January 05, 2022 / 16:01 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:

Markets have crossed a significant barrier of 17800 and managed to close above the same. I believe from an uncertain/volatile environment Nifty is now headed for a directional move.

We expect 19000-19500 levels in the medium term. Overall participation is expected to take place– value is seen in Metals, Energy, FMCG, and Banking stocks; IT stocks can be bought on correction post recent run-up.

January 05, 2022 / 15:48 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index closed the day on a positive note for consecutive fourth session at 17925 with nearly one percent and formed a bullish candle on the daily chart.

Now index has reached near its good hurdle of 18000-18100 zone where one can look for trimming their long position, also if managed to sustain above said resistance we may see fresh breakout & then we may inch towards previous swing high.

On the other hand good support zone is formed near 17800-17700 zone and any dip near mentioned support zone will be again fresh buying opportunity.

January 05, 2022 / 15:42 IST

Vinod Nair, Head of Research at Geojit Financial Services.:

In a highly volatile session, the domestic market witnessed a recovery following a mild dip though the global sentiments were not in favour of bulls. Increasing covid cases leading to stricter restrictions has pressurised market volatility.

The banking sector outshone other sectoral indices as few private lenders reported double-digit business growth during the third quarter.

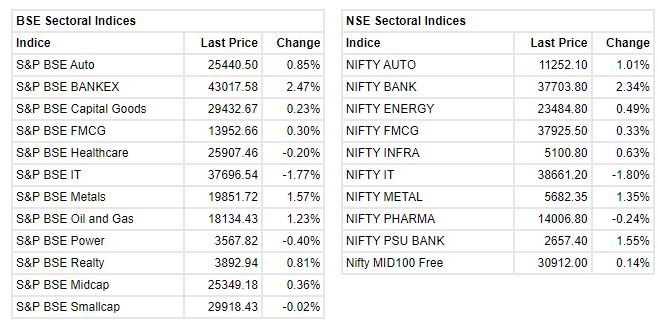

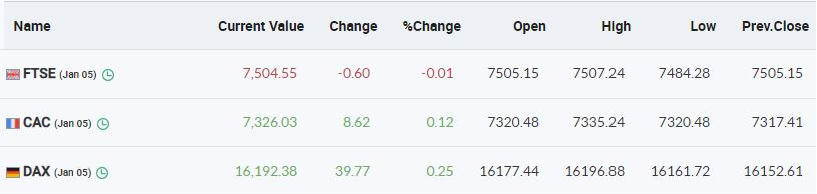

IT stocks took a blow as investors awaited the onset of the quarterly results season. US and Asian markets traded weak ahead of the release of the US Fed meeting minutes while European indexes held ground.

January 05, 2022 / 15:36 IST

Market Close:

Benchmark indices ended higher for the fourth consecutive session on January 5 led by auto, bank, metal, realty and oil & gas stocks.

At close, the Sensex was up 367.22 points or 0.61% at 60,223.15, and the Nifty was up 120 points or 0.67% at 17,925.30. About 1649 shares have advanced, 1495 shares declined, and 74 shares are unchanged.

Bajaj Finserv, Bajaj Finance, Kotak Mahindra Bank, JSW Steel and Grasim Industries were among the top Nifty gainers, however losers included Tech Mahindra, Infosys, HCL Technologies, Divis Labs and Wipro

Except IT, pharma and power all other sectoral indices ended in the green with auto, bank, metal, realty and oil & gas indices up 1-2 percent. The BSE midcap index added 0.36 percent, while smallcap index ended on flat note.

January 05, 2022 / 15:25 IST

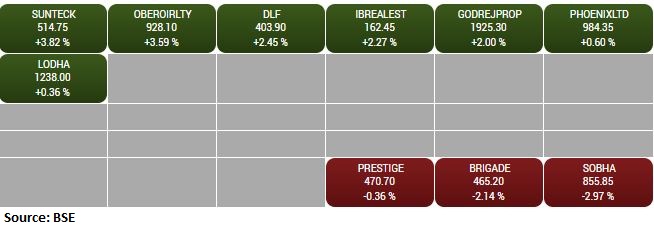

BSE Realty index rose 1 percent supported by the Sunteck Realty, Oberoi Realty, DLF

January 05, 2022 / 15:21 IST

Jefferies on ICICI Bank

Jefferies maintained buy on ICICI Bank call with target at Rs 1,000 per share. The recent correction offers a good entry price.

The next leg of structural rerating will come with narrowing of RoE gap with HDFC Bank and next leg of rerating to be led by upside in margin and/or lower credit costs.

The bank remains among our top picks, said Jefferies.

ICICI Bank was quoting at Rs 788.25, up Rs 15.35, or 1.99 percent.

January 05, 2022 / 15:14 IST

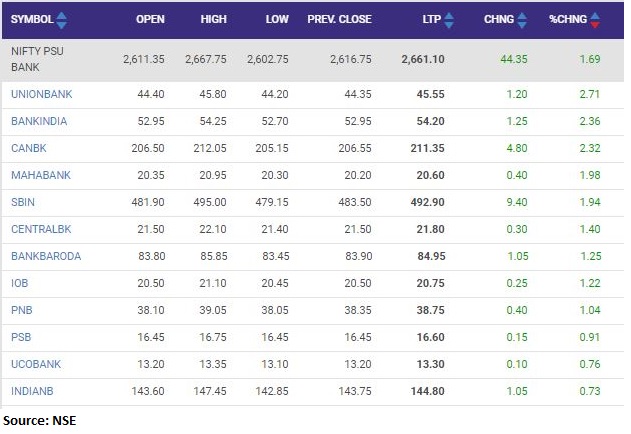

Nifty PSU Bank index rose 1 percent led by the Union Bank of India, Bank of India, Canara Bank

January 05, 2022 / 15:07 IST

Goldman Sachs keeps buy on Bandhan Bank

Foreign research house Goldman Sachs has kept buy call on Bandhan Bank with a target at Rs 440 per share.

The preliminary Q3 business update shows AUM growth of 11% YoY versus our estimate of 10%, said Goldman Sachs.

The improvement in collection efficiencies to 91% in MFI business is a key positive in Q3. However, adjusting for NPLs, overall collections on standard portfolio may potentially improve to 96-97%, it added.

Bandhan Bank was quoting at Rs 261.05, up Rs 6.80, or 2.67 percent.

January 05, 2022 / 15:03 IST

Market at 3 PM

Benchmark indices were trading near the day's high with Sensex above 60000 level.

The Sensex was up 406.35 points or 0.68% at 60262.28, and the Nifty was up 124.50 points or 0.70% at 17929.80. About 1636 shares have advanced, 1494 shares declined, and 72 shares are unchanged.

January 05, 2022 / 14:47 IST

Gaurav Garg, Head of Research, Capitalvia Global Research:

After a cautious start today, Indian equity benchmarks were trading around day highs, with the Sensex and Nifty both in positive territory. Traders are more hopeful with the RBI's decision to keep the reverse repo rate unchanged in the next policy amid an increase of Corona cases in India.

The Indian market is gaining strength as a result of the Federal Reserve's hawkish move to enhance economic growth.

Our research suggests that 60000 may act as an important psychological level in the market. Sustaining above this level can leads to a higher level of 60500. Technical indicators also support positivity in the market.

January 05, 2022 / 14:23 IST

European Markets Updates

January 05, 2022 / 14:07 IST

Market update at 2 PM: Sensex is up 422.55 points or 0.71% at 60278.48, and the Nifty jumped 119.30 points or 0.67% at 17924.60.