Global macro fundamentals returned to haunt the equity markets as the year 2022 draws to a close.

Even though the Indian indices scaled their fresh peaks at the beginning of December, the markets were fraught with volatility through the rest of the month. The much anticipated ‘Santa Rally’ never took off and the overall sentiment remained dull. Still, the Nifty has been the best-performing index among emerging markets this year and, despite a massive sell-off by foreign institutional investors, amounting to over $17 billion, it delivered 3 percent returns.

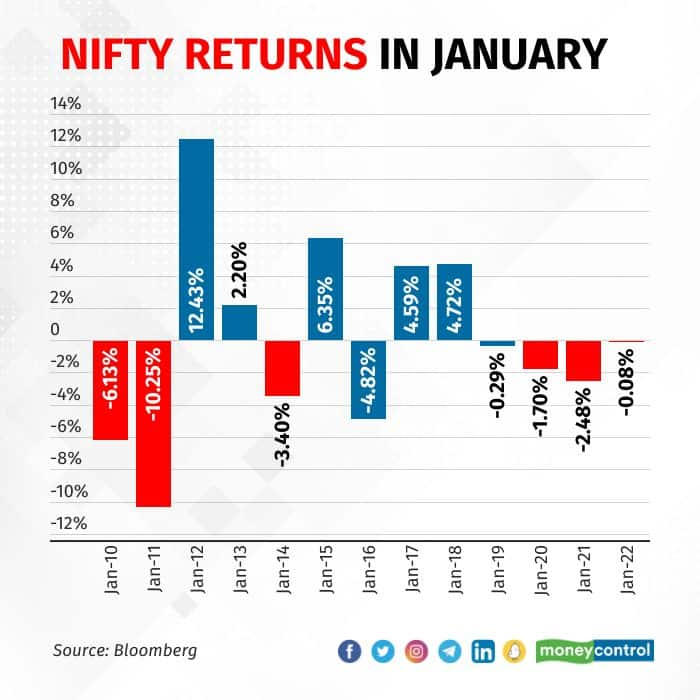

As we get ready to step into the New Year which also marks the beginning of the third quarter earnings season, past trends for January do not augur too well for the market with the Nifty giving negative returns for the past four years during the month.

Will the Nifty break its losing streak this January? Will this January bring the much-needed ‘New Year Cheer’ since the excitement fizzled out at a whisker in Christmas?

Will January jinx end this time?The past 20 years do not paint a great picture for the Nifty in January. It has predominantly been in the red zone with median returns for January since 2000 at -0.3 percent. It has been consistently delivering negative returns in January since 2019 and, if experts are to be believed, it is due to a combination of concerns about third-quarter earnings and also the fact that market movement in January becomes a function of budget expectation.

“Before the announcement of the Union Budget, the major market participants try to reduce equity exposure,” Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities, told Moneycontrol. With the Budget round the corner, it could keep markets on tenterhooks and one can be reasonably assured of increased volatility.

Also, the macros might continue to swing the boat sideways and, according to Shiv Sehgal, president and head of Nuvama Capital markets, though it is difficult to comment on one month’s market movement, the underlying tone remains that of volatility and uncertainty and on the global front, growth rather than Fed will be critical to watch.

However, looking at things technically, this time, things might turn out differently. After creating the peaks in October 2021, the index was in a long corrective phase and had developed a downward-sloping channel. In June 2022, it received support near the lower channel line and started to reverse the negative trend.

“In October 2022, the index broke out of the channel on the upside and went on to register a new all-time high of 18,887 in December 2022,” said Gaurav Ratnaparkhi, Head of Technical Research at Sharekhan by BNP Paribas. Thereon, the Nifty has seen a short-term correction in the last few weeks.

“The overall structure, however, shows that the benchmark index has given a multi-month breakout and has resumed its larger uptrend because of which we are likely to see the positive trajectory in the next few months starting from January 2023,” Ratnaparkhi suggested.

Siddhartha Khemka, Head of Retail Research, Motilal Oswal Financial Services, too expects the uptrend to resume in January after the consolidation of last few weeks and one of the weakest December of past several years.

More optimism than pessimismSince, January is a month where to some extent, market movement becomes a function of Budget expectation, this year’s Budget, being the last full budget before the general elections, is likely to play out in favour of equity markets.

“The finance ministry has indicated that the upcoming Union Budget will be game-changing that will lay the groundwork for the next 25 years and this news has sparked a good deal of interest in the market,” Sunil Damania, Chief Investment Officer of MarketsMojo, told Moneycontrol.

The optimism also stems from a pick-up in the credit cycle after a decade of slowdown and that provides great strength to the markets.

Corporate earnings, another important factor, are largely expected to show strong momentum which will aid the market sentiment, though any sign of moderation there could potentially weigh on Nifty’s valuations.

Strong Rabi season, rural recovery, sustained domestic flows, positive flows from FII led by higher allocation of India amongst EM, and upcoming growth-oriented budget makes Sushant Bhansali, CEO, Ambit Asset Management, constructive on the markets.

Earnings expectationsExperts are largely positive about the Q3 earnings of India Inc even though there might be some pockets may see a bit of moderation.

“We continue to believe that Q3 will be a very strong quarter for India Inc, owing to the continued strength of GST and corporate tax collections in India,” Damania told Moneycontrol.

Also, petrol and diesel consumption as well as FASTag collections give the impression that the Indian economy is in great shape and India's third-quarter corporate earnings will remain resilient despite global challenges.

“Corporate earnings for Q2FY23 were better than our expectations, despite several headwinds, with Financials driving the quarter and this trend is likely to continue in Q3 as well,” Khemka said. “With the supply chain woes improving and benefits of a cool-off in commodity prices kicking in from Q3, the overall profitability should remain buoyant for the quarter.”

Growth momentum in Banking will be propelled by healthy loan growth, margin expansions, and continued moderation in provisions. Autos will reap the benefits of robust demand post-festive season along with the benefits of commodity prices and operating leverage. IT, on the other hand, would continue to be weak given the challenging macro environment and continued supply headwinds.

“The festive season this year is tracking well, with mid-teens demand growth in domestic consumption and we believe with sustained demand coupled with reversion in operating margins, earnings growth should accelerate sequentially”, added Bhansali.

However, Sehgal of Nuvama, sees some moderation in earnings creeping in this quarter attributable a) to the fading of base effects as the base period was also a normalized one; b) inflation, which played a big role in boosting earnings in the past quarters but now its impact is likely to fade and could potentially weigh on topline as well as margins and c) export outlook is deteriorating which is likely to have a toll. “Nonetheless, earnings should still be reasonable and more importantly credit growth is still strong”, he added.

Thus, while some moderation in earnings is likely, it is unlikely to be large enough to deteriorate sentiments and the start to the new year in all likelihood will be on a strong note.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.