The Nifty saw its highest weekly close when it ended the November 25 session at 18, 513, rising more than one percent for the week.

Through all the turbulent moves during the year, we have maintained a strong optimistic bias around key support zones. Now, when the bulls are in cruise control, we remain sanguine on the near-term outlook.

The banking index and the Sensex have already entered uncharted territory and it’s just a matter of time before the Nifty follows suit.

As far as levels are concerned, 18,600 and 18,750 are the next levels to watch out for, above which the path towards the next milestone of 19,000 unfolds.

The “buy-on-decline” strategy continues to pay rich dividends and should be continued.

The immediate support zone is in the vicinity of 18,400– 18,300, whereas the actual base shifts higher towards 18,100. As long as the Nifty manages to defend this territory, there is no reason to worry for.

Once the Nifty clocks fresh highs, apart from heavyweights, one should keep a close eye on the broader end of the spectrum, which has been quiet for some time now.

The way the Nifty midcap50 index is placed, we will likely see some flamboyant moves in mid and small-cap baskets.

Traders are advised to continue with an optimistic approach and now, with other sectors chipping in, we expect good, broad-based buying during the forthcoming week.

Here are two buy calls for the next two-three weeks:NLC India: Buy | LTP: Rs 83.55 | Stop-Loss: Rs 78.40 | Target: Rs 92.50 | Return: 11 percentIt has been in a cycle of higher highs–higher lows and has recently seen traction in terms of trading volume, indicating strength in the counter.

In the past trading week, the stock has breached the crucial resistance placed around Rs 80-82, signifying a bullish quotient in the upsurge.

Technical indicators, too, are in line with the uptrend. We recommend buying for a near-term target of Rs 92.50. Traders can participate by following a strict stop-loss at Rs 78.40.

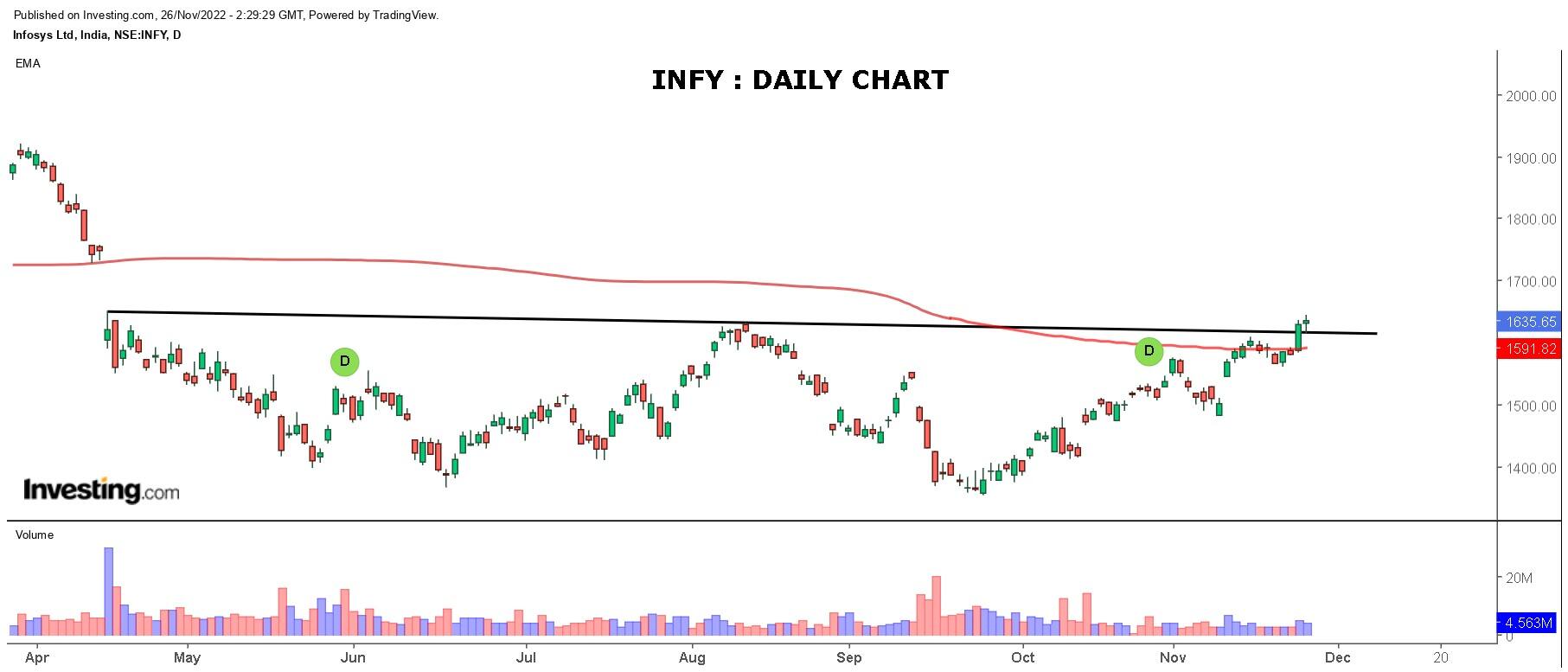

The entire IT space is in process of getting its mojo back after a long period of underperformance. Infosys started the recovery move quite slowly and we can see it coming into its groove now.

Last week, the stock price managed to traverse the 200-day simple moving average (SMA) for the first time since April 2022. After spending a few sessions above it, the stock showed an upsurge in the latter half of the week gone by.

Considering the weekly formation and the placement of momentum oscillators, we will not be surprised to see this stock participating in the next leg of the market rally.

Traders are advised to buy for a near-term target of Rs 1,725. A strict stop-loss needs to be placed at Rs 1,584.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.