January 25, 2022 / 16:24 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets took a breather and gained over half a percent, tracking firm recovery in the US markets and upbeat earnings. Initially, the benchmark remained volatile however healthy buying in select index majors from banking, auto and telecom space helped the index to gradually inch higher as the day progressed. Consequently, the Nifty index settled at 17,277; up by 0.75%. The broader markets too ended with healthy gains of nearly a percent each.

Markets will react to the Fed meeting outcome in early trade on Thursday and we expect volatility to remain high, thanks to the scheduled monthly expiry. Keeping in mind the scenario, we reiterate our cautious view and suggest preferring hedged positions.

January 25, 2022 / 16:12 IST

Vinod Nair, Head of Research at Geojit Financial Services.

After a week-long consolidation, domestic indices took a breather supported by low-level buying. Western markets also supported staging recovery following correction in oil markets, and as uncertainties over Fed policy and geopolitical tensions eased.

However, volatility is expected to linger as investors await the Fed’s final policy statement, providing clarity on the timeline of rate hikes. If the statement is hawkish as anticipated, we cannot ignore a bounce in the market.

January 25, 2022 / 16:10 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty opened on a negative note on January 25 & witnessed follow through selling in the initial trade. It moved southward to test 78.6% retracement of the Dec – Jan rally, which is at 16825.

The key Fibonacci level induced the bulls into the action. As a result, the Nifty had a steep recovery as the day progressed. On the way up, the index marginally crossed a falling trendline & paused near the 20 hour moving average. So 17300-17330 is an immediate resistance zone beyond which the index can target 17500 in the short term. On the flip side, 17000 will continue to act as a crucial support on a closing basis.

January 25, 2022 / 15:57 IST

S Ranganathan, Head of Research at LKP securities:

Investors bought into the 1000 point dip in the Sensex today morning as Banks & Autos led the recovery. As markets approach important near term events, the mood appeared circumspect although on the positive side the street is going into the Union Budget much lighter post the recent correction.

Afternoon trade witnessed investor appetite in stocks of PSE and advance - decline ratio ended the day on a positive note.

January 25, 2022 / 15:55 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments

The markets have closed above 16950 which is a crucial medium-term support for the Nifty. If we need to bounce or make a V shape recovery, this is the place from where that can happen.

The next resistance is at 17400-17500. If we break 16950 on a closing basis, the markets can fall further to 16500-16550.

January 25, 2022 / 15:50 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty witnessed a recovery during the day as it found support around 80% retracement of the previous rally from 16400 to 18350. A large green candle with a lower shadow has been formed on the daily chart which indicates buying at the lower levels of the day.

Going forward, the resistance at 17400 may challenge the bulls; however, a decisive move above that level may take the Nifty higher towards 17800. On the lower end support is visible at 17000/16800.

January 25, 2022 / 15:34 IST

Market Close:

Benchmark indices made a smart recovery and ended higher in the highly volatile session on January 25 supported by the auto, power and banking names.

At close, the Sensex was up 366.64 points or 0.64% at 57,858.15, and the Nifty was up 128.90 points or 0.75% at 17,278.00. About 1935 shares have advanced, 1330 shares declined, and 84 shares are unchanged.

Maruti Suzuki, Axis Bank, SBI, IndusInd Bank and UPL were the top Nifty gainers, while losers included Wipro, Bajaj Finserv, Titan Company, Infosys and Tech Mahindra.

Except IT, all other sectoral indices ended in the green with PSU bank, power, auto and bank rose 2-4 percent. BSE midcap and smallcap indices gained 0.8-1 percent.

January 25, 2022 / 15:27 IST

APL Apollo Tubes Q3

APL Apollo Tubes has posted 12.4 percent fall in consolidated net profit at Rs 115.6 crore versus Rs 132 crore, while revenue was up 24.2% at Rs 3,230 crore versus Rs 2,601 crore, YoY.

Earnings before interest, tax, depreciation and amortization (EBITDA) was down 12.9% at Rs 202.3 crore versus Rs 232.1 crore and margin was down at 6.3% versus 8.9%, YoY.

APL Apollo Tubes was quoting at Rs 862.25, down Rs 76.05, or 8.11 percent on the BSE.

January 25, 2022 / 15:24 IST

Lux Industries locked in 20% lower circuit

The share price of Lux Industries Ltd hit a 20 percent lower circuit after its executive director was banned for insider trading, raising concerns over corporate governance at the company.

On January 25, the market regulator Securities Exchange Board of India barred 14 entities for insider trading and ordered impounding of “ill-gotten gains” worth Rs 2.94 crore in the matter of Lux Industries.

January 25, 2022 / 15:20 IST

Aditya Birla Sun Life AMC Q3 results:

Aditya Birla Sun Life AMC has reported 26.9 percent jump in its Q3 net profit at Rs 186.2 crore versus Rs 146.7 crore and revenue was up 19.9% at Rs 334.3 crore versus Rs 278.7 crore, YoY

Aditya Birla Sun Life AMC was quoting at Rs 522, down Rs 10.80, or 2.03 percent on the BSE.

January 25, 2022 / 15:19 IST

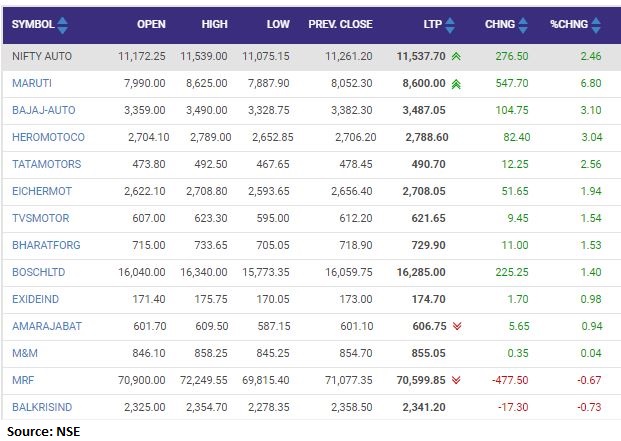

Nifty Auto index rose 2 percent supported by the Maruti Suzuki, Bajaj Auto, Hero MotoCorp:

January 25, 2022 / 15:17 IST

Star Cement Q3 results:

Star Cement has reported net profit of Rs 43.8 crore in the quarter ended December 2021 versus loss of Rs 1.74 crore in the same quarter last fiscal.

Revenue of the company was up 31% at Rs 554.9 crore versus Rs 423.4 crore, YoY.

Earnings before interest, tax, depreciation and amortization (EBITDA) was down 19.6% at Rs 67.53 crore versus Rs 84 crore and margin was down at 12.17% versus 20%, YoY.

Star Cement was quoting at Rs 96.20, up Rs 2.80, or 3percent on the BSE.

January 25, 2022 / 15:14 IST

Oyo to submit revised draft prospectus for Rs 8,430 cr IPO:

Softbank-backed Oyo is all set to file a revised draft document with the markets regulator SEBI as it moves ahead with its Rs 8,430-crore initial public offering, according to sources privy to the development.

The company has already received in-principle approval from Bombay Stock Exchange as well as National Stock Exchange, the sources added.

Oyo's move to file a revised prospectus comes amid questions on whether it will be able to go ahead with a listing in the current environment. Stocks of loss making internet companies have seen intense selling pressure in India and the US, as investors turn cautious.