The market closed the rangebound session higher, with the Nifty50 ending at fresh record closing high on September 14, tracking positive global cues. Going forward, 20,100 is likely to be crucial level for further direction in the market, with resistance at 20,200-20,300 area and the key support at 19,900 levels, experts said.

The BSE Sensex rose 52 points to 67,519, extending upward journey for 10th consecutive session, while the Nifty50 advanced 33 points to 20,103, a fresh closing high, and formed bearish candle with minor upper & lower wicks which resembles Spinning Top kind of candlestick pattern format on the daily charts, signalling indecisiveness among bulls and bears about future market trend.

"The "buy on dips" strategy is expected to be the preferred approach until Nifty falls below 19,900 decisively," Rupak De, senior technical analyst at LKP Securities said.

On the upside, he feels Call writers at 20,100 are likely to defend the index against further upward movement. A sustained trade above 20,100 could potentially trigger a significant rally in the short term, he said.

Broader markets also continued to recoup further losses, with positive breadth in the ratio of 3:1. The Nifty Midcap 100 and Smallcap 100 indices gained more than 1 percent each, sustaining uptrend for second straight session, after falling 3 percent and 4 percent on September 12.

The fear index, India VIX remained below 12, which gives comfort for bulls, falling 4.31 percent to 11.32 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 20,057, followed by 20,028 and 19,980. On the higher side, 20,152 can be an immediate resistance, followed by 20,182 and 20,229.

On September 14, the Bank Nifty failed to give a decisive breakout above 46,000 mark, though it closed with 91 points gains at 46,001. Sustaining above this mark can possibly take the banking index above previous record high of 46,370, experts said.

The Bank Nifty has formed Doji kind of candlestick pattern on the daily timeframe as the closing was near its opening levels, indicating the indecisiveness among buyers and sellers about further market trend.

"Supports are gradually shifting higher and now it has to continue to hold above 45,750 zone for an up move towards 46,350 then 46,500 levels, whereas on the downside support is expected at 45,600 then 45,250 levels," Chandan Taparia, Senior Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the banking index is expected to take support at 45,851, followed by 45,768 and 45,633. On the upside, the initial resistance is at 46,120, then 46,203 and 46,338.

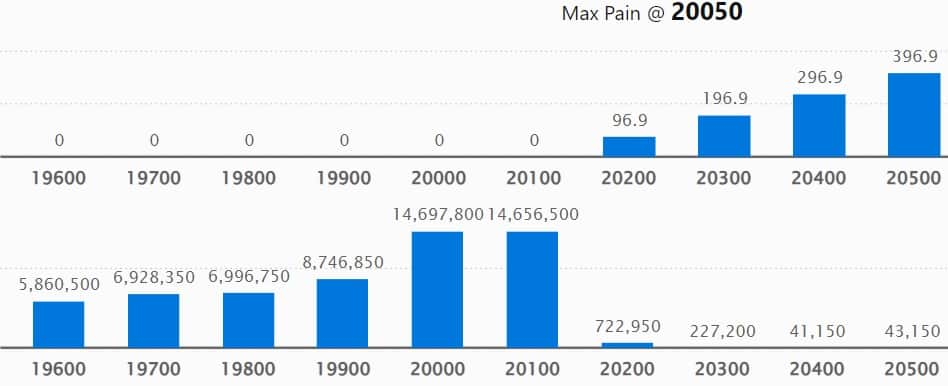

As per the options data, the maximum weekly Call open interest (OI) was at 20,100 strike, with 1.87 crore contracts, which can act as a key resistance for the Nifty. It was followed by 20,300 strike, which had 1.42 crore contracts, while 20,200 strike had 1.3 crore contracts.

The meaningful Call writing was visible at 20,100 strike, which added 70.92 lakh contracts, followed by 20,300 and 20,400 strikes, which added 59.36 lakh and 34.08 lakh contracts.

The maximum Call unwinding was at 19,800 strike, which shed 14.74 lakh contracts, followed by 19,500 strike and 19,900 strike, which shed 7.77 lakh contracts, and 6.38 lakh contracts.

