After hitting a lifetime high in January 2018, the broader markets continued to underperform frontline indices. In fact, the Nifty Midcap index traded at a big discount to Nifty50 on back of sharp correction in several key stocks.

Asset quality concerns, LTCG tax imposition, liquidity crisis, consumption slowdown, debt defaults, global trade war, and crude volatility etc., have hit several stocks, which corrected sharply in the past.

The Nifty Midcap index fell 18 percent and around 45 stocks included in the index corrected in the range of 30-90 percent in the last 18 months.

"The midcap indices (Nifty 100Midcap and BSE100 Midcap) are now trading at a discount of 15 percent to the Nifty 50 (compared to historical lows of 30-40 percent discount)." JM Financial said.

"The correction followed the downward revisions to the earnings for FY19 (28 percent lower than estimated) on account of high expectations, higher share PSU financials/ stressed groups and cyclicals (industrials/ discretionary in the midcap indices being at 27.5 percent versus 12.7 percent in Nifty 50)," they added.

But, as most analysts say, the NBFC crisis is near the end and with most of the negative priced in, there is hope building. This sentiment could be renewed by the Union Budget and expected rate cuts by India's and other global central banks. Hence, the sharp rally could be seen in midcaps rather than large-caps in the coming quarters, experts said.

Most experts believe earnings could see a major revival in FY20, especially in the second half.

JM Financial said the combination of monetary easing and expected fiscal expansionary policies with a benign global backdrop (low rates, low oil prices) can start to drive a recovery over the next 12 months.

Motilal Oswal also said the progress of the monsoon (which began on a very tepid note with 38 percent deficiency on June 23), the Budget, potential government measures on consumption/liquidity, and Q1FY20 earnings performance are the key near-term triggers for the markets.

"Midcaps now trade at discount to large-caps and offer relatively good risk-reward, but the market sentiment and potential liquidity improvement in the economy are key pre-requisites for midcaps to perform," it added.

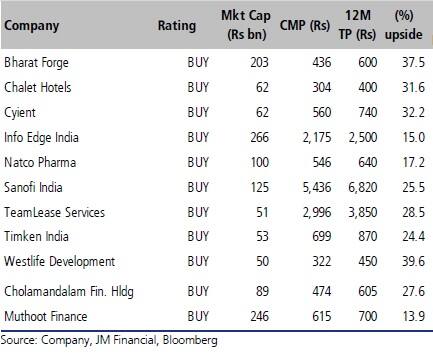

As individual stocks begin to offer reasonable risk-reward, JM Financial identified 11 non-large cap stocks to invest in which are a combination of 'growth at reasonable price' and 'value' stocks.

After factoring in moderation of CV growth in India, the US and Europe over FY19-21, we estimate revenue/EPS CAGR of 7/15 percent over FY19-21 primarily driven by the industrials segment and emerging opportunities such as aerospace, defence and light-weighting technology.

The stock is currently trading at 18x NTMe EPS after the steep correction in the last twelve months (LTM). We maintain buy on Bharat Forge, valuing it at 21x (22 percent discount to its long term average) forward earnings to arrive at our Mar’20 of Rs 600.

Chalet HotelsChalet Hotels is the asset owner and manager of five high-end hotels with 2,328 keys across three major metros.

We are factoring in an ARR growth of 7-8 percent, occupancy improvement on industry up-cycle and in exit ARR growth of 5 percent for the hospitality business and 8 percent exit cap rate for commercial/retail assets.

Hospitality assets, retail/commercial assets and pipeline assets contributed 76 percent, 10 percent and 18 percent to the enterprise value.

An adverse judgement in Vashi hotel and subdued demand/ARR growth are the key risks.

Cholamandalam FinancialSome of the reasons we are enthused by this underresearched mid-cap name are the completion of a corporate restructuring (demerger), a simplified holding structure, credible parentage, high corporate governance standards, vast opportunity and scalability of major businesses (NBFC/GIC), and a high implied holding company discount.

We anticipate steady compounding of its major investments, which in turn will drive up the valuation of the company. We assign a buy rating with a target price of Rs 605 per share giving it a 25 percent holding company discount and valuing its investment in CIFC at 2.6x FY21E BV and Cholamandalam MS GIC at 20x FY21E EPS.

