Fund managers raised stake in as many as 194 companies in the December quarter as compared to the previous quarter. Stocks of some these companies have fallen up to 70 percent since January 2018.

So, when is good time to buy a stock? That is the most difficult call when investing in stock market, especially when a stock is falling.

Experts have suggested that if a good-quality stock is taking a hit due to external factors, investors should use dips to buy for long-term growth potential.

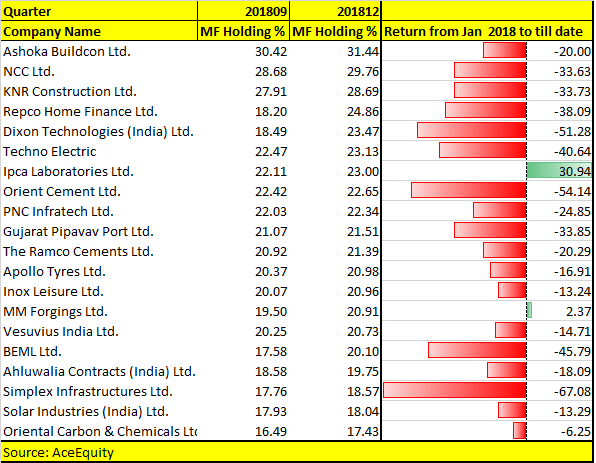

Stocks in which fund managers have increased their stake in the December quarter include Ashok Buildcon, NCC, KNR Construction, Orient Cement, Dixon Technologies, Apollo Tyres, MM Forging, BEML, Ahluwalia Contracts and Solar Industries, as of data collated on January 21.

On the contrary, fund managers decreased their stake in 117 companies, including Bharat Financial, Atul, MCX, Divi’s Laboratories, Aurobindo Pharma, Atul Auto, CL Educate, Raymond, Manpasand Beverages and Arvind.

Here is a list of 20 stocks of the 194 in which fund managers raised their stake in December quarter:

The next big questions is – should investors look at stocks which are part of mutual fund managers' list, considering the fact that they are known to be the experts.

Well, most analysts suggest investors to avoid following fund managers blindly and instead do their own research before putting money. Key variables such as risk profile, investment horizon, as well as portfolio holding will be different for every fund and there is a low probability that retail investors will be able to match that.

“Retail investors, unlike mutual funds, should not attempt to catch a falling knife. A retail investor should first look at the reason for fall and if he/ she believes that fundamentals do not justify the fall then he/she should accumulate good stock and have the view of at least 3 years,” Atish Matlawala of SSJ Finance & Securities told Moneycontrol.

“Retail investor should obviously look at the stocks accumulated by mutual funds but should not exactly copy their investment. However, there are few companies like Future consumer, Natco Pharma and Godrej Agrovet in midcaps where prices have corrected but the future outlook has not changed much. We would advice retail investors to buy these stocks for 3 year perspective for a good return,” he said.

A large part of the retail money is flowing into mutual funds via systematic investment plan (SIP) route, which is definitely a good sign for equity markets. Mutual funds account for the lion’s share of domestic investment in the market.

SIP inflows, which touched Rs 8,022.33 crore in December 2018, are a silver lining for MFs whose asset base shrunk slightly in December.

Mutual fund (MF) industry's assets declined to Rs 22.8 lakh crore in December 2018 from Rs 23.4 lakh core in November 2018 on the back of moderation in the flows into equity funds and outflows from liquid funds.

MFs look for sound background companies to invest in. In India, most of the youth and salaried employees park their money in mutual funds through SIP, since they don’t track markets and do not have much knowledge of stock picking.

“SIP which is a systematic Investment plan in which a handful amount on monthly or quarterly basis put in the schemes of mutual fund managers. Most of the stocks mentioned gave negative returns because fund managers have adequate liquidity to put it on,” Abhijeet Bajpai, CEO, CapitalAim Financial Advisory Pvt. Ltd told Moneycontrol.

“From technical view point stock are beaten on their peak looks like someone gave or putting their stake to mutual fund managers and they are eager to absorb the liquidity buy ace investor or big player,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.