August 17, 2021 / 15:35 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research

The market witnessed some lackluster movement and an attempt to hold the support level around the Nifty 50 Index level of 16500. It is going to be crucial for the short-term market scenario to sustain above the 16500.

If the market is unable to sustain the level of 16500, the market witness lower levels of 16350. The momentum indicators like RSI and MACD showing signs of reversal in the market.

August 17, 2021 / 15:33 IST

Market Close:

The last hour buying pushed the benchmark indices to the record high led by the IT stocks.

At close, the Sensex was up 209.69 points or 0.38% at 55792.27, and the Nifty was up 51.60 points or 0.31% at 16614.60. About 1090 shares have advanced, 2009 shares declined, and 111 shares are unchanged.

TATA Consumer Products, Wipro, Tech Mahindra, Nestle and HUL were the top Nifty gainers. JSW Steel, Tata Motors, Adani Ports, IndusInd Bank and Coal India were among the top losers.

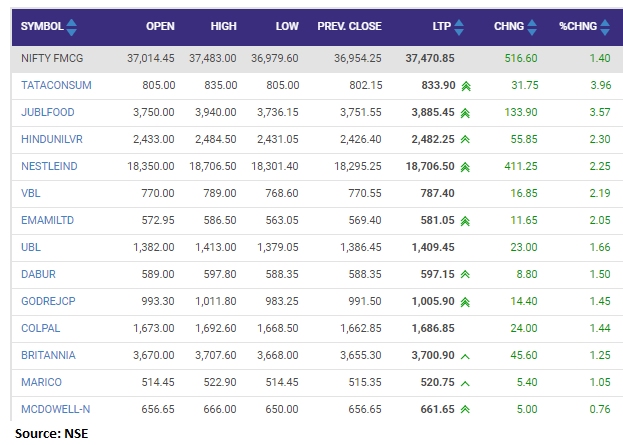

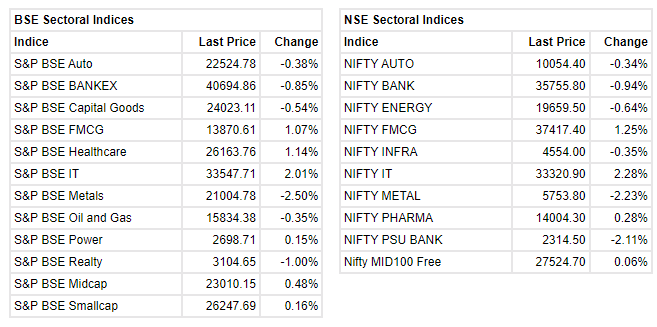

On the sectoral front, Nifty IT and FMCG indices were up 1-2.5 percent, while metal and PSU Bank indices fall 2 percent each.

August 17, 2021 / 15:21 IST

AnandRathi on Suven Pharmaceuticals:

We expect strong, 18.5%/ 21.4%, CAGRs in revenue/profit over FY21-23, driven by commercial supplies for two specialty-chemical products (one in the pharma division), and the launch of 3-5 formulation products a year.

We raise our FY22e/FY23e PAT 1.6%/4.9%. We retain our buy rating, with a higher target of Rs 630 (earlier Rs 560).

August 17, 2021 / 15:19 IST

Nifty FMCG index up over 1 percent led by the Tata Consumer, Jubilant FoodWorks, HUL

August 17, 2021 / 15:10 IST

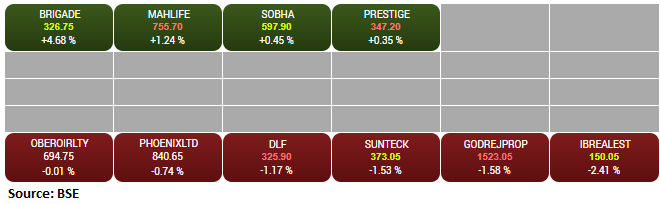

BSE Realty index fell nearly 1 percent dragged by the Indiabulls Real Estate, Godrej Properties, Sunteck Realty

August 17, 2021 / 15:02 IST

Market at 3 PM

Benchmark indices were trading flat in the volatile session with selling seen in the metal and banking names, while IT stocks gained.

The Sensex was up 148.28 points or 0.27% at 55730.86, and the Nifty was up 34.60 points or 0.21% at 16597.60. About 942 shares have advanced, 1984 shares declined, and 84 shares are unchanged.

August 17, 2021 / 14:54 IST

Vedanta share price falls 12%:

Vedanta share price fell 12 percent on August 17 after Madras High Court issues notice on remediation of contaminated sites at Tuticorin unit.

Madras HC issued a notice on remediation of contaminated sites at Tuticorin unit after a PIL against the company. The PIL demands that Vedanta remove all contaminated material within Sterlite copper plant, reported CNBC-TV18.

August 17, 2021 / 14:43 IST

Motilal Oswal on Kaveri Seed

Despite market share gains in cotton seed in Gujarat and Haryana, company lost sales in AP, Telangana, and Karnataka due to (a) lower acreage, (b) loss of volume market share due to lockdown related restrictions, and (c) higher HTBt seed sales. This resulted in overall revenue decline of 12% in 1QFY22; thereby, the company lost the season for FY22.

However, company is well on track to diversify from cotton seed sales by increasing the share of rice and vegetables - which are not only growing at a faster pace but also yielding higher margins (v/s the Cotton segment).

We value the company at 13x FY23E EPS (in line with five-year average P/E) to arrive at target price of Rs 710. Maintain buy.

Kaveri Seed Company was quoting at Rs 576.30, down Rs 30.30, or 5.00 percent.

August 17, 2021 / 14:33 IST

Hindustan Zinc defers Board meet scheduled for today:

The Board meet of Hindustan Zinc which was scheduled for August 17, 2021 to consider interim dividend for financial year 2021-2022has been deferred. Accordingly the record date of August 26, 2021 stands called off, the company said in a BSE filing. The stock was trading at Rs 316.50, down Rs 14.60, or 4.41 percent. It has touched an intraday high of Rs 332.60 and an intraday low of Rs 314.20.

August 17, 2021 / 14:27 IST

Tapan Patel- Senior Analyst (Commodities), HDFC Securities

: Crude oil prices traded lower with benchmark NYMEX WTI crude oil prices were trading over half a percent down near $66.67 per barrel for the day. MCX Crude oil August futures were down by 0.68% at Rs 4972 per barrel by noon.

Crude oil prices are expected to trade down for the day with resistance at $68 and support at $65 per barrel. MCX Crude oil August has support at Rs 4910 and resistance at Rs 5060.

August 17, 2021 / 14:17 IST

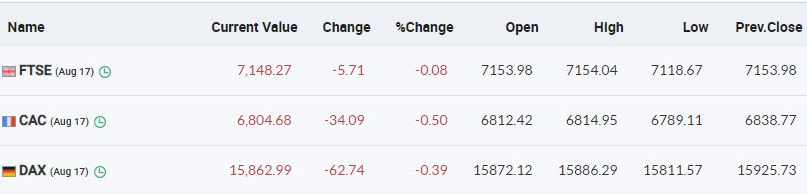

European markets are trading in the red with CAC and DAX down half a percent

August 17, 2021 / 14:02 IST

Market update at 2 PM:

Sensex is up 33.80 points or 0.06% at 55616.38, and the Nifty shed 2.30 points or 0.01% at 16560.70. Tech Mahindra, Tata Consumer and Wipro are the top gainers while INdusInd Bank, M&M and L&T dragged the most.