On the Put side, the maximum open interest was at 20,000 strike, with 1.47 crore contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 20,100 strike comprising 1.46 crore contracts, and 19,900 strike with 87.46 lakh contracts.

The meaningful Put writing was at 20,100 strike, which added 1.02 crore contracts, followed by 20,000 strike and 19,600 strike, which added 29.25 lakh and 3.08 lakh contracts.

Put unwinding was at 19,900 strike, which shed 36.8 lakh contracts followed by 19,100 strike and 19,700 strike, which shed 15.9 lakh and 15.45 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Shree Cement, Pidilite Industries, Godrej Consumer Products, Shriram Finance, and Page Industries were among the stocks with the highest delivery.

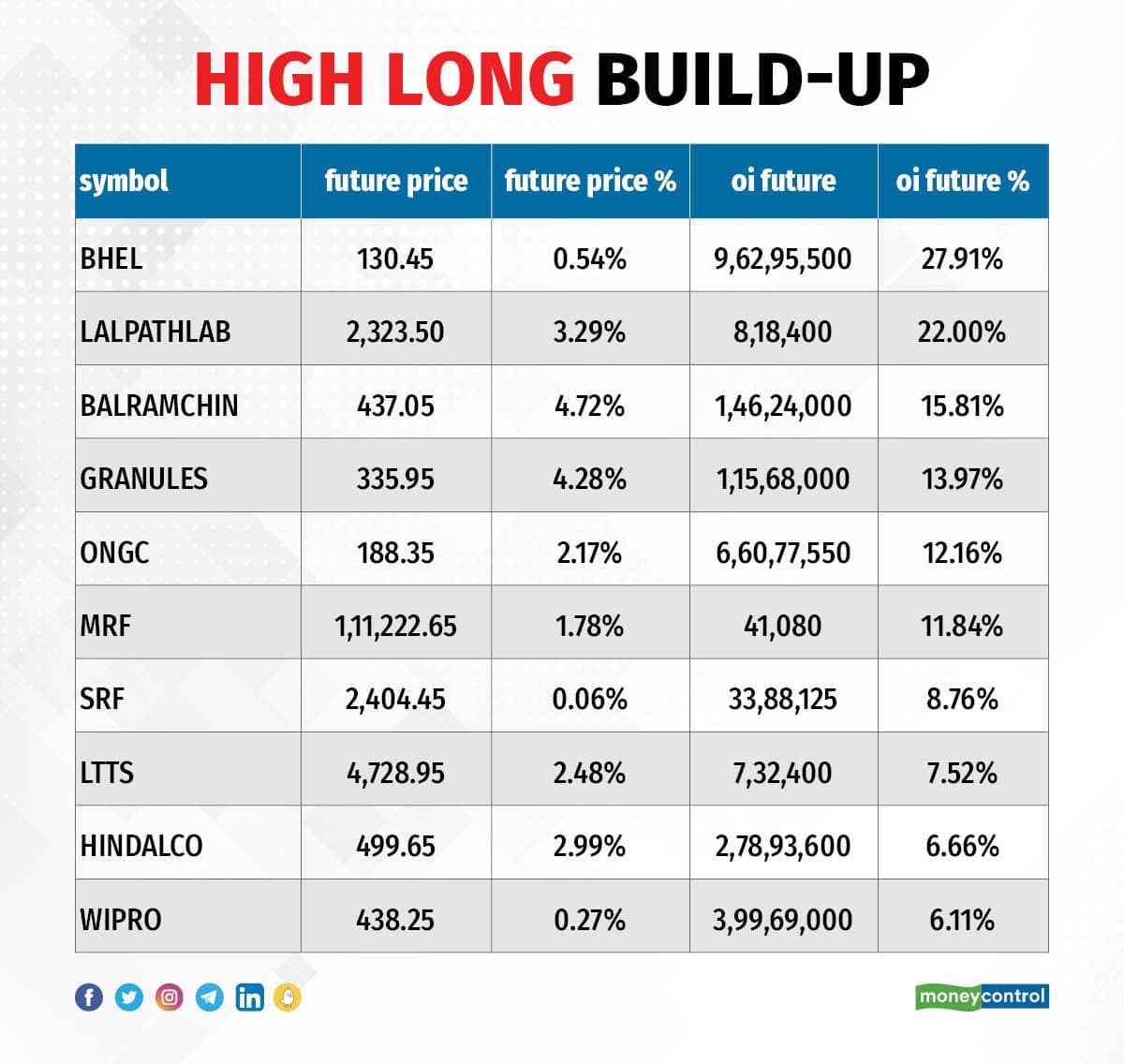

A long build-up was seen in 71 stocks, including BHEL, Dr Lal PathLabs, Balrampur Chini Mills, Granules India, and ONGC. An increase in open interest (OI) and price indicates a build-up of long positions.

