While the benchmark index, S&P BSE Sensex, has dropped about 9 percent from its record high that it hit in August, many midcap stocks have fallen by about 40 percent from their respective highs.

High valuations, liquidity concerns, rise in commodity prices and weakening rupee resulted in a sharp correction in the mid-cap names in the recent past.

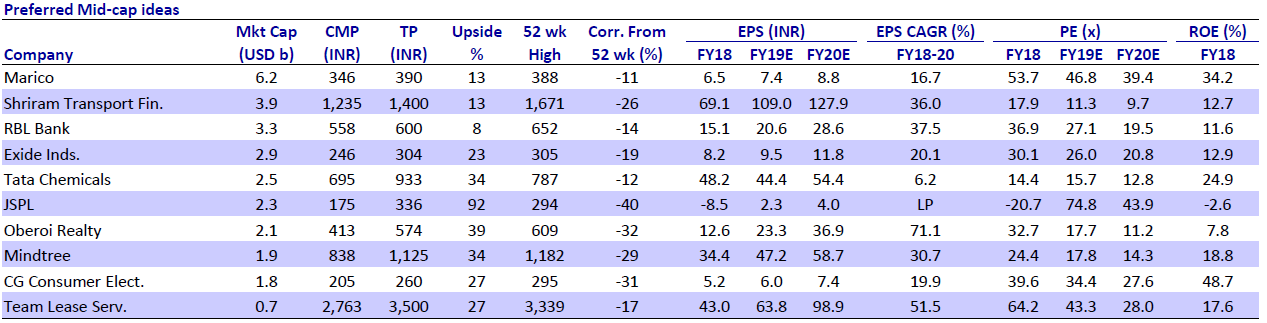

Motilal Oswal has shortlisted 10 stocks that have fallen up to 40 percent from their 52-week highs, but still have potential to give 10-90% return in the next 12 months.

Stocks which have dropped 10-40 percent from their respective 52-week highs include Shriram Transport, RBL Bank, Exide Industries, Tata Chemicals, JSPL, Oberoi Realty, MindTree, CG Consumer and Teamlease.

A midcap company which is able to maintain its margins, along with growth, may be accumulated on declines, suggest experts.

“In the current fall, many companies with strong fundamentals have corrected owing to cyclical issues or high valuations. Sustainable growth companies where free cash flows are high/rising along with strong balance sheet are always the preferred midcaps,” Vineeta Sharma, HOR at Narnolia Financial Advisors told Moneycontrol.

In terms of valuations, midcaps have moderated slightly which will give comfort to long-term investors to get into quality stocks on declines. Now that valuations are close to be reasonable, the two main factors to be considered in picking stocks in the broader market are earnings growth and stability of earnings.

“A company which has steady and consistent earnings growth over time even during times of economic difficulty and market upheaval can be good bet for the future. Investors who got stuck in this correction are advised not to compromise with quality while reviewing their portfolio,” Soumen Chatterjee, Director, Guiness Securities told Moneycontrol.

Both BSE Midcap and Smallcap indices are currently trading at 18-28 percent below their recent highs, and in some cases, stocks have corrected by more than 40-50 percent.

“Such declines have generated opportunities for buying into selective good quality midcap stocks where earnings visibility is stable and high. One-year forward price-to-earnings (PE) ratio of BSE Midcap is currently at 21 times, a premium of 11 percent over the Sensex which trades at 19 times, according to Bloomberg data,” said Chatterjee.

What should investors do?The selection criteria for investors could be a mix of technical as well as fundamental factors. It is important to understand how the prices are moving, and fundamentally how the company does its business and earnings potential.

“Investors are advised to look for fundamentally strong stocks trading above their 50- and 200-DMA, and are about to break out on higher volume, to add to their portfolios,” Vipin Khare, Director- Research, William O'Neil India told Moneycontrol.

“Some good quality stocks include VIP industries and Vinati Organics. On the other hand, technically weak stocks, which are unable to sustain above 200- or 50-DMA, should be avoided,” he said.

Out of the Motilal Oswal's midcap picks, Khare said following three stocks are technically looking very strong:

The stock, after hitting its all-time high of Rs 387.85 on August 24, came under huge selling pressure and breached all its key support levels at 50- and 200-DMA. It bottomed out at the Rs 282.95 mark, down 27 percent from its all-time high. Since then, it has had a good run and has reclaimed all its support levels, backed by strong Q2 numbers.

In its Q2 results, revenue from operations increased 20 percent YoY to Rs 1,836.8 crore, beating consensus estimates. Improving technical characteristics backed by strong Q2 results bolstered investors’ optimism in recent times. While we would love to see it break above the pivot, aggressive investors can initiate their position as it retook all its key support levels (50-, 100-, and 200-DMA).

Shriram Transport remains a strong business model due to its presence in the less competitive used-vehicle finance market. The Company reported a strong set of number in Q2 with its revenue growing at 20 percent and PAT at 23 percent, beats consensus estimates.

Post the result, the stock acted strongly and within a span of four trading session, it retook its 50-DMA. However, we would love to see it breaks above 200-DMA, before initiating any fresh position.

On the back of strong Q2 results and upbeat estimates, the stock has moved higher and is currently trading 40 percent above its recent lows and retook all its support levels. As per our methodology, we would like to see it break out with high volumes, however on aggressive stance; an investor can initiate a position if it breaks above Rs 3,000 level on high volumes.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.