The market ended lower on March 15 but it staged a smart recovery from the day's low in the last two hours of trade. The FII and DII outflow, partial lockdown in some states and higher WPI inflation weighed on investor sentiment.

The S&P BSE Sensex shed 397 points to close at 50,395.08, while the Nifty50 index lost 101.50 points to shut the shop at 14,929.50 levels and formed a bearish Hammer kind of pattern on the daily charts.

"The market has once again recovered strongly. The market is not ready to give up easily. The uptrend from 14,745 stopped directly at 14,950 and the Bank Nifty improved by 800 points from the bottom," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

"If the Nifty goes into an improper correction, there could be severe short covering above 15,100 levels and in that case, again the possibilities of hitting 15,350-15,450 would turn bright. It would be better if we stay stock-specific until then," he said.

"If the market goes down again, 14,800-14,750 would be the best support, he added.

The broader markets also corrected in line with frontliners. The Nifty Midcap 100 index was down 0.68 percent and Smallcap 100 index fell 0.79 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,767.4, followed by 14,605.3. If the index moves up, the key resistance levels to watch out for are 15,070 and 15,210.5.

Nifty Bank

The Nifty Bank index declined 314.15 points to close at 35,182.55 on March 15. The important pivot level, which will act as crucial support for the index, is placed at 34,560.73, followed by 33,938.87. On the upside, key resistance levels are placed at 35,674.33 and 36,166.06 levels.

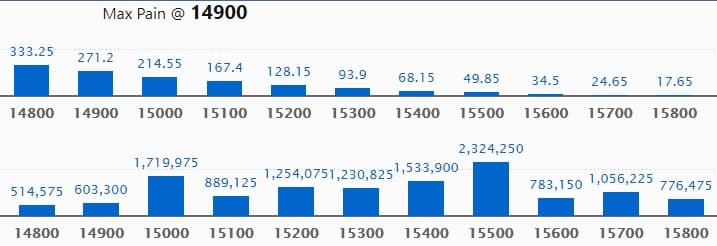

Call option data

Maximum Call open interest of 23.24 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,000 strike, which holds 17.19 lakh contracts, and 15,400 strike, which has accumulated 15.33 lakh contracts.

Call writing was seen at 14,900 strike, which added 2.28 lakh contracts, followed by 15,100 strike which added 2.17 lakh contracts and 15,700 strike which added 1.94 lakh contracts.

Call unwinding was seen at 15,800 strike, which shed 1.22 lakh contracts, followed by 14,300 strike which shed 53,550 contracts.

Put option data

Maximum Put open interest of 26.60 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 15,000 strike, which holds 17.40 lakh contracts, and 14,300 strike, which has accumulated 14.22 lakh contracts.

Put writing was seen at 14,500 strike, which added 1.63 lakh contracts, followed by 14,600 strike, which added 1.43 lakh contracts and 14,100 strike which added 1.27 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 4.3 lakh contracts, followed by 14,800 strike which shed 1.15 lakh contracts.

