Whether you opt for swing or any other type of trading, you always need a clearly defined exit strategy. Setting a "stop-loss" is critical but its execution can vary.

The purpose of a stop loss is to limit your losses. After all, the best way to avoid big losses is to take small losses.

One way to execute that is with a stop-loss order.

Our priority is to protect the capital. Taking a small loss from time to time is like paying an insurance premium to make sure you do not suffer a devastating hit. And you can always buy a stock back if it shows signs of strength later.

Managing risk is key in the stock market. To get a favourable return in the market, one has to manage the risk. Ideally, investors use a 1:2 risk/reward ratio.

But, it differs from person to person. Also, risk appetite differs among largecap, midcap and smallcap stocks.

Liquidity in the broader market and individual stocks plays a crucial role in trading. Entry is quite easy in such stocks but it is difficult to exit.

Likewise, few stocks are extremely sensitive and trade with upper and lower circuit limits. Sometimes it becomes difficult to decide the stop loss in such stocks.

A stop-loss order can be placed with your broker or you can set a price alert to manage stop-loss levels. If your stock trades below that price, your broker will automatically initiate a sell order for you.

This can be useful for two reasons. First, it forces you to be disciplined. You make the decision ahead of time and if the stock triggers the stop price, the order is executed.

There is no risk of hesitation with your finger on the sell button, hoping the stock comes back. Second, if you are not always available during market hours, you do not run the risk of getting caught unaware by price action going against you.

Another way to approach your stop-loss is by setting an alert and then analysing the action as it happens.

Various methodologies, tools, and techniques to keep a stop-loss1. Fixed percentage-based stop-loss criteria

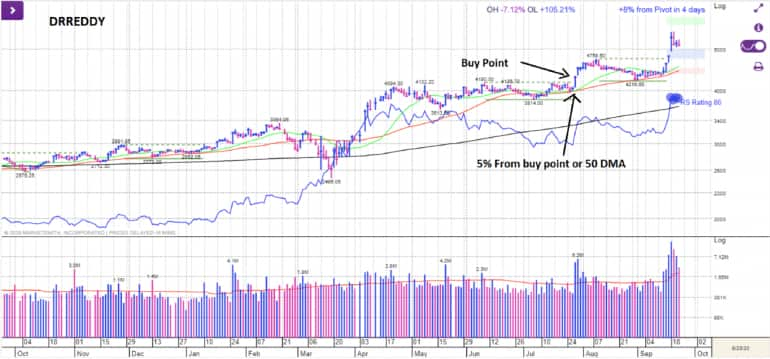

One can decide a fixed percentage of stop-loss from the buy point. We generally advise not to keep 4–5 percent stop-loss percentage from the buy point.

One can keep a stop-loss below any one of the key moving averages by looking at the chart and observing the market direction.

Suppose the market and stock are both in an uptrend and all short-term key moving averages are trending above the long-term key moving average, and the stock is frequently taking support at its 21-DMA. In such a case, one can go long, with a stop-loss below the 21-DMA.

One can keep the stop-loss based on the support level and observe the price volume action. Above-average volume is the key level to watch.

One can always exit the position if the trendline is breached to remain on the safer side.

ATR (average true range) is a good tool to decide the stop-loss level for swing or short-term positional trading. One can follow a 21-day ATR or 14-days ATR to keep stop loss.

Apart from the above-mentioned stop-loss criteria, one can always consider the current market conditions before taking a trade.

As per William O Neil Methodology, we categorise the market in four different directions:

1. Rally (uptrend)

2. Under pressure

3. Correction (downtrend)

4. Rally attempt

We always recommend that investors trade as per the market direction. It is advisable to go aggressive if the market is in an uptrend rally and be cautious and very selective when the market direction is uptrend under pressure.

Likewise, we generally do not recommend trades in a downtrend. However, if any sector or stock is doing well in a downtrend market, then one can buy from that universe.

(Mayuresh Joshi, Head of Equity Research, William O'Neil India)Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.