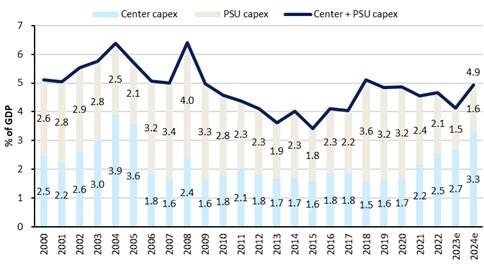

The Indian Capex cycle is gearing up to take off. The Indian government in the Budget 2023 announced an increased impetus towards capex. Based on our estimates the capex spends by the government including the Public Sector Companies in FY2024 should increase from 4.1 percent of GDP to 4.9 percent. The overall Government share in capex is expected to grow from Rs 11.3 trillion in FY2023 to Rs 14.9 trillion in FY2024. (Source: Union Budget)

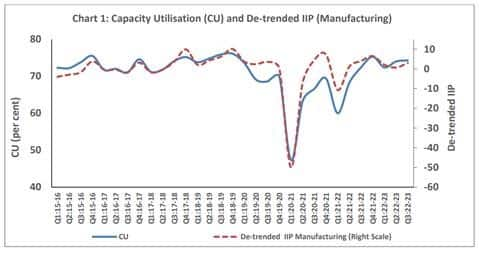

The Indian corporate too have slowly and steadily de-levered their balance sheets; and the capacity utilisation of the country is almost 74 percent (Source: RBI). Most companies have been using the route of buying sick companies or merging with smaller weaker companies and increasing their capacity and hence we have not seen a trend of increased capex for the corporate world as a whole, though we have seen great pockets of growth as well.

Over the last couple of years, steel players have acquired many companies under IBC (Insolvency and Bankruptcy Code) process. For example, Tata Steel acquired BSL, JSW acquired BPSL and Monnet Ispat, Vedanta acquired Electro steel and Arcelor Mittal acquired Essar Steel. Similarