The selling pressure continued for yet another session on April 6 as the benchmark indices fell nearly a percent, weighed by weak global cues owing to Federal Reserve governor's hawkish commentary, and FII selling. Private banks, financial services, IT and select auto & FMCG stocks were under pressure.

The BSE Sensex declined 566 points to 59,610, while the Nifty50 fell 150 points to 17,808 and formed small bodied bearish candle on the daily charts.

"A small negative candle was formed on the daily chart with minor upper shadow. This pattern confirms a short term top reversal at the swing high of 18,114 levels and a beginning of downward correction in the market. The overhead resistance of down sloping trend line seems to have acted as a crucial hurdle for the market and resulted in a trend reversal down," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Presently, Nifty is placed above the previous upside gap of April 4 at 17,800 levels.

Shetti feels the short term trend of Nifty seems to have reversed down and the downward correction is on the way. "There is a possibility of further weakness in the market down to 17,600 levels in the next few sessions. Confirmation of bearish Island Reversal could open more downside for the market."

In the broader space, there was an outperformance as the Nifty Midcap index was up 0.6 percent and Smallcap index gained 0.1 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,758, followed by 17,708. If the index moves up, the key resistance levels to watch out for are 17,879 and 17,951.

Private banking stocks continued to be under pressure as Bank Nifty fell 435 points or 1.1 percent to 37,633 on April 6. The important pivot level, which will act as crucial support for the index, is placed at 37,475, followed by 37,317. On the upside, key resistance levels are placed at 37,830 and 38,026 levels.

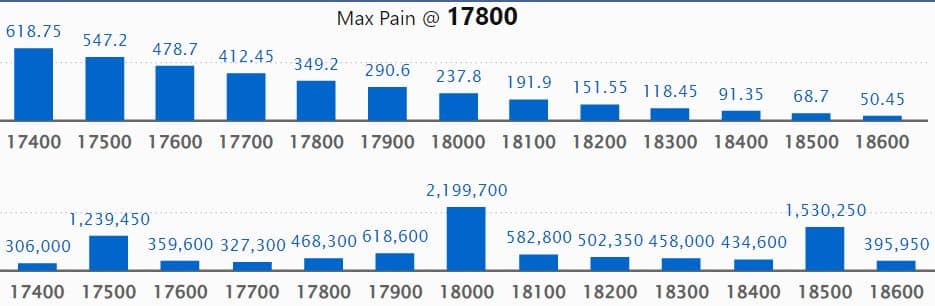

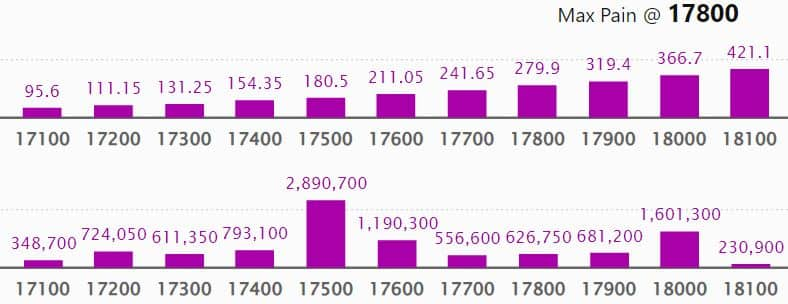

Maximum Call open interest of 21.99 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 19,000 strike, which holds 19.49 lakh contracts, and 18,500 strike, which has accumulated 15.30 lakh contracts.

Call writing was seen at 17,900 strike, which added 3.9 lakh contracts, followed by 17,800 strike which added 1.61 lakh contracts, and 18,000 strike which added 1.4 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 53,700 contracts, followed by 18,800 strike which shed 34,800 contracts and 17,600 strike which shed 25,600 contracts.

Maximum Put open interest of 28.90 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which holds 18.74 lakh contracts, and 16,500 strike, which has accumulated 17.52 lakh contracts.

Put writing was seen at 17,500 strike, which added 4.3 lakh contracts, followed by 17,600 strike, which added 3.2 lakh contracts and 17,900 strike which added 3.14 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 2.4 lakh contracts, followed by 18,100 strike which shed 1.36 lakh contracts, and 17,200 strike which shed 69,000 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Indus Towers, Honeywell Automation, ICICI Prudential Life Insurance, SBI Life Insurance Company, and Hindustan Unilever, among others on Wednesday.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Torrent Power, Coal India, Aditya Birla Fashion & Retail, Indian Hotels, and Balrampur Chini Mills, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Ipca Laboratories, GNFC, Bank Nifty, Syngene International, and Nifty, in which long unwinding was seen.

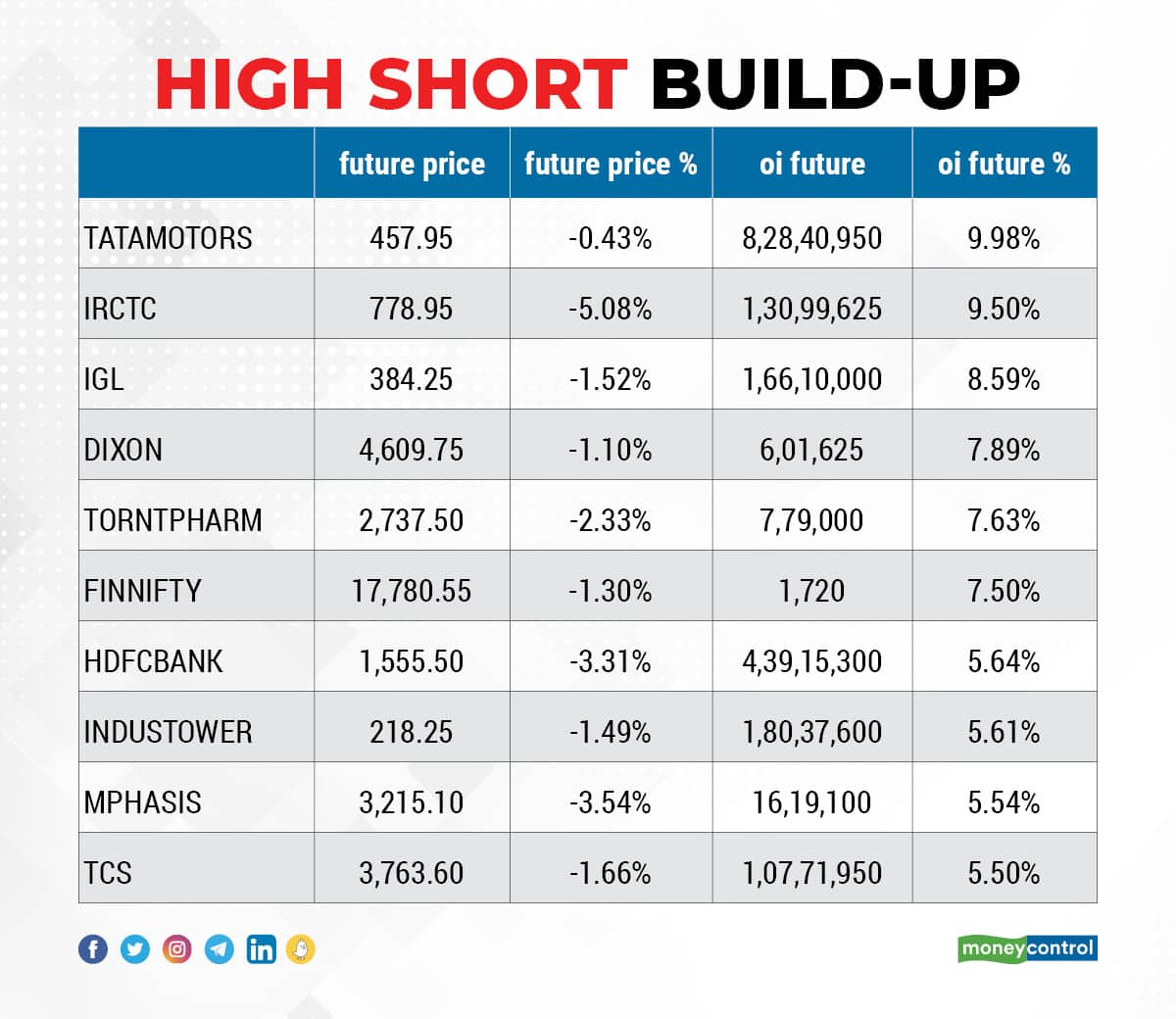

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Tata Motors, IRCTC, Indraprastha Gas, Dixon Technologies, and Torrent Pharma, in which a short build-up was seen.

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including JK Cement, Intellect Design Arena, Coromandel International, Larsen & Toubro, and Ashok Leyland, in which short-covering was seen.

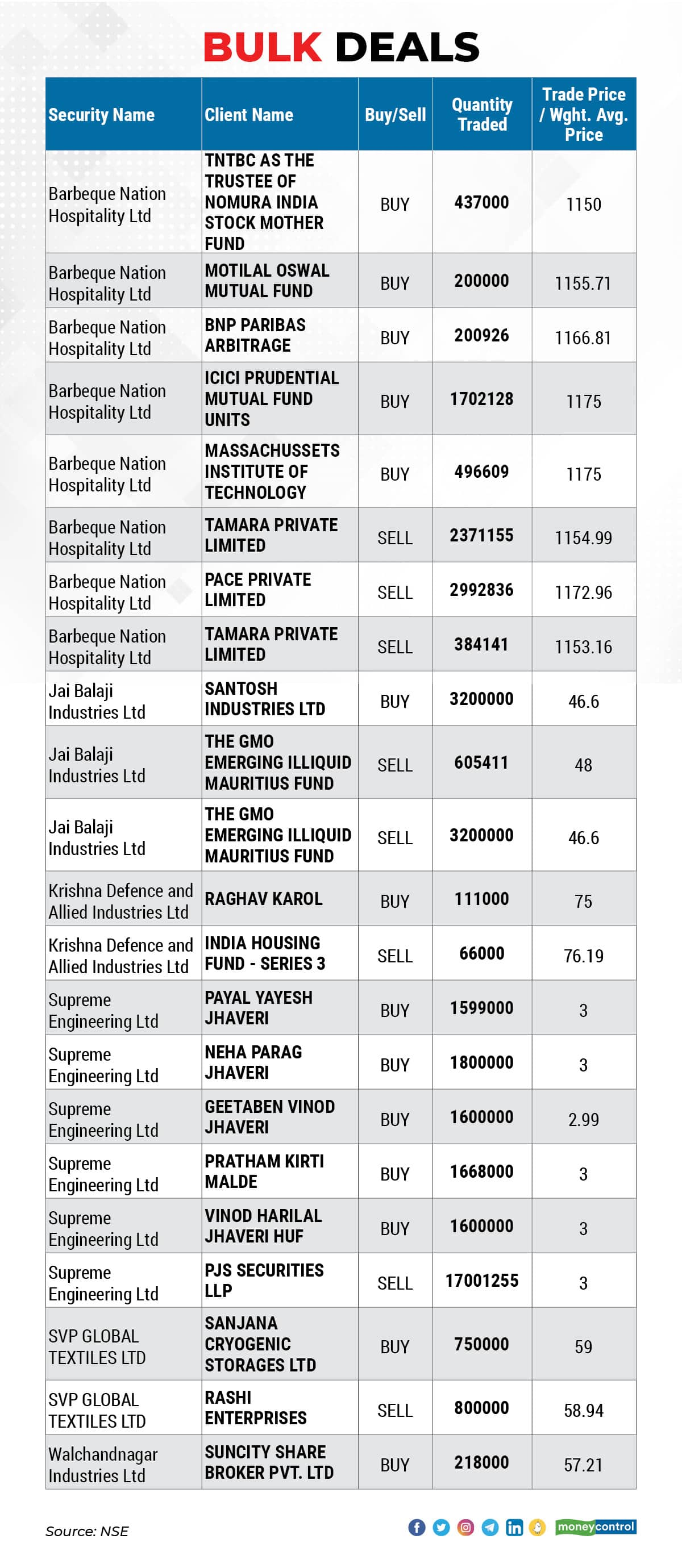

Barbeque Nation Hospitality: TNTBC as the Trustee of Nomura India Stock Mother Fund acquired 4.37 lakh equity shares in the company via open market transactions at an average price of Rs 1,150 per share, Motilal Oswal Mutual Fund acquired 2 lakh shares at Rs 1,155.71 per share, BNP Paribas Arbitrage bought 2,00,926 lakh shares at Rs 1,166.81 per share, ICICI Prudential Mutual Fund Units purchased 17,02,128 shares at Rs 1,175 per share, and Massachussets Institute of Technology acquired 4,96,609 equity shares at Rs 1,175 per share. However, investor Tamara Private Limited exited Barbeque by selling 23,71,155 equity shares at Rs 1,154.99 per share, and 3,84,141 shares at Rs 1,153.16 per share. Investor Pace Private Limited also offloaded 29,92,836 shares at Rs 1,172.96 per share, against its total shareholding of 31,82,964 shares as of December 2021.

(For more bulk deals, click here)

Analysts/Investors Meetings on April 7

Krsnaa Diagnostics: The company's officials will meet Alpha Alternatives, and Sapphire Capital.

India Pesticides: The company's officials will meet Joindree Capital, Arjav Partners, and InvestQ.

RailTel Corporation of India: The company's officials will meet HDFC Life, Aditya Birla Sun Life Insurance, MK ventures, Mahindra Manulife Mutual Fund, Quant Mutual Fund, Aditya Birla Sun Life Mutual Fund, HDFC Mutual Fund and ICICI Prudential Mutual fund.

Allcargo Logistics: The company's officials will meet MK Ventures.

Som Distilleries & Breweries: The company's officials will meet Augmen Catalyst, Amideep Investments, Envision Capital, Equity Intelligence, I-Wealth, and Pragya Securities.

Aarti Drugs: The company's officials will meet investors and analysts.

SMS Pharmaceuticals: The company's officials will meet investors and analysts.

Welspun Corp: The company's officials will meet investors and analysts.

Mahindra Lifespace Developers: The company's officials will meet investors.

Nazara Technologies: The company's officials will meet B&K, CLSA, DAM Capital, Dolat Capital, Equirus, IIFL Securities, Jefferies, MOSL, Phillip Capital, Prabhudas Lilladher, Spark Capital, and Yes Securities.

TCNS Clothing: The company's officials will meet Arihant Capital.

Ujjivan Small Finance Bank: The company's officials will meet IDFC MF.

Tata Motors: The company's officials will meet Bajaj Allianz Life Insurance.

Cera Sanitaryware: The company's officials will meet Ocean Dial Asset Management.

Metropolis Healthcare: The company's officials will meet Julius Baer.

Stocks in News

Uma Exports: The company will make its debut on the bourses on April 7.

Godrej Consumer Products: In India, the company expects to deliver close to double-digit sales growth in Q4FY22, driven entirely by pricing. Personal Care sustained its double-digit growth trajectory, primarily led by pricing in Personal Wash, while Home Care witnessed a soft performance on a high base, impacted by a relatively muted season for home insecticides and the discretionary nature of air fresheners. In Godrej Africa, USA and Middle East, it continued growth momentum across most of key countries of operations and expects to deliver a constant currency sales growth close to the mid-teens.

Motherson Sumi Systems: The company has completed acquisition of a 55 percent stake in CIM Tools Private Limited, one of the leading suppliers in aerospace supply chain based in Bengaluru. CIM in turn holds 83 percent in Aero Treatment (ATPL) and 49.99 percent in Lauak CIM Aerospace (JV with Lauak International, LCA). The three founders, Srikanth GS, Umesh AS and Vishwanath Deshpande, retain the remaining 45 percent stake in CIM. Since the initial announcement in October 2021, CIM's order book has grown 26 percent to $252 million.

IDFC: IDFC and a consortium comprising Bandhan Financial Holdings, GIC and ChrysCapital have entered into a definitive agreement to acquire IDFC Asset Management Company and IDFC AMC Trustee Company, from IDFC, for Rs 4,500 crore. The company has declared an interim dividend of Re 1 per equity share.

Asian Granito India: The company in its BSE filing said its Rs 441 crore Rights issue will open for eligible shareholders on April 25. The company has fixed April 12 as record date for the purpose of determining the equity shareholders eligible to receive the rights entitlement in the rights issue. The Rights Entitlement Ratio is 37:30. The company will offer 7 crore equity shares through this Rights issue.

Titan Company: The company in a BSE filing said jewellery business in Q4FY22 declined by 4 percent YoY, with addition of 16 stores during the quarter, but watches & wearables business registered 12 percent growth YoY with addition of 34 stores. Its Eyecare segment reported 5 percent growth YoY with addition of 51 stores during the quarter.

Zee Entertainment Enterprises: Invesco Developing Market Funds will launch a block deal to sell 7.8 percent stake in the company on April 7, but will continue to hold remaining 11 percent stake. Invesco reaffirmed belief that Zee Sony deal has a great potential.

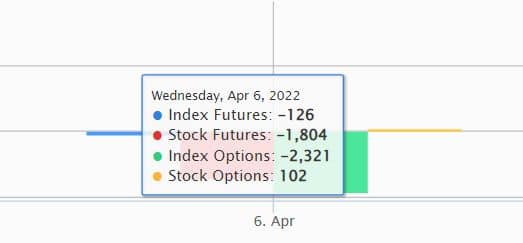

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,279.97 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 622.92 crore on April 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for April 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!