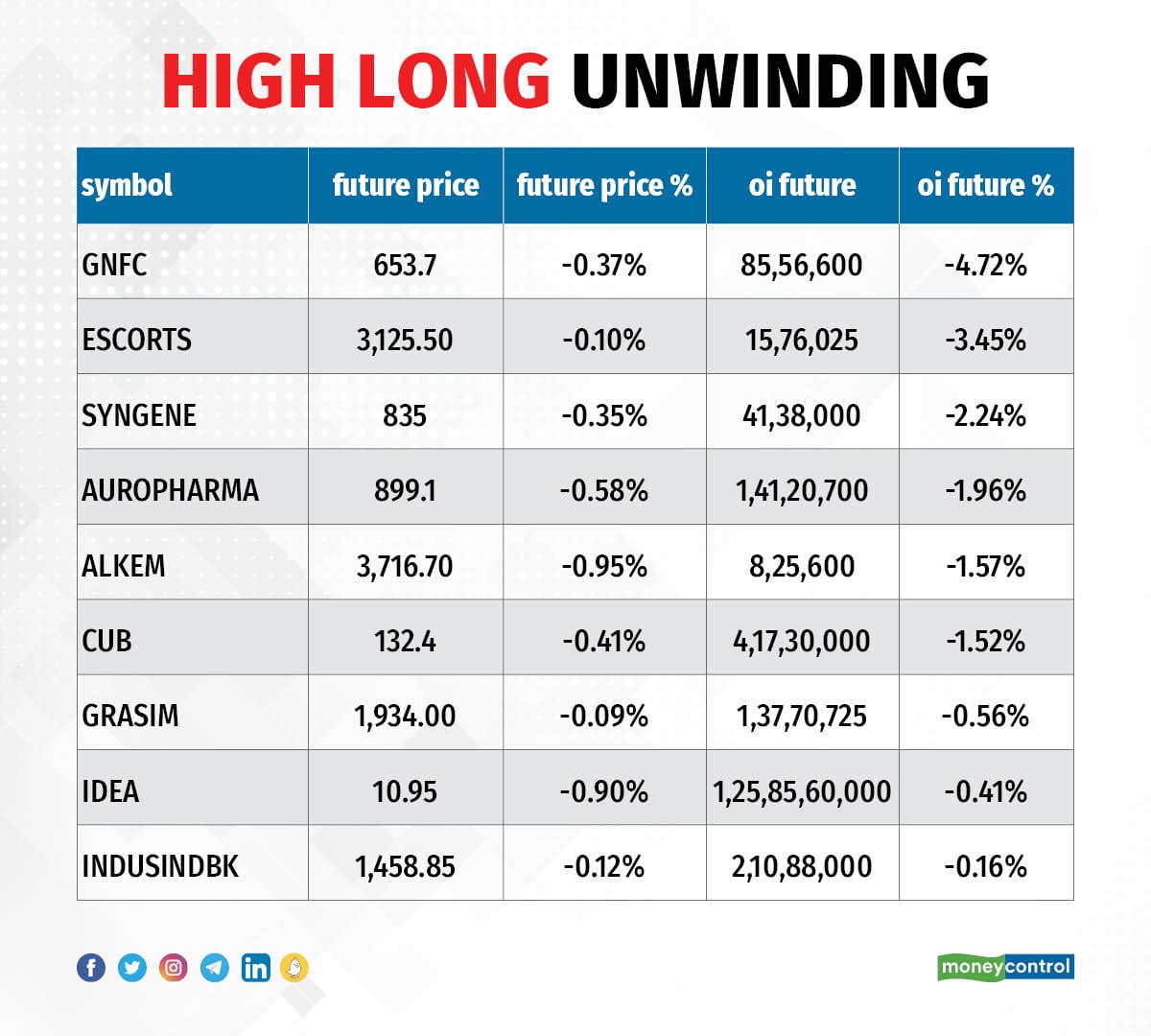

Based on the OI percentage, nine stocks, including Gujarat Narmada Valley Fertilizers and Chemicals (GNFC), Escorts Kubota, Syngene International, Aurobindo Pharma, and Alkem Laboratories, saw long unwinding. A decline in OI and price indicates long unwinding.

