The market recouped intraday losses in last hour of trade and ended marginally higher at fresh record closing high on December 18 as gains led by IT, pharma and select FMCG stocks were capped by the selling in select banking & financials, auto and metals stocks.

The BSE Sensex rose 70.35 points to 46,960.69, while the Nifty50 gained 19.80 points at 13,760.50 and formed Dragon Fly Doji kind of pattern on the daily charts. The index rose 1.8 percent for the week and witnessed bullish candle formation on weekly scale.

"Long bull candle was formed on the weekly chart with minor lower shadow. This indicate a continuation of up trended move as per long term chart. Though, Nifty placed at the highs, there is no indication of any reversal pattern unfolding as per intraday/daily and weekly timeframe charts," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

According to him, the consolidation movement could continue for the early part of next week, before showing further upside momentum in the mid part. "The next crucial long term resistance to be watched around 13,900-14,000 levels for the next 1-2 weeks. Immediate support is placed at 13,660," he said.

The overall market breadth continued to be negative on Friday and broad market indices like Nifty Midcap and Smallcap closed mildly lower by 0.25 percent and 0.21 percent respectively. "This indicates consolidation movement in the sector and one may expect resumption of upside in the broader market post range movement," Shetti said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,688.47, followed by 13,616.43. If the index moves up, the key resistance levels to watch out for are 13,802.67 and 13,844.83.

Nifty Bank

The Nifty Bank fell 132.35 points to close at 30,714.65 on December 18. The important pivot level, which will act as crucial support for the index, is placed at 30,441.43, followed by 30,168.17. On the upside, key resistance levels are placed at 30,921.03 and 31,127.37.

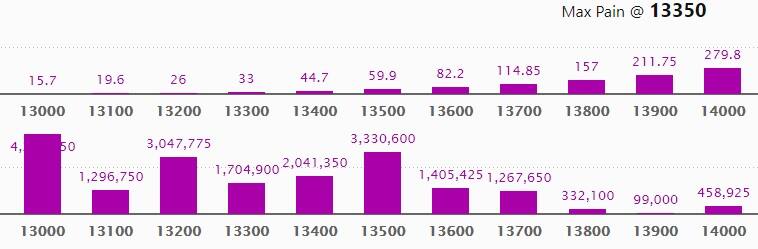

Call option data

Maximum Call open interest of 21.66 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 14,000 strike, which holds 20.97 lakh contracts, and 13,500 strike, which has accumulated 18.90 lakh contracts.

Call writing was seen at 14,400 strike, which added 2.67 lakh contracts, followed by 14,200 strike which added 1.96 lakh contracts and 14,000 strike which added 1.86 lakh contracts.

Call unwinding was seen at 14,300 strike, which shed 1.02 lakh contracts, followed by 13,600 strike which shed 92,250 contracts.

Put option data

Maximum Put open interest of 42.81 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 13,500 strike, which holds 33.30 lakh contracts, and 13,200 strike, which has accumulated 30.47 lakh contracts.

Put writing was seen at 13,700 strike, which added 3.62 lakh contracts, followed by 13,400 strike, which added 3.21 lakh contracts and 13,500 strike which added 1.83 lakh contracts.

Put unwinding was seen at 13,000 strike, which shed 2.02 lakh contracts, followed by 13,100 strike, which shed 60,675 contracts.

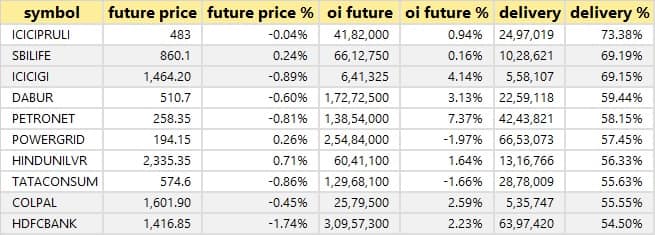

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

30 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which a long build-up was seen.

