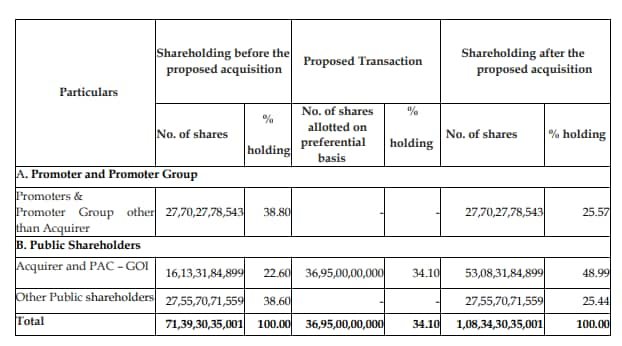

The market regulator has exempted the Government of India (GoI) from making an open offer when acquiring 34.10 percent of Vodafone Idea Ltd (VIL), after which GoI will increase its stake in the company from the present 22.60 percent to 48.99 percent.

This is following an application filed by Department of Investment and Public Asset Management (DIPAM), Ministry of Finance, dated March 30, 2025. Vodafone Idea Ltd had asked to settle its spectrum auction dues by converting the dues into equity shares of the company.

In the exemption order passed on April 3, the Securities and Exchange Board of India (SEBI) has equated the conversion of the company's dues to the government into equity shares with acquisition of shares by lenders as part of a debt restructuring scheme.

In the order, SEBI's Whole-time Member Ashwani Bhatia stated, "Considering the fact that a substantial sum of money is due to be paid to the GoI by VIL, which may place a potential burden on the financials of VIL, and also that an open offer obligation on the part of GoI involves huge sums of cash outflow (from GoI), I find that it would be appropriate to grant exemption to the Acquirer from open offer requirements as laid down in Regulation 3(1) of the Takeover Regulations, 2011."

Source: SEBI

Source: SEBIOn equating this conversion with a debt-restructuring scheme, Bhatia wrote, "In terms of Regulation 10(1)(i) of the Takeover Regulations, 2011, acquisition of shares by lenders pursuant to conversion of their debt as part of a debt restructuring scheme implemented in accordance with the guidelines of Reserve Bank of India is exempt from the obligation to make an open offer. In my view, it shall be appropriate to treat the conversion of VIL’s Outstanding Spectrum Auction Dues (including deferred dues) repayable after the expiry of the moratorium period, into equity shares to be issued to GoI, at par with a debt restructuring scheme as envisaged under Regulation 10(1)(i) of Takeover Regulations, 2011".

After the Telecom Relief Package 2021 was announced in September that year, Vodafone India had opted for three things: deferment of spectrum auction instalments due up to 4 years; deferment of AGR related dues by 4 years; and conversion of the full amount of interest related to spectrum auction instalments and AGR dues into equity shares to be issued to the President of India (acting through and represented by DIPAM).

Vodafone Idea Ltd expressed its inability to pay the government dues and therefore , submitted a proposal to the Department of Telecom (DoT) requesting for further Government support by seeking approval for conversion of outstanding spectrum auction dues (including deferred dues) equal to Rs. 36,950 crore into equity shares of the company.

After this, GoI's stake in the company would go up to 48.99 percent, which would have triggered an open offer obligation for the GoI under Regulation 3(1) of Takeover Regulations, 2011.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.