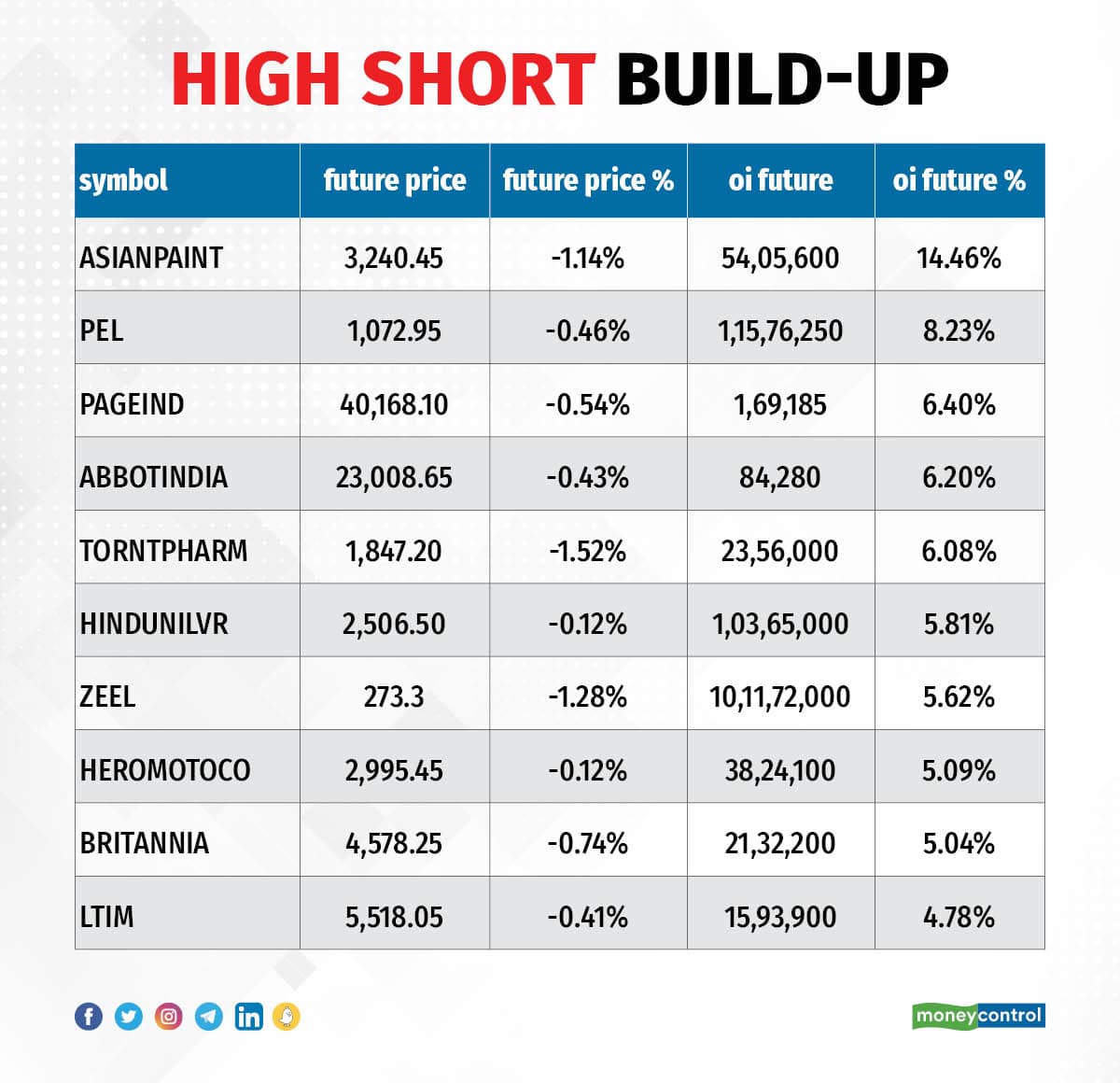

44 stocks see a short build-up

A short build-up was seen in 44 stocks. These included Asian Paints, Piramal Enterprises, Page Industries, Abbott India, and Torrent Pharma. An increase in OI along with a fall in price points to a build-up of short positions.

