing the fall for a second consecutive session while the Nifty 50 dropped 24.40 points to 11,699.70 forming a bearish candle which resembles a Spinning Top kind of pattern on daily charts.

For the last few sessions, the Nifty has been trading in a range of 11,625 on the downside & 11,850 on the upside, but overall structure remains bearish, experts said.

"The larger picture shows that the index has been sliding down within a downward sloping channel. The recent bounce faced resistance near the upper channel line & the index is currently moving towards the lower end of the channel. The momentum indicators on various time frames are in agreement with the bearish price structure. Thus the Nifty is likely to maintain the downward trajectory going ahead," Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas told Moneycontrol.

On the downside, 11,625-11,591 is the key support zone to watch out for; once that breaks, the Nifty can tumble towards 11,250-11,200, he said.

Jayant Manglik, President - Retail Distribution, Religare Broking said Nifty has crucial support at 11,600 and its breakdown could trigger further fall. "We advise keeping positions on both sides in such scenario and waiting for a decisive break for the next directional move."

All sectoral indices except FMCG closed in the red with Nifty Metal and Realty falling a percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

Nifty closed at 11,699.65 on June 24. According to the Pivot charts, the key support level is placed at 11,661.93, followed by 11,624.17. If the index starts moving upward, key resistance levels to watch out are 11,745.73 and 11,791.77.

Nifty Bank

The Nifty Bank closed at 30,602.05, down 26.30 points on June 24. The important Pivot level, which will act as crucial support for the index, is placed at 30,492.16, followed by 30,382.23. On the upside, key resistance levels are placed at 30,747.86, followed by 30,893.63.

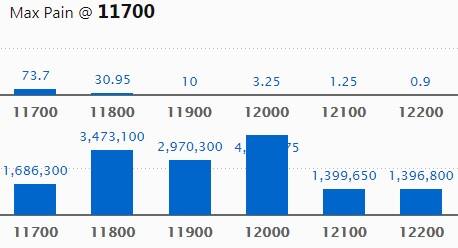

Call options data

Maximum Call open interest (OI) of 42.76 lakh contracts was seen at the 12,000 strike price. This will act as a crucial resistance level for the June series.

This is followed by 11,800 strike price, which now holds 34.73 lakh contracts in open interest, and 11,900, which has accumulated 29.70 lakh contracts in open interest.

Significant Call writing was seen at 11,700 strike price that added 4.28 lakh contracts, followed by 11,800 strike price that added 3.9 lakh contracts and 11,900 strike price, which added 1.84 lakh contracts.

Call unwinding was seen at the strike price of 12,100, which shed 2.95 lakh contracts, followed by 12,200 strike that shed 1.05 lakh contracts and 12,300 strike which shed 1.04 lakh contracts.

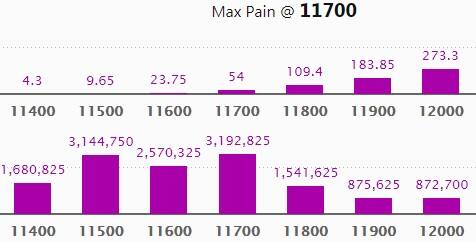

Put options data

Maximum Put open interest of 31.92 lakh contracts was seen at 11,700 strike price. This will act as a crucial support level for the June series.

This was followed by 11,500 strike price, which now holds 31.44 lakh contracts in open interest and 11,600 strike price, which has now accumulated 25.70 lakh contracts in open interest.

Put writing was seen at the 11,000 strike price, which added 3.84 lakh contracts, followed by 11,600 strike price that added 2.06 lakh contracts and 11,200 strike that added 1.74 lakh contracts.

Put unwinding was seen at the strike price of 11,800, which shed 5.3 lakh contracts, followed by 11,700 strike price, which shed 2.31 lakh contracts and 12,000 strike that shed 1.08 lakh contracts.

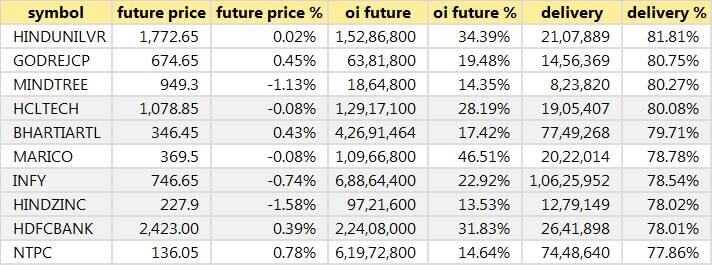

Stocks with a high delivery percentage

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on it.