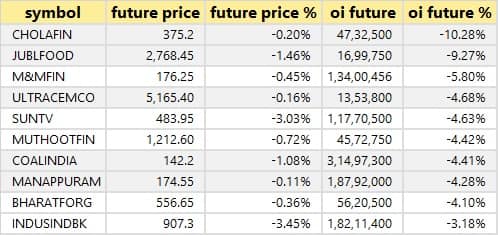

38 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

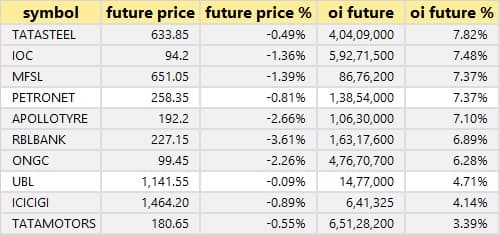

30 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

38 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

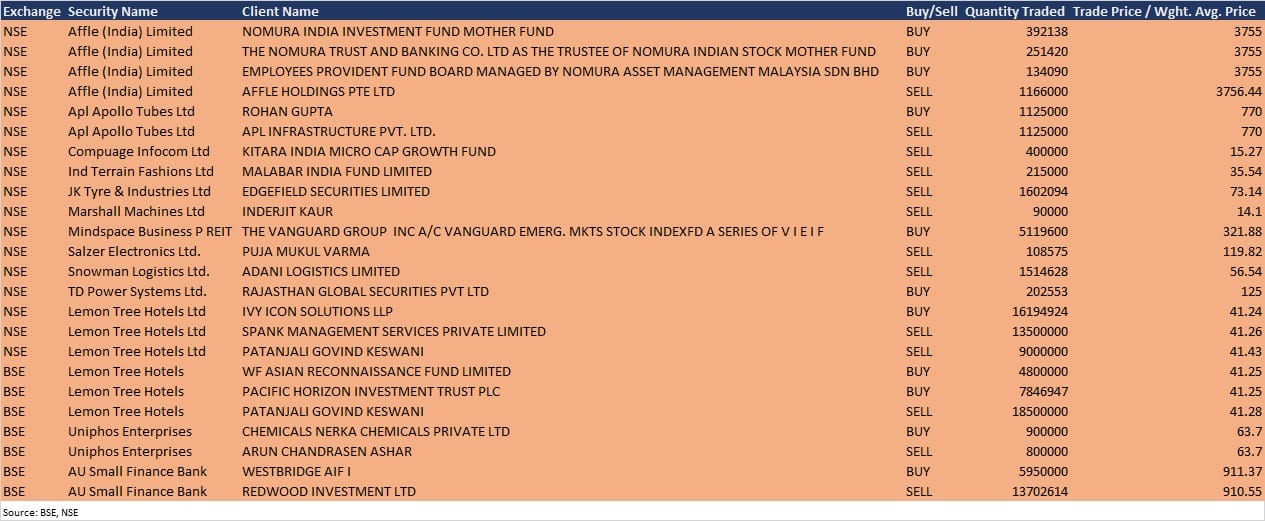

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Affordable Robotic & Automation: Company's officials will meet analysts/investors on December 21.

Nxtdigital: Company's officials will meet analysts/investors on December 21.

Finolex Industries: Company's officials will meet Kotak Mutual Fund on December 22 and Birla Mutual Fund on December 24.

Pidilite Industries: Company's officials will meet JP Morgan India on December 23.

CESC: Proposal for issue of secured NCDs Rs 200 crore will be considered by Board of Directors on December 23.

PC Jeweller: Board meeting is scheduled on December 23 to consider the issue of securities by way of preferential allotment to promoter Shri Balram Garg against conversion of his unsecured loan to the company.

Stocks in the news

Lupin: Company has received approval from USFDA for Colesevelam hydrochloride tablets which are used to reduce cholesterol.

PVR: Company will raise up to Rs 800 crore via equity.

KPR Mill: Company will invest Rs 500 crore for expansion of sugar mill operations.

Reliance Industries: Company and BP announced first gas from Asia's deepest project. Project is expected to meet 15% of India's gas demand by 2023.

Oberoi Realty: Subsidiary Evenstar Hotels purchased a hotel property in Worli, Mumbai, for Rs 1,040 crore.

Exide Industries: Life Insurance Corporation Of India increased stake in company to 5.5% from 3.48% earlier.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,720.95 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,424.61 crore in the Indian equity market on December 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Canara Bank, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for December 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!