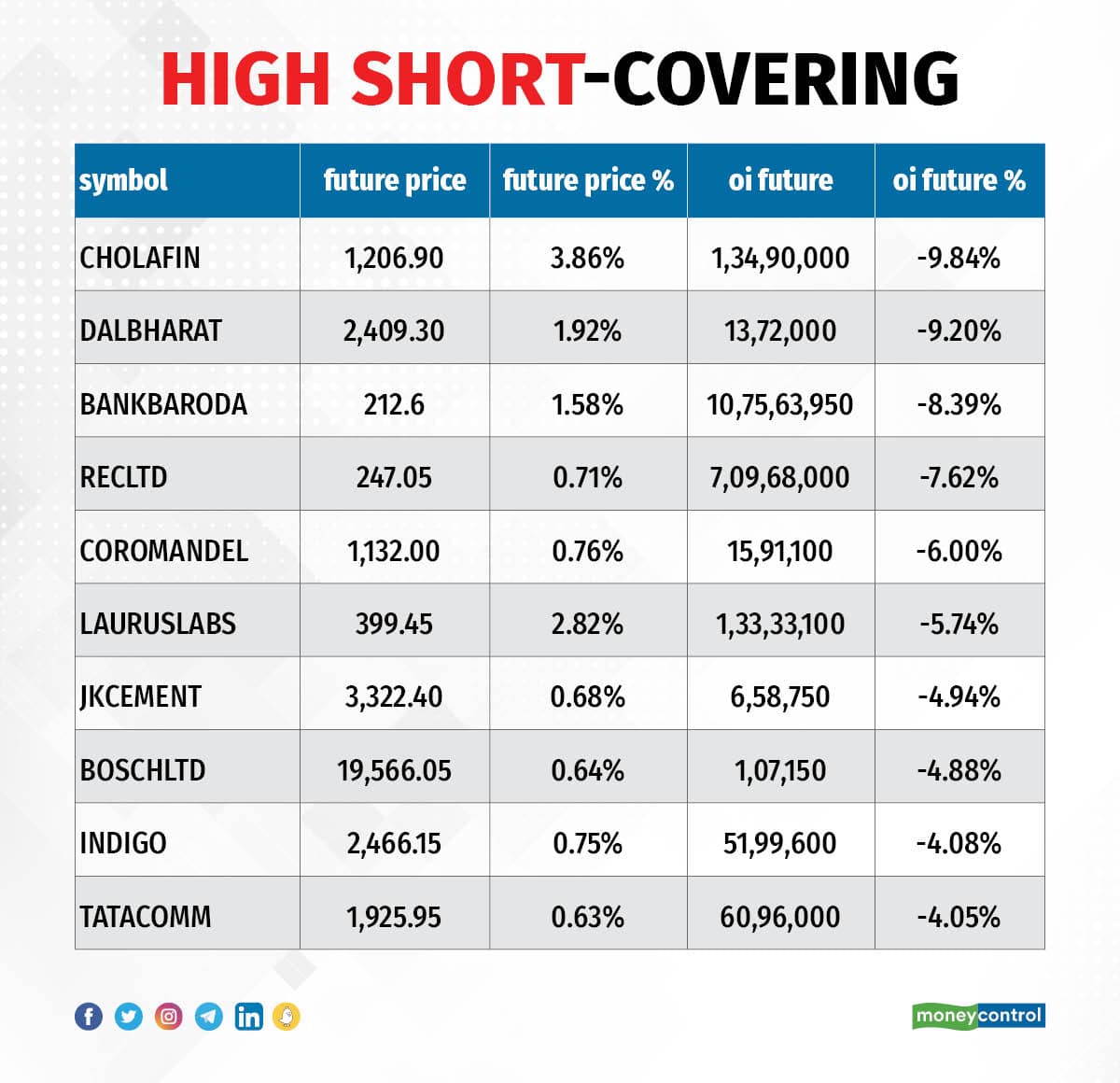

Based on the OI percentage, 63 stocks were on the short-covering list. These included Cholamandalam Investment & Finance, Dalmia Bharat, Bank of Baroda, REC, and Coromandel International. A decrease in OI along with a price increase is an indication of short-covering.