63 stocks saw a long buildup

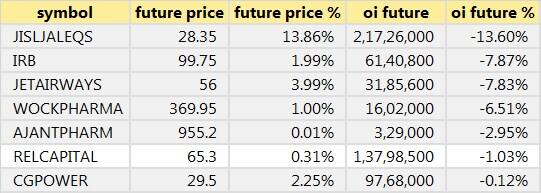

7 stocks that saw short covering

A decrease in open interest, along with an increase in price, mostly indicates short covering.

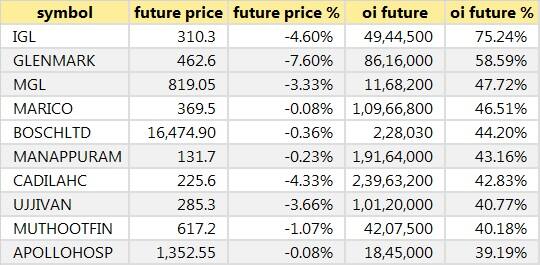

107 stocks saw a short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

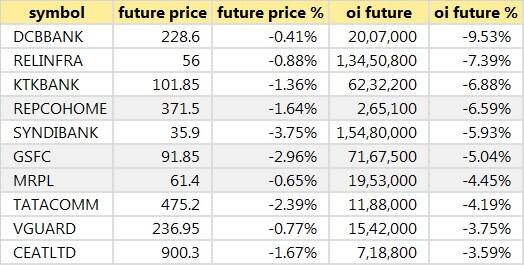

20 stocks saw long unwinding

Analyst or Board Meetings/Briefings

Som Distilleries & Breweries: Board meeting is scheduled on July 3 to consider final annual accounts for the year 2018-19.

Sterlite Technologies: AGM is scheduled to be held on July 23.

Motherson Sumi Systems: Board meeting is scheduled on August 12 to consider unaudited financial results for the quarter ended June 30, 2019.

KEI Industries: Company's officials will meet Motilal Oswal Financial Services on July 2 in Mumbai.

Fine Organic Industries: Officials of the company will be interacting with investors and analyst on June 25.

Mahindra Holidays & Resorts India: Company's officials will meet ICICI Securities and Equity Master on June 26.

Stocks in news

Infosys: Company announced a strategic partnership with Toyota Material Handling Europe.

L&T Technology Services: L&T to sell up to 2 lakh shares of company via offer for sale on June 25-26, floor price fixed at Rs 1,650 per share.

TCS: Company to increase stake in Japanese arm by 15 percent to 66 percent for $33 million.

Suzlon Energy: Company is exploring funding options including raising equity.

HEG: India Ratings and Research affirmed its long-term issuer rating at 'AA' with a stable outlook.

Smart Finsec: Sourabh Kumar resigned as Chief Financial Officer of the company.

Organic Coatings: Parvej Mansuri has resigned as a Chief Financial Officer of the company for his future growth.

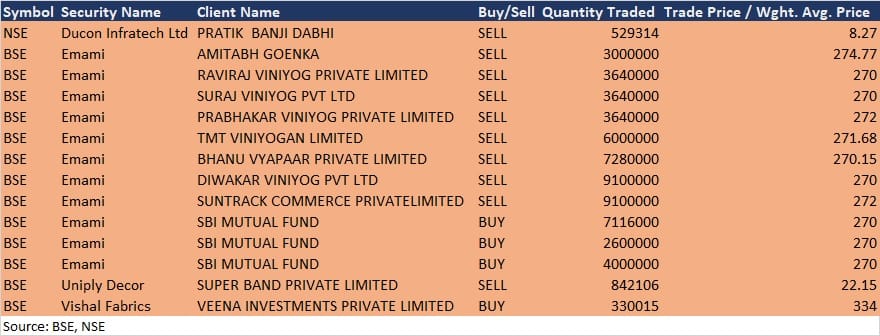

Bulk deals

(For more bulk deals, Click Here)

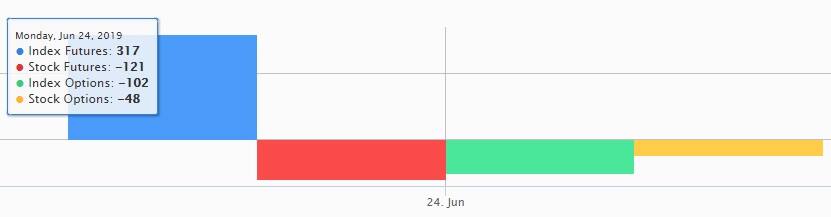

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth net Rs 207.33 crore and Domestic Institutional Investors (DIIs) purchased Rs 984.43 crore worth of shares in the Indian equity market on June 24, as per provisional data available on the NSE.

Fund Flow Picture

Five stocks under F&O ban period on NSE

For June 25, Adani Power, IDBI Bank, Jet Airways, Reliance Capital and Reliance Infrastructure are under the F&O ban period.

Securities in ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Out of F&O Ban: Jain Irrigation Systems

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!