CyientCyient has been in a down cycle for the past few quarters due to internal issues in some of the large clients that led to deferrals of orders and suspension of project flows. We believe the issues in Cyient are typical of the cyclicality in the ER&D industry given its high client concentration (Top5/Top10 clients are 37/50 percent of services revenues). Also, its integration in the supply chain of its large clients is high and thus, with no major client loss, it should be a net gainer once the cycle revives.

Thus, a probable recovery in the revenue growth from 2QFY20 + shift in valuations to FY21 by Q2FY20 could revive investors' interest given the stock’s inexpensive valuations (10.7x FY21F EPS).

Info Edge IndiaBoth Naukri and 99acres are at the cusp of a renewed growth cycle. Naukri is likely to get back to its high teen growth trajectory on the reversal of IT hiring trends, while technology and product spend will likely give it further boost of 2-3 percent. 99acres has been growing even when the real estate industry was on a decline during the past five to seven years, likely on the back of improving 'digital spend' penetration.

We expect to see strong movement from print ads to digital classifieds, resulting in a 29 percent billing growth for 99acres during FY19-22. The business has seen a strong margin improvement in the past four years (though still making losses) even with increasing spends on marketing and employee costs. We think the business will breakeven in FY21.

Muthoot FinanceWe expect the company to maintain its leadership position in gold financing with its strong business model (low cost of operations, high margins and negligible ALM & NPA issues) and revival in asset growth. This would help maintain a strong return on equities (ROE) of over 20 percent and return on assets (RoAs) of around 5.2 percent by FY21E.

Strong promoter interest is holding at 73.5 percent. Capital adequacy is healthy at around 26 percent with Tier-1 at 25.7 percent. We maintain buy rating on the stock with a target price of Rs 700 (valuing at 2.1x FY21E ABV and 10.8x FY21E EPS).

Natco PharmaAt 16x FY20E earnings, Natco is trading at 40 percent discount to its 5-year average trading range. We believe that the current valuations barely price in the base earnings with the value of Natco’s US portfolio and pipeline with the strong launch and earnings visibility not factored in.

Given Natco’s strong domestic business, robust balance sheet, increasing focus in new markets and maturing R&D pipeline, risk-reward is extremely favourable.

Sanofi IndiaSanofi India is trading at 24x CY20E EPS; in line with its historical trading range. We are positive on the name owing to the expected strong double-digit PAT growth, strong return metrics (Return on invested capital-ROIC of 45 percent) and industry-leading dividend payout ratio.

TeamLease ServicesA strong balance sheet (net cash-to-equity of 0.4x, strong cash conversion) and stable management strengthen TEAM’s ability to expand into specialised areas of staffing (acquisition of IT and telecom staffing companies). Maintain buy with Mar’20 target price of Rs 3,850. Regulatory interference and a simultaneous slowdown in key sectors remain risks.

Timken IndiaOver FY19-21E, we forecast sales and net profit CAGR of 13 percent and 21 percent respectively. We believe the current margin uptick does factor in any cost synergies from ABC Bearings integration and is likely to present earnings upsides.

The stock continues to be our top pick in bearings space given healthy return ratios (18-20 percent range), free cash flow generation (3 percent yield), cheaper valuations (15x EVE multiple vs 17x for SKF/SCHFL) and superior EBITDA growth (18 percent versus 14 percent for SKF/SCHFL).

Westlife DevelopmentWestlife Development’s FY19 results are a testimony to the fact that it remains well on track to deliver its vision 2022 targets of achieving Rs 6-6.3 crore revenue per store and delivering early-to-mid teens EBITDA margin.

Interestingly it delivered a 56 percent growth in EBITDA aided by 181bps margin expansion to 9 percent in FY19. This was achieved through its focus on delivering consistent menu innovations and scaling-up its brand extensions viz. McCafe and McDelivery which have outperformed its earlier targets.

These actions lend confidence to our belief that the company can deliver 11-12 percent EBITDA margin over the next three to four years with ROIC scaling-up to mid-to-high teens level. Overall, we expect the company to deliver revenue and EBITDA CAGR of 15 percent and 25 percent, respectively, over FY19-21.

We continue to value the stock on DCF basis (multiple-based valuation presently looks expensive at 32x NTM EV/EBITDA on account of sub-optimal margin that does not entirely capture the long growth runway) and arrive at a target price of Rs 450 presenting 40 percent upside.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.