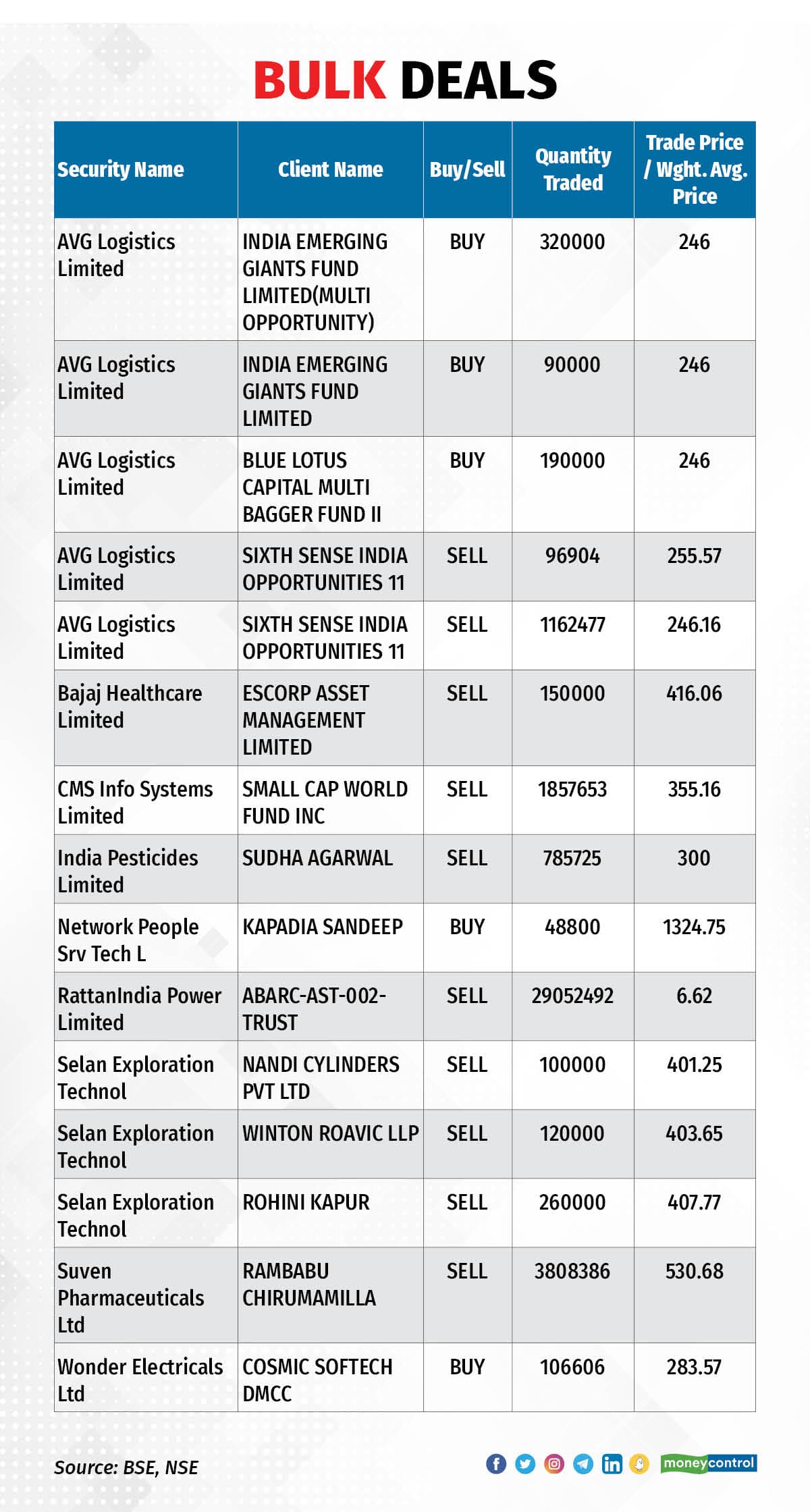

(For more bulk deals, click here)

Investors meeting on September 15

Stocks in the news

NTPC: The state-owned power generation company has signed a supplementary joint venture agreement with Uttar Pradesh Rajya Vidyut Utpadan Nigam (UPRVUNL), to amend Joint Venture Agreement (JVA) and form integral part of JVA dated February 28, 2008. NTPC & UPRVUNL signed JV agreement in 2008 for formation of a joint venture company Meja Urja Nigam (MUNPL).

Schneider Electric Infrastructure: The company said the board of directors have approved the appointment of Udai Singh as Managing Director (MD) & Chief Executive Officer (CEO) for three years with effect from September 15. In addition, Arnab Roy resigned as non-executive director of the company effective from September 14.

Bharat Forge: UAE-headquartered global aerospace and technology company Paramount announced a broadening of its development and manufacturing partnership with Indian industrial conglomerate, Bharat Forge and Kalyani Strategic Systems, to produce a wider range of armoured vehicles in India for Paramount’s global customers. Their existing partnership produces KM4 armoured vehicles for the Indian Army.

Strides Pharma Science: Subsidiary Strides Pharma Global Pte Limited, Singapore has received tentative approval for Dolutegravir 50mg tablets from the United States Food & Drug Administration (USFDA). The product is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Tivicay tablets of ViiV Healthcare Company.

