After a 31 percent crash in the small-cap index of the National Stock Exchange, some market participants believe there is a case for investors to have another look at the segment.

The Nifty Smallcap 100 index has fallen more than 30 percent after hitting a record high in January as concerns over valuations, rising interest rates, high inflation and slowing earnings growth weighed on sentiment.

The capitulation in the small-cap space so far has been in line with previous bear markets, with the segment losing an average of more than 30 percent from its recent high. The decline, however, has also resulted in an even sharper compression in valuations of small-cap stocks this year.

The one-year forward price-to-earnings (PE) ratio of the Nifty Smallcap 100 index has shrunk more than 51 percent from its peak of 28.53 times in March 2021 to around 14 times currently, according to Bloomberg data. In comparison, the Nifty 50’s one-year forward PE has shrunk around 37 percent from the peak of 27.8 times in December 2021 to 17.4 times currently.

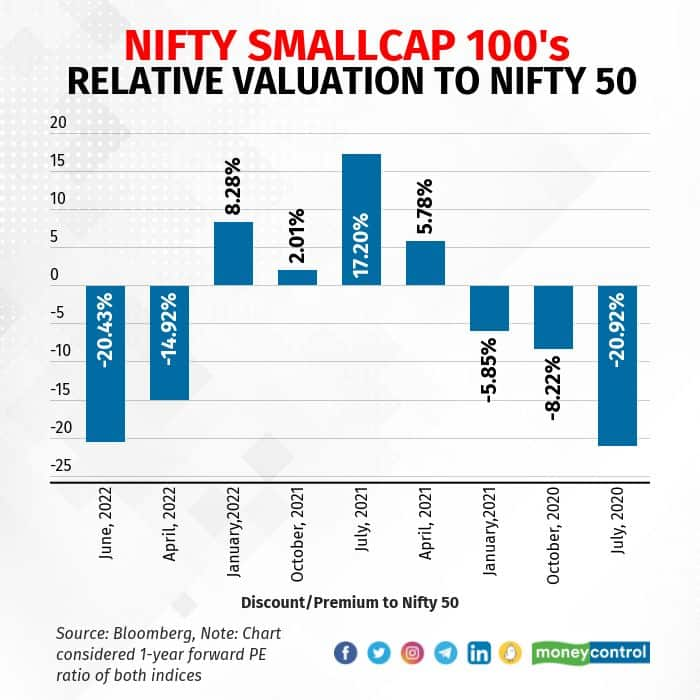

More importantly, from a relative valuation perspective, small-cap stocks are now at their cheapest level to their Nifty 50 peers since July 2020—the height of the COVID-19 pandemic in the country. Currently, the Nifty Smallcap 100 index is trading at a more than 20 percent discount to the Nifty in terms of one-year forward PE ratio.

In the past, a discount of more than 20 percent between the valuations of the two indices has been a catalyst for a bullish turnaround for small-caps, leading to a narrowing of discount.

“It’s an opportune time for long-term investors to buy when companies are available at such reasonable valuations. We can say that the risk-reward ratio has become favourable for long-term investors in India,” said Arvind Kothari, founder of Niveshaay and portfolio manager, Smallcase, a fintech company.

Kothari, however, warned that discount in valuations should not be viewed in isolation and suggested that investors look at companies generating cash flows with a healthy balance sheet and available at reasonable valuations.

“Investment decisions shouldn’t be made in stocks that look cheap in the hope that things will turn around in one or two years. Hope is never a strategy and such companies generally are de-rated in markets which are brutal as the current ones,” Kothari added.

The de-rating or decline in valuations of small-cap companies are likely a function of higher interest rates that make it difficult for investors to price profits far out in the future into the current stock price and concerns that domestic economic growth may slow down considerably in 2022 owing to higher global commodity prices.

Notably, veteran investors like Shankar Sharma have also recently spoken in favour of small-cap stocks. “This is the best opportunity in the next 10 years to buy quality Indian small caps,” Sharma tweeted.

Even as valuations have become affordable, analysts believe that the small-cap space may not see a quick revival given investors’ risk appetite has shrunk following a gruelling bear market over the past four months.

“We have seen a multiple breakdown in the small-cap index so I will not be going long on this space as the overall sentiment is also not good. Any near-term upside should be used to trim holding in the small-cap space,” said Gaurav Bissa, vice-president at InCred Equities.

Bissa argued that small-cap stocks were unlikely to lead the revival in the Indian stock market. “The revival will come with the Nifty, not the other way around,” Bissa said.

Regardless, retail investors have been buying the dip as can be gauged from the upturn in inflows for small-cap mutual fund schemes. The average monthly inflow into small-cap equity funds in the first five months of 2022 has risen 364 percent to Rs 1,621 crore compared to the last five months of 2021, data from the Association of Mutual Funds in India showed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.