October 14, 2022 / 16:14 IST

Ajit Mishra, VP - Research, Religare Broking

Markets witnessed a decent surge on Friday and gained nearly a percent. Strong recovery in the global indices combined with upbeat earnings triggered a gap-up start in Nifty however profit taking in the latter half trimmed the gains. It finally settled at 17,185.7 levels; up by 1.01%. Among the sectors, banking, financials and IT contributed the maximum while realty, energy and auto were on the back foot.

Markets have been consolidating for the last two weeks amid mixed cues and we expect this to end soon. Meanwhile, participants should maintain their focus on sectors and stocks which are showing resilience despite the prevailing uncertainty and utilise this phase to accumulate them.

October 14, 2022 / 16:08 IST

Vinod Nair, Head of Research at Geojit Financial Services.

The domestic market showed an uptick, in-line with the surprise bounce in the US market. Initially the US market fell because the data exceeded the forecast. However, it recovered quickly, due to the oversold state of the market.

The rally in the domestic market was led by large caps, with IT and banking at the forefront due to the robust start to Q2 earnings. The rally can continue in the short-term led by festival demand, Q2 results and positive trend of the global market.

October 14, 2022 / 16:06 IST

Raghvendra Nath, Managing Director – Ladderup Wealth Management.

The WPI like CPI still remains at elevated levels even though it has come down a bit from last month. The easing of inflation has primarily been on account of easing commodity prices globally. There is a good likelihood that global commodities may correct even further as the developed world faces the risk of recession which in turn would mean reduced demand.

Even in India, with the festive season coming to an end, the months ahead may see tepid demand in comparison to the first half. We feel that WPI inflation should ease further in the next 4 to 6 months.

October 14, 2022 / 16:01 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty had a strong leap from the support zone of 17,000-16,950. It broke out from a triangular pattern on the hourly chart & surpassed the key daily moving averages with an opening gap.

The index, however, failed to build upon the early gains. On the contrary, it witnessed fresh round of selling in the second half of the session.

The overall structure shows that the index is still in the short term consolidation phase. In terms of the price patterns, it can form a triangular pattern on the daily chart. This implies that the range bound action can continue in the short term. The index can revisit 17,050 on the downside. On the other hand, the near term resistance is at 17,350.

October 14, 2022 / 15:50 IST

S Hariharan, Head Institutional Equity Sales, Emkay Global Financial Services

FII flows into India have turned negative for the last few sessions, after a positive start in October. As a result, despite expectations of a strong earnings season, the broader market has been moving sideways, with DII inflows offsetting FII selling. Fears of potential earnings downgrades for IT stocks have not materialized thus far, while Banks are expected to report strong earnings in the coming couple of weeks.

We expect the current bout of macro volatility to continue to cap any meaningful upsides in the indices, strong fundamentals notwithstanding. Consumer staples and discretionary names have been seeing some pressure on account of concerns related to margins going forward with commodity prices picking up again.

October 14, 2022 / 15:45 IST

S Ranganathan, Head of Research at LKP securities

With Inflation becoming the most widely watched economic statistic globally, yesterday's inflation print in the US saw extreme volatility there and as expected our markets opened gap up in sync with global cues.

IT & Financials buoyed by earnings led the rally before profit taking in Energy stocks wiped off a bit of gains. The broader markets did see buying interest in select stocks on the back of quarterly earnings although the gains were visible only across Large Cap names.

October 14, 2022 / 15:33 IST

Rupee Close:

Indian rupee closed flat at 82.36 per dollar against previous close of 82.35.

October 14, 2022 / 15:31 IST

Market Close:

Benchmark indices ended on positive note on October 14 with Nifty around 17,200

At Close, the Sensex was up 684.64 points or 1.20% at 57,919.97, and the Nifty was up 171.40 points or 1.01% at 17,185.70. About 1757 shares have advanced, 1591 shares declined, and 146 shares are unchanged.

Infosys, HDFC Bank, HDFC, UPL and HCL Tech were among the top Nifty gainers. ONGC, M&M, Bajaj Auto, JSW Steel and Hindalco Industries were the top losers.

Among sectors, bank, capital goods, healthcare, IT, up 0.5-1.8 percent, while metal, power and realty indices down 0.5-1 percent each.

BSE Midcap and Smallcap indices ended on flat note

October 14, 2022 / 15:26 IST

JPMorgan On Mindtree

JPMorgan has kept underweight rating on the stock with target at Rs 3,000 per share.

There was a strong print but cautious outlook; meanwhile merger will be key to watch.

The Constant Currency QoQ growth of 7.2% 170 bps ahead of estimate. The margin declines 60 bps due to wage hikes.

See concerns from a potential slowdown that already impacted deal decision making, reported CNBC-TV18.

October 14, 2022 / 15:22 IST

BSE Realty index shed 0.7 percdnt dragged by the Phoenix Mills, Indiabulls Real Estate, Macrtech Developers

October 14, 2022 / 15:18 IST

Indian rupee Updates:

Indian rupee is trading marginally lower at 82.40 per dollar against previous close of 82.35.

October 14, 2022 / 15:16 IST

Praveen Singh – AVP, Fundamental currencies and Commodities analyst at Sharekhan by BNP Paribas

The US Dollar Index is expected to rise further as the turnaround in the markets lacks any coherent narrative or solid fundamental reason, however in near-term a lot will depend on the risk sentiments. Traders will keep a close watch on the US retail sales and U. of Michigan inflation expectations data to be released tonight.

The USDINR pair may decline to Rs 81.50 in near-term, though we expect the pair to rise to 83 in the coming days.

October 14, 2022 / 15:14 IST

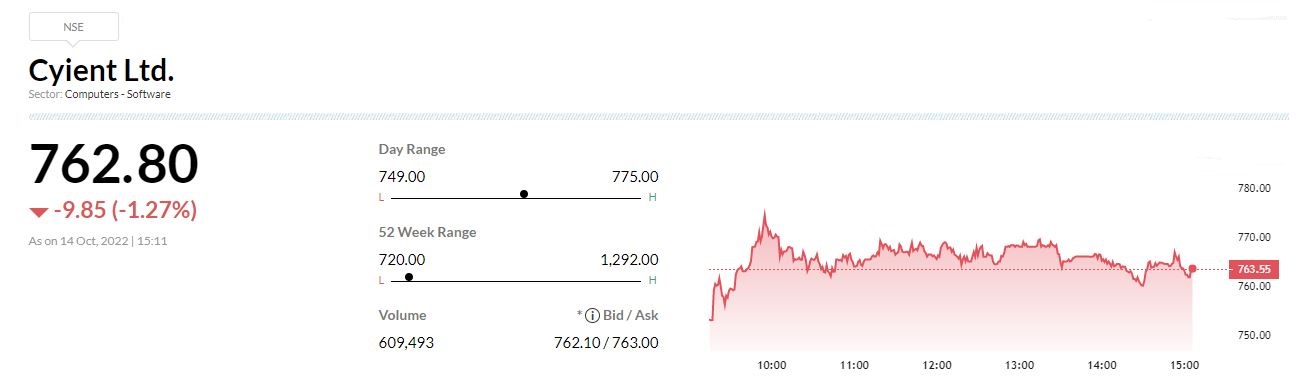

Morgan Stanley View On Cyient

Research firm Morgan Stanley has kept underweight rating on the stock with a target at Rs 700 per share.

The uncertain macro environment do not provide confidence on revenue growth guidance. The margin excluding one-offs was good sequentially, reported CNBC-TV18.