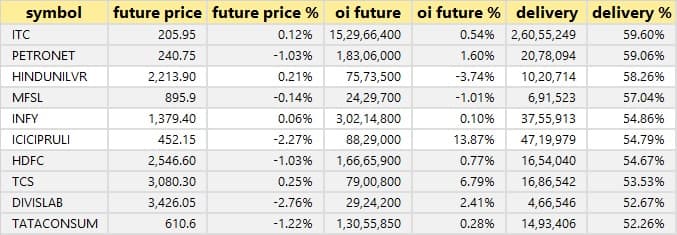

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

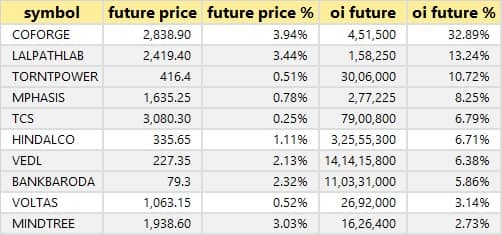

25 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

54 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

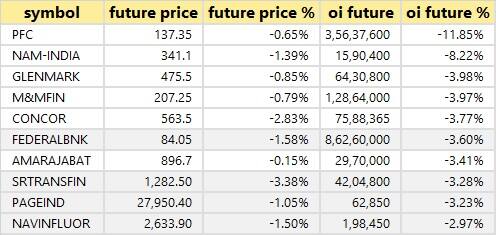

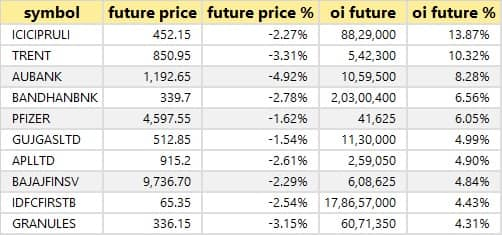

46 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

33 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

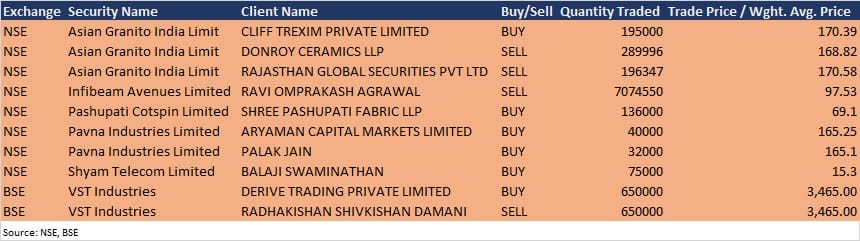

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Kalpataru Power Transmission: The company's officials will interact with Quest Investment Advisors on March 17 and attend India Virtual Forum: Capex Drivers organized by BofA Securities India on March 18.

Railtel Corporation Of India: The meeting of the board of directors of the company is scheduled on March 22 to consider audited consolidated and standalone financial results for the quarter and nine months ended on December 2020 and to declare interim dividend, if any.

Mahindra Logistics: One-on-one call is scheduled to be held with Nippon AMC on March 16.

JSW Steel: The company's officials will attend 'India Virtual conference: Capex drivers' organised by BofA Securities.

Infibeam Avenues: The company's officials will meet multiple investors in a non-deal roadshow on March 17-18.

VRL Logistics: The company's officials will meet Singapore-based global investor in a conference call organised by Motilal Oswal Financial Services.

Som Distilleries & Breweries: The senior management of the company is scheduled to conference call meetings on Zoom Call, with analysts and investors on March 16.

Dhanuka Agritech: Mahendra Kumar Dhanuka, Managing Director of Dhanuka Agritech will participate in 'Nakshatra- The Shining Star- Mid & Small-Cap' conference on March 23 hosted by Centrum Capital.

Stocks in the news

Adani Ports and Special Economic Zone: The company is going to develop the west container terminal (WCT) of Colombo Port in Sri Lanka. It will partner with Sri Lanka's largest diversified conglomerate John Keells Holdings PLC and with the Sri Lanka Ports Authority (SLPA) as a part of the consortium awarded this mandate.

Shipping Corporation of India: Life Insurance Corporation of India sold 2.01 percent stake in state-owned Shipping Corporation of India through open market transaction.

NIIT: NIIT (USA) Inc, a US subsidiary of the company, has signed a managed services agreement with a US-based financial services organisation (an existing client) to provide a range of learning services.

HFCL: The company has signed a share subscription and shareholders' agreement with Tamil Nadu-based cable reinforcement solutions company Nimpaa Telecommunications and its promoter shareholders. The company intends to acquire up to 50 percent of the paid-up equity share capital of Nimpaa, in one or more tranches.

Mishra Dhatu Nigam: The board of directors have declared an interim dividend of Rs 1.20 per equity share of Rs 10 each for the financial year 2020-21.

Usha Martin: Promoter Peterhouse Investments and other promoters reduced stake in the company to 3.90 percent from 3.98 percent via open market transaction.

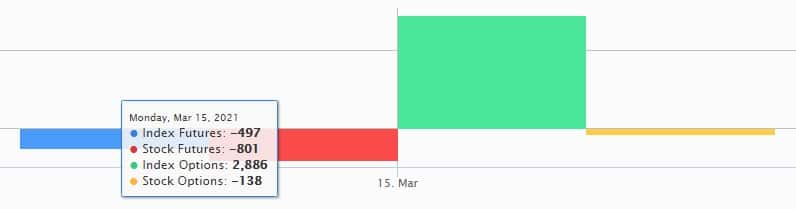

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,101.35 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 749.71 crore in the Indian equity market on March 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and Sun TV Network - are under the F&O ban for March 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!