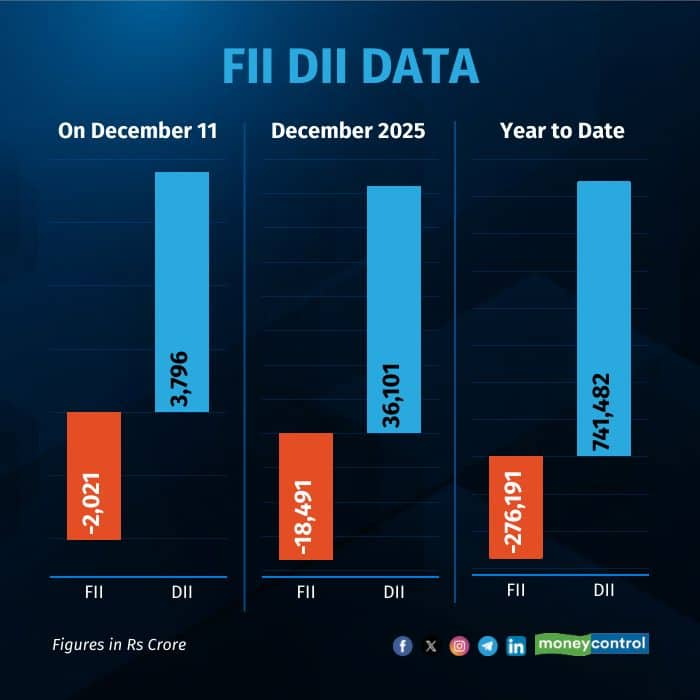

On Thursday, December 11, Foreign Portfolio Investors/ Foreign Institutional Investors (FPIs/FIIs) net sold Indian equities worth Rs 2,021 crore. Meanwhile, Domestic Institutional Investors (DIIs) bought Indian equities worth Rs 3,796 crore, as per data on the exchanges.

FPI/FIIs bought shares worth 7,534 crore, while offloading marginally higher at Rs 9,555. crore. As for DIIs, the buying was worth Rs 13,196 crore and selling was lower at Rs 9,400 crore.

For the year so far, FII/FPIs remain net sellers, offloading Indian equities worth Rs 2.72 lakh crore. On the other hand, DIIs added strength to the market with their buying spree reaching Rs 7.33 lakh crore for the year so far.

At close, the Sensex was up 426.86 points or 0.51 percent at 84,818.13, and the Nifty was up 140.55 points or 0.55 percent at 25,898.55.

Kotak Mahindra Bank, Eternal, Jio Financial, Tata Steel, Grasim Industries were among major gainers on the Nifty, while losers were Bharti Airtel, Asian Paints, SBI Life Insurance, Bajaj Finance, Axis Bank.

All the sectoral indices ended in the green with auto, IT, pharma, telecom, PSU Bank, Private Bank, metal, realty up 0.5-1%.

On today's market, Siddhartha Khemka - Head of Research, Wealth Management, Motilal Oswal Financial Services noted that Indian equities traded higher on Thursday after the U.S. Federal Reserve delivered a widely anticipated 25-basis-point rate cut—a move investors hope will help temper foreign outflows. "Uncertainty around progress in India–US trade negotiations, continuous Foreign Institutional Investor selling, and the absence of major near-term triggers—with the Fed rate cut now behind—are likely to keep market sentiment somewhat lacklustre," he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.