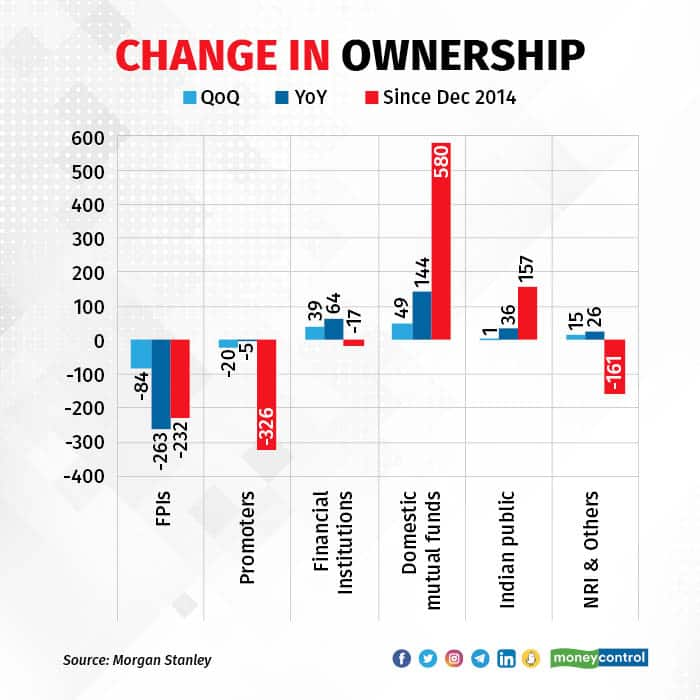

In the second quarter of this calendar year, promoters of the country’s largest 75 companies seem to have exited their holdings most after the FPIs.

Promoters reduced their holdings by 20 bps quarter on quarter, coming second only to FPIs who reduced their holdings by 84bps, according to a report by Morgan Stanley. None of the other investor categories–financial institutions, domestic mutual funds, Indian public and NRI & others–have reduced their holdings in these companies over this period.

Also read: What UPL's first buyback in 8 years reveals

While it seems like an odd thing for promoters to reduce their holding when the market is trending downwards, market experts said that a 20bps reduction is too small in magnitude to be a matter of concern. With uncertainty and fear looming in the market, promoters may have taken some money off the table before things got worse.

Graphic: Upnesh Raval

Graphic: Upnesh Raval

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.