Tata Power: Subsidiary Tata Power Renewable Energy signed a power delivery agreement (PDA) with Xpro India, through a special purpose vehicle (SPV), for the development of a 3.125 MW AC group captive solar plant. The SPV will develop, operate, and maintain the said captive solar power facility. The said plant, in Achegaon (Maharashtra) is expected to produce 7.128 million units of electricity annually and will support the use of renewable energy for Xpro India’s polymer processing business.

Alkem Laboratories: The Income Tax Department is conducting a survey at some of company's offices and subsidiaries. The company said it is fully cooperating with the officials of the IT Department. This has no impact on the operations of the company.

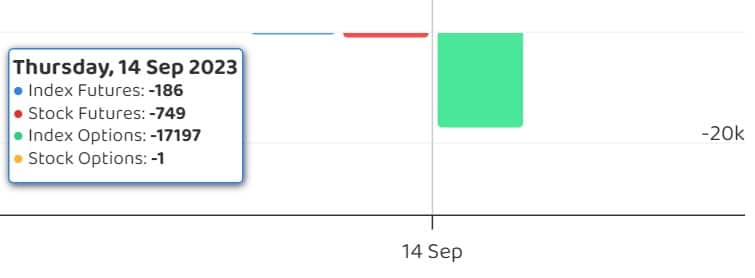

Fund Flow (Rs Crore)

Foreign institutional investors (FII) bought shares worth Rs 294.69 crore, while domestic institutional investors (DII) sold Rs 50.80 crore worth of stocks on September 14, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Balrampur Chini Mills, BHEL, and Zee Entertainment Enterprises to its F&O ban list for September 15, while retaining Delta Corp, Hindustan Copper, Indiabulls Housing Finance, Indian Energy Exchange, India Cements, Manappuram Finance, National Aluminium Company, REC and SAIL.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!