September 21, 2022 / 16:01 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Markets across the globe were trading with considerable volatility ahead of the Fed policy announcement. A 75bps hike by FED was factored in by the markets, while reports of mobilising Russian forces in Ukraine has escalated geopolitical tension and fears of rising inflation.

Any military escalation will have a significant effect on the world & domestic economy. This will have an influence on the near-term trend of the global market and implications on local market can be high as it is trading at premium prices compared to the world.

September 21, 2022 / 15:57 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded volatile for yet another session and lost over half a percent. After the initial positivity, the Nifty index pared all its gains as the session progressed and finally settled at 17718.35; down by 0.5%. Barring FMCG and media, most of the sectoral indices traded in tandem with the benchmark and ended lower.

Markets will first react to the Fed meet outcome in early trades on Thursday. Besides, the scheduled weekly expiry would add to the volatility.

Amid all, indications are in the favour of further consolidation, so we suggest traders to stay light and focus more on the risk management part. On index front, 17,400-17,500 zone would acts a cushion in Nifty while rebound towards 17,900-18,000 zone may attract selling pressure.

September 21, 2022 / 15:53 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services

Domestic market consolidated ahead of FOMC outcome expected late on Wednesday. Markets will react to the Fed’s interest rate hike decision while the 75bps have been factored in, an aggressive commentary or sharper rate hike of 100bps could lead to higher volatility and pressure on the market.

An inline rate hike can bring relief to the market. Stock specific action was seen in sectors like defence, FMCG, capital goods and Healthcare.

Indian equities witnessed volatility amid weak global cues. Nifty opened with minor cuts and remained under pressure throughout the day to close with loss of 98 points at 17,719 levels. India VIX was up by 3.4% at 19.4 levels. Except for FMCG, all other sectors ended in red.

September 21, 2022 / 15:34 IST

Market Close:

Benchmark indices broke two-day winning streak and ended lower with Nifty around 17,700 in the highly volatile session ahead of US Federal Reserve interest rate decision later tonight.

At Close, the Sensex was down 262.96 points or 0.44% at 59,456.78, and the Nifty was down 98 points or 0.55% at 17,718.30. About 1251 shares have advanced, 2115 shares declined, and 117 shares are unchanged.

Shree Cements, Adani Ports, IndusInd Bank, Power Grid Corp and UltraTech Cement were among the major Nifty losers.

The gainers included Britannia Industries, ITC, HUL, Apollo Hospitals and Coal India.

Among sectors, FMCG index added 1 percent, while capital goods, oil & gas, realty and power indices shed 1-2 percent each.

September 21, 2022 / 15:33 IST

Rupee Close:

Indian rupee closed22 paise lower at 79.97 per dollar on Wednesday against previous close of 79.75.

September 21, 2022 / 15:27 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities

Nifty has been in a corrective phase since the last few trading sessions. We have not seen a short term reversal attempt succeeding and hence maintain a negative bias for the near term. Monthly support is only seen at 17000.

US Fed comments are expected to keep volatility high in the near term. Expect consolidation to correction in the near term as the broader market sentiment has also turned negative.

FII and PRO positions also suggest reduction in net shorts suggesting limited downside in near term. For Nifty, maximum OI buildup seen at 17000 Put and 18000 Call Option. For Bank-Nifty, maximum OI buildup is seen at 40500/41000 put and 41500/42000 call options. For the expiry day, expect Nifty to trade with resistance of 17950 – any move above the same can invite short covering.

September 21, 2022 / 15:23 IST

Hilton Metal Forging wins tender for supply of railway wheel

Hilton Metal Forging has received the tender for supply of railway wheel to Railway Department of wheel monobloc- rolled, in its favour. It already supplied two consignments of wheels & became one of the suppliers of this railway wheel requirement of Indian government.

Hilton Metal Forging touched a 52-week high of Rs 83.75 and quoting at Rs 76.20, down Rs 4.00, or 4.99 percent on the BSE.

September 21, 2022 / 15:20 IST

BSE Midcap index fell 0.6 percent dragged by the ACC, 3M India, Nuvoco Vistas Corporation

September 21, 2022 / 15:14 IST

Jefferies View On Zomato:

Brokerage house Jefferies has kept buy rating on Zomato with a price target of Rs 100 per share.

The investors are convinced on food delivery moat, with skepticism is high on quick commerce.

The management bullish on quick commerce business & sees blinkit as a large driver of growth, reported CNBC-TV18.

Zomato was quoting at Rs 63.20, up Rs 0.35, or 0.56 percent.

September 21, 2022 / 15:06 IST

BSE Smallcap index shed 0.5 percent dragged by the Wonderla Holidays, N.R.Agarwal Industries, JK Lakshmi Cement

September 21, 2022 / 15:01 IST

Market at 3 PM

Indian benchmark indices were trading lower with Nifty around 17750.

The Sensex was down 208.26 points or 0.35% at 59511.48, and the Nifty was down 81.00 points or 0.45% at 17735.30. About 1167 shares have advanced, 2044 shares declined, and 101 shares are unchanged.

September 21, 2022 / 14:52 IST

Buzzing

NBCC (India) has secured the total business of Rs 274.77 crore during the month of August, 2022.

NBCC (India) was quoting at Rs 33.70, down Rs 0.15, or 0.44 percent.

September 21, 2022 / 14:50 IST

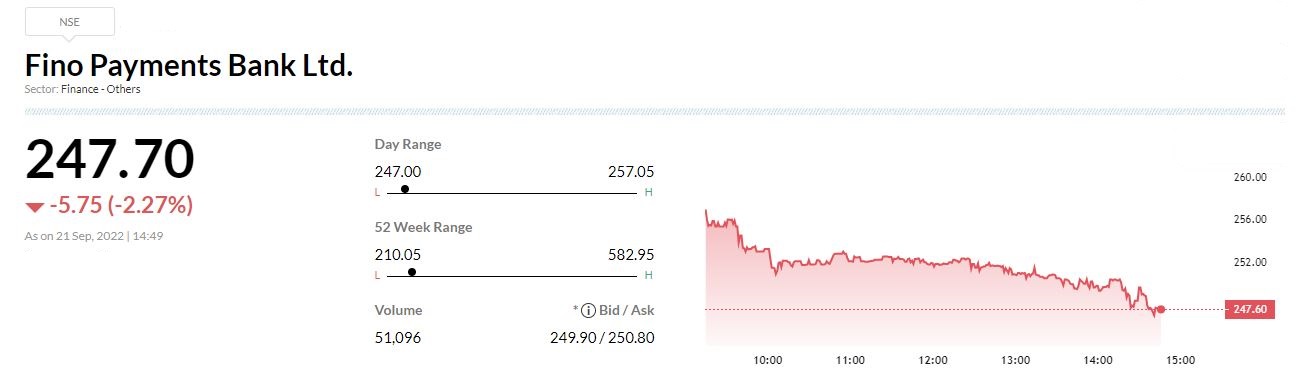

Fino Payments Bank to buy stake in PaySprint

Fino Payments Bank has executed the share subscription and shareholders’ agreement for investment by way of subscription of shareholding in PaySprint Private Limited.

The first tranche of the proposed investment upto Rs 2.5 crore is expected to be completed on or before October 10, 2022.

Remaining investment upto Rs 1.5 crore is expected to be completed on or before March 31, 2023, subject to RBI approval, as applicable and at the sole discretion of the Bank.