The market gained for the eighth consecutive session with the benchmark indices hitting a fresh record high on November 11 as bulls seem to be not in a position to let the bears enter Dalal Street. The rally across sectors barring PSU banks pushed the benchmark indices higher.

The BSE Sensex rallied 316.02 points to end at a record closing high of 43,593.67, while the Nifty50 climbed 118.10 points to 12,749.20 and formed a bullish candle which resembles a Hanging Man kind of pattern on the daily charts, though it was a roller-coaster ride intraday.

"The emergence of high intraday volatility in the last two sessions could signal the possibility of a confused state of mind among participants at the new highs. Hence, there is a possibility of a halt of this sharp trended upmove in the next 1-2 sessions. But still, there is no indication of any reversal pattern at the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty is now nearing a crucial long term resistance of around 12,800-12,850 levels (ascending long term trend line on the monthly chart, connected from a tops of August 2018 and June 2019. This is going to be strong overhead resistance for the market and the selling pressure is expected to emerge from the highs," he said.

Long positions need to be protected with appropriate stoploss, he advised.

The broader markets' underperformance to frontliners continued as the Nifty Midcap index was up 0.4 percent and Smallcap index gained 0.7 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,623.6, followed by 12,498.0. If the index moves up, the key resistance levels to watch out for are 12,822.3 and 12,895.4.

Nifty Bank

The Bank Nifty gained 239 points to close at 28,845 on November 11. The important pivot level, which will act as crucial support for the index, is placed at 28,360.43, followed by 27,875.87. On the upside, key resistance levels are placed at 29,180.23 and 29,515.47.

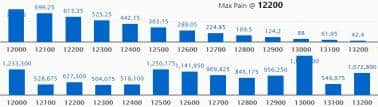

Call option data

Maximum Call open interest of 19.04 lakh contracts was seen at 13,000 strike, which will act as a crucial resistance level in the November series.

This is followed by 12,500 strike, which holds 12.50 lakh contracts, and 12,000 strike, which has accumulated 12.33 lakh contracts.

Call writing was seen at 12,700 strike, which added 3.19 lakh contracts, followed by 13,000 strike which added 2.26 lakh contracts and 12,900 strike which added 1.58 lakh contracts.

Call unwinding was seen at 13,200 strike, which shed 97,200 contracts, followed by 12,400 strike which shed 56,550 contracts and 12,100 strike which shed 43,950 contracts.

Put option data

Maximum Put open interest of 32.63 lakh contracts was seen at 12,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 22.75 lakh contracts, and 12,500 strike, which has accumulated 14.74 lakh contracts.

Put writing was seen at 12,700 strike, which added 6.75 lakh contracts, followed by 12,000 strike, which added 2.63 lakh contracts and 12,600 strike which added 2.55 lakh contracts.

Put unwinding was seen at 11,600 strike, which shed 2.26 lakh contracts, followed by 11,800 strike, which shed 47,025 contracts and 13,100 strike which shed 11,550 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

48 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

14 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

24 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

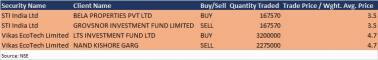

Bulk deals

(For more bulk deals, click here)

Results on November 12

Eicher Motors, Engineers India, Grasim Industries, HUDCO, Infibeam Avenues, IRCTC, IRB Infrastructure Developers, Jubilant FoodWorks, Aksh Optifibre, Alok Industries, Apollo Micro Systems, Aarey Drugs, Arvind Fashions, Avanti Feeds, Bajaj Hindusthan Sugar, Bharat Dynamics, BF Utilities, Clariant Chemicals, Cochin Shipyard, Dishman Carbogen Amcis, Fortis Healthcare, Gujarat Pipavav Port, HCC, HEG, KNR Constructions, Mazagon Dock Shipbuilders, Mahanagar Gas, Natco Pharma, Page Industries, PFC, Punjab & Sind Bank and Sun TV Network are among 808 companies to declare their quarterly earnings on November 12.

Stocks in the news

Aurobindo Pharma: The company reported a higher profit at Rs 805.6 crore in Q2FY21 compared to Rs 639.5 crore, revenue rose to Rs 6,483.3 crore from Rs 5,600.5 crore YoY.

Gujarat State Petronet: The company reported a lower profit at Rs 498.6 crore in Q2FY21 compared to Rs 696.2 crore, revenue declined to Rs 2,980.4 crore versus Rs 3,043.2 crore YoY.

SpiceJet: The company reported loss at Rs 105.6 crore in Q2FY21 against loss at Rs 461.2 crore, revenue fell to Rs 1,070.5 crore versus Rs 2,848.3 crore YoY.

Ashoka Buildcon: The company reported a higher profit at Rs 70.4 crore in Q2FY21 against Rs 11.4 crore, revenue increased to Rs 1,189.3 crore from Rs 1,037.8 crore YoY.

Indiabulls Housing Finance: The company reported a higher profit at Rs 323 crore in Q2FY21 compared to Rs 273 crore, net interest income rose to Rs 750 crore from Rs 731 crore QoQ.

Coal India: The company reported a lower profit at Rs 2,951.6 crore in Q2FY21 compared to Rs 3,522.9 crore, revenue increased to Rs 21,153.1 crore from Rs 20,382.6 crore YoY.

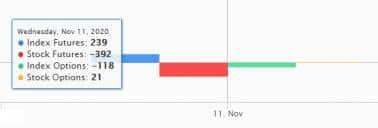

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 6,207.19 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 3,463.86 crore in the Indian equity market on November 11, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Two stocks - BHEL and Jindal Steel & Power - are under the F&O ban for November 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!