Taking Stock: Market End Lower For 3rd Straight Session; Smallcaps Outperform

More than 450 stocks, including Zee Media Corporation, Sasken Technologies, SRF and Marico, hit a fresh 52-week high on the BSE.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,429.18 | -29.97 | -0.04% |

| Nifty 50 | 25,554.75 | -42.90 | -0.17% |

| Nifty Bank | 57,613.30 | -213.75 | -0.37% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,603.80 | 117.10 | +4.71% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 779.00 | -52.40 | -6.30% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Auto | 26649.50 | 39.50 | +0.15% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10266.00 | -233.00 | -2.22% |

Markets ended almost on a flat note amid volatility, in continuation to the prevailing consolidation phase. The benchmark initially opened on a firm note and inched higher in the first half however underperformance of the banking majors combined with profit taking in select index majors dragged the indices lower in the latter half. Consequently, the Nifty index ended lower by 0.2% at 15,722 levels. Amongst the sectors, banking, oil gas and realty were the top losers whereas IT and consumer durables ended with gains.

Global cues and updates on the new variant of Coronavirus would continue to dictate the trend in near future. On the domestic front, participants will also be closely eyeing the auto sales and PMI data for cues. Meanwhile, we reiterate our advice to restrict naked leveraged positions and wait for clarity.

Nifty continues to remain in medium term uptrend with buying advisable on aggressive dips; expect volatility before momentum support gets triggered. In the near term expect range bounce movement as short term indicators are stretched. IT, Metals and Pharma are expected to do well while BFCI and Midcap stocks can be bought on corrections.

The rupee is on an edge, for which the greater sensitivity probably lies towards stronger US data and a stronger dollar. Overall, fx market is focusing on a potentially hot US labour report or the degree to which new covid variant reduces recovery expectations. So until the USDINR spot trades above 73.75-73.80, it will remain afloat with immediate resistance around 74.50 and then 74.75 zone. While the major supports lie around 73.75-73.50-73.45.

We were unable to get past the range today, 15900 continues to be a major road block for the Nifty. If we can cross that, we will head to 16100. Until then we will vacillate between 15400 and 15900 on the back of lackluster volumes. 15400 is a good support for the markets and until we do not disrespect that on a closing basis, the macro trend continues to remain bullish.

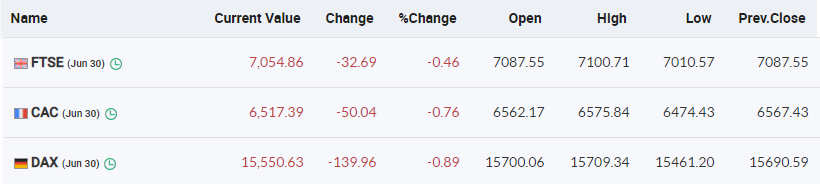

Euro zone inflation eased this month, levelling off for the summer months before an expected move well above the European Central Bank's target towards the autumn on higher commodity prices.

Inflation in the 19 countries sharing the euro slipped to 1.9% in June from 2.0% in May, in line with forecasts in a Reuters poll and right on the ECB's target of "below but close to 2%".

Indian rupee ended lower by 9 paise at 74.32 per dollar, amid volatility saw in the domestic equity market.It opened flat at 74.22 per dollar against previous close of 74.23 and traded in the range of 74.22-74.44.

Fitch Ratings expects the rating headroom for Oil India (BBB-/Negative) to reduce in the medium term as leverage will rise, when it accelerates capex to expand capacity at Numaligarh Refinery Limited (NRL).

: Benchmark indices erased all the intraday gains and ended lower in the highly volatile session on June 30.

At close, the Sensex was down 66.95 points or 0.13% at 52482.71, and the Nifty was down 27 points or 0.17% at 15721.50. About 1503 shares have advanced, 1455 shares declined, and 97 shares are unchanged.

Among sectors, except IT, all other indices ended in the red with Nifty Bank index falling 0.7 percent. BSE Midcap ended flat, while Smallcap index gained 0.5 percent.

Shree Cements, Bajaj Finserv, Power Grid Corp, ICICI Bank and UPL were among top losers on the Nifty. Top gainers were Coal India, Divis Labs, Reliance Industries, Infosys and SBI Life Insurance.

The market witnessed a very volatile movement in the range of 15740-15840. Trading above 15800 is positive from a short-term perspective. If the market closes below 15800, the market expects a correction till the level of 15650.

The technical indicator suggests, a volatile movement in the market in the range of 15650-15900. As such the traders are advised to refrain from building a fresh buying position until further decisive movement is seen in the market.

Tech Mahindra announced partnership with TAC Security to enable next-generation enterprise security for customers globally. The partnership will leverage artificial intelligence and user-friendly analytics to help measure, prioritize, and mitigate vulnerabilities across the entire IT stack.

Tech Mahindra was quoting at Rs 1,093.85, up Rs 5.30, or 0.49 percent on the BSE.

Vindhya Telelink touched a 52-week high of Rs 1,420, rising over 15 percent on June 30 after the company reported improved numbers for the quarter ended March 2021.

The company reported a sharp jump in consolidated profit at Rs 116.04 crore in Q4 FY21 against Rs 38.26 crore in Q4 FY20.

Its revenue jumped to Rs 556.56 crore from Rs 459.08 crore YoY.