When you construct a trading strategy, do you test if it is profitable or loss-making by directly using it? Or would you rather try it out without risking real capital?

Building from the Ground-Up -“A mistake is not something to be determined after the fact, but in light of the information available until that point.”

Backtesting helps you assess the viability of your trading strategy by discovering how it would play out using historical data.

Let’s say you come across a trend, following which is a commonly known strategy and figured out it depends on fast and slow exponential moving average (EMA) signals.

The trade setup looks somewhat like this –

Fast moving signal – 30 Day EMA

Slow moving signal – 90 Day EMA

Go long (buy) – When 30D EMA rises above 90D EMA

Exit long (sell) – When 30D EMA falls below 90D EMA

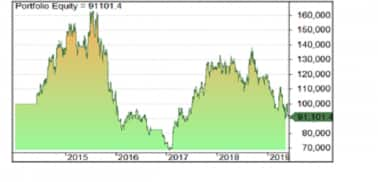

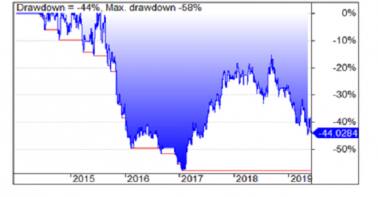

Here is the equity curve and drawdown from the trade setup. If you thought that backtesting your strategy is a waste of time, think again. If you thought that plain old trend following was a good strategy, think again!

Backtesting simulates the risk and profitability of a strategy before the trader decides to risk actual capital in the live market.

With these reports, you can evaluate if the trading idea is giving you the results you desire. If the results are positive, the strategy is fundamentally sound and is likely to yield profits when implemented in reality.

If the strategy yields suboptimal results, as is in the case of this trend following setup, you know that you have to optimise or reject the strategy.

As long as a trading idea can be quantified, it can be backtested.

Optimizing your StrategyThere are several ways to better a strategy, including adding a stop loss, a target profit, position sizing, parameter optimization among others.

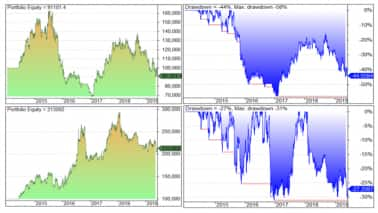

Continuing with the example of trend following, adding stop-loss logic to it will yield the following results –

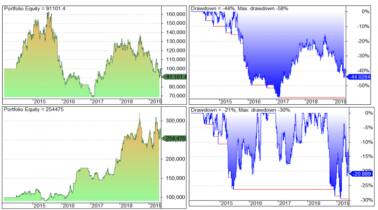

Redoing the strategy to include target profit makes the strategy handsomely profitable with lower risk.

After having seen that the backtest – optimise - backtest cycle can give you improvised results of this basic strategy, it’s easy to fall into the trap of “curve fitting”. Too much optimisation, and you will end up with a strategy that will do well only if the exact events repeat themselves in the live market. Remember…

“Too much success is the enemy, too much failure is demoralising.”

Having a general idea, however, is important. So, when you next come up with a trading strategy, will you find out if it is a profitable or loss-making one by directly trading it? Or will you decide to figure that out without stepping into the live market?

The author is Founder, Arque.Tech. He can be contacted at hrishabh@arque.techDisclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.