June 20, 2023 / 16:16 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty showed a smart recovery on June 20 from morning weakness to end in the positive. At close, Nifty was up 0.33% or 61.25 points at 18816.7. Volumes on the NSE were on the higher side. Broad market indices rose a little more than the Nifty even as the advance decline ratio recovered to 1.37:1.

European and Asian stocks mostly fell on Tuesday after China cut interest rates by less than expected (LPR cut 10 bps) and investors awaited more details on Beijing's plans to shore up a faltering economic recovery. Investors feel that they will have to probably wait for China's Politburo meeting, headed by President Xi early in July, for any concrete announcement on a new round of stimulus.

Nifty negated the Dark Cloud Cover bearish formation formed on June 19 by ending in the positive. It has now formed a bullish piercing pattern. Nifty needs to break out of 18669-18888 band for showing acceleration in that direction.

June 20, 2023 / 16:09 IST

Shrikant Chouhan, Head of Research (Retail), Kotak Securities

While most of the Asian markets ended laggards, last-hour buying in IT, metal, banking and power stocks helped Sensex regain the 63000 level in a trading session marked with sharp intra-day volatility. It will not be a smooth one-way rally, with intermittent hiccups such as interest rate uncertainty, global economic slowdown and inflation woes likely to play spoilsport in the near to medium term.

Technically, the Nifty took support near 18650 and bounced back sharply. On intraday charts, the index has formed a double bottom formation which is indicating the continuation of an uptrend formation in the near future.

For the day traders, 18750 would be the trend decider level. Above the same, the index could rally till 18900-18925. Below 18750, the selling pressure is likely to accelerate and the index could retest the level of 18650-18620.

June 20, 2023 / 15:53 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index saw the bulls hold a support level of 43400. Currently, the index is trading within a broad range between 43400 and 44000. A breakout on either side of this range is likely to result in trending moves.

As long as the support level of 43400 is held, a buy-on-dip approach is suggested. Once the index surpasses the level of 44000 it will witness sharp short covering on the upside towards 45000 levels.

June 20, 2023 / 15:51 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets settled higher in a volatile trading session, in continuation of the prevailing trend. Initially, weakness in the Asian markets was weighing on the sentiment however gradual recovery in select heavyweights not only pared all the losses but also pushed the index higher. Consequently, Nifty settled around the day’s high at 18,816.70 levels. Among the sectoral pack, financials, IT and auto posted decent gains while defensive viz. pharma and FMCG traded subdued. Amid all, the broader indices managed to gain nearly half a percent each.

Nifty has respected the trend line support around 18,660 levels and witnessed a steady rebound. This move shows that bulls are in control and the tone would remain positive till it holds 18,550. Traders should align their positions accordingly but suggest keeping a check on the size of positions citing intermediate choppiness.

June 20, 2023 / 15:47 IST

Vinod Nair, Head of Research at Geojit Financial Services

The Indian market opened cautiously due to weak global cues, with heightened concerns over the Chinese economy following their decision to cut interest rates after a 10-month pause. Global worries were amplified by concerns of a possible rate hike by the US Fed in its July meeting, with investors eagerly awaiting Powell’s testimony. However, the indices managed to recover smartly, led by upside in IT and Auto stocks.

June 20, 2023 / 15:42 IST

USDINR to consolidate between 82.30-81.85: Dilip Parmar, Research Analyst, HDFC Securities

The Indian rupee depreciated against the US dollar along with weaker Asian currencies and foreign fund outflows through block deals. Risk assets along with US Treasuries fell as traders unwound positions following signs of overbought and economic headwinds.

In the near term, spot USDINR has resistance at 82.30 and support at 81.85. We expect the pair could consolidate between said range before heading lower.

June 20, 2023 / 15:33 IST

Rupee Close:

Indian rupee closed 17 paise lower at 82.11 per dollar against previous close of 81.94.

June 20, 2023 / 15:30 IST

Market Close:

Benchmark indices ended on a positive note in a highly volatile session on June 20 with Nifty above 18,800.

At close, the Sensex was up 159.40 points or 0.25percentat 63,327.70, and the Nifty was up 61.20 points or 0.33percentat 18,816.70. About 1,885 shares advanced, 1,527 shares declined, and 118 shares were unchanged.

Top gainers on the Nifty included Tata Motors, HDFC Life, HCL Technologies, Power Grid Corporation and Eicher Motors, while losers were Bajaj Finance, Bajaj Finserv, Sun Pharma, BPCL and Divis Labs.

All the sectoral indices ended in the green with the power index up 1 percent, while auto, realty, metal and information technology indices were up 0.5percenteach.

The BSE midcap and smallcap indices gained 0.4 percent each.

June 20, 2023 / 15:29 IST

HMA Agro Industries IPO sees 19 percent demand on debut

The initial public offering of HMA Agro Industries has seen a tepid start on June 20, the first day of bidding, as the issue garnered bids for 11.32 lakh shares against the IPO size of 60.54 lakh shares, subscribing only around 19 percent.

Retail investors have bought 17 percent shares of the reserved portion, while high networth individuals have bid 47 percent shares against the allotted quota of 12.97 lakh shares.

Qualified institutional investors are yet to invest in the IPO.

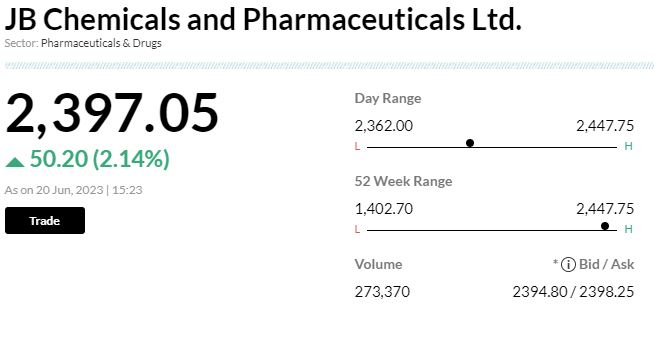

June 20, 2023 / 15:23 IST

Jefferies View On JB Chemicals

-Initiate buy rating, target at Rs 2,680 per share

-JB Chemicals is fastest growing domestic pharma company

-Growth is led by therapy dominance in cardiac and gastro

-Life cycle Management of key brands, synergistic acquisition & new launches to lead growth

Export growth will be led by contract manufacturing of lozeng

June 20, 2023 / 15:22 IST

JPMorgan View On Bank Of Baorda

-Overweight rating, target at Rs 230 per share

-Market share is improving, retail loan growth faster than private banks

-Unique model for attracting talent from private sector

-Asset quality has steadily improved

-RoA still have levers on NIM, costs and provisions

-Value crystallisation in subsidiaries could be an added trigger

Bank Of Baroda was quoting at Rs 194.85, up Rs 1.10, or 0.57 percent.

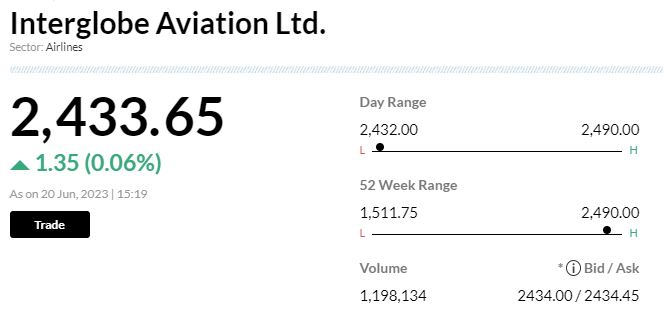

June 20, 2023 / 15:20 IST

Morgan Stanley View On Interglobe Aviation

-Overweight rating, target at Rs 3,126 per share

-Announced another order of 500 A320 family aircraft, will be delivered over 2030-35

-With this order, company’s pending aircraft orders reach around 1,000

-Market share & margin have been two key drivers, both inching up in near term