Dabur India Ltd stock has given a technical breakout from the falling trendline, and it has consolidated accordingly. On June 7, Dabur's shares gained over 1 percent, trading above Rs 605.

Momentum indicator MACD (Moving Average Convergence Divergence) has shown a bullish crossover in the Dabur stock on the daily, weekly, and monthly charts. According to Jay Thakkar, Derivatives and Quantitative Research Analyst at ICICI Securities, this indicates a high probability of an upside.

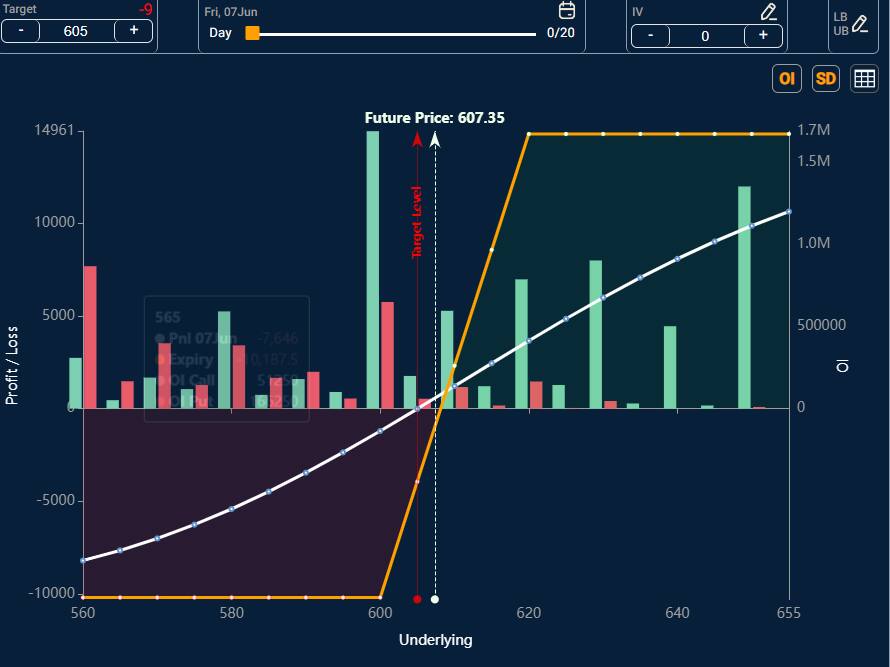

Thakkar recommends implementing a bull call spread strategy on the Dabur scrip to capture this upside momentum.

Strategy Recommended:

Dabur Spread Trade (Bull Call Spread: June Expiry)

- Buy Rs 600 CE (call option) at Rs 19

- Sell Rs 620 CE at Rs 11.

- Total outflow (maximum risk): 8 points

- Maximum potential gain: 12 points

- Risk-Reward Ratio: 1:1.50

"The total outflow of 8 points represents the maximum risk. The maximum gain, at or above Rs 620, will be 12 points, resulting in a risk-to-reward ratio of 1:1.50,” said Thakkar.

Derivatives view

Thakkar noted that on the derivatives front, the Dabur stock has witnessed long built-up in the current series and has also surpassed Rs 500, where there is the highest concentration on the call option side. "Hence, some call unwinding is expected, which will also help the stock to continue its upward momentum," he said.

The bull call spread is a type of options trading strategy, which involves two call options. This type of strategy is used when the trader expects a moderate rise in the price of an underlying asset. The bull call strategy is executed by buying call options at a specific strike or exercise price while also selling the same number of calls of the same asset at a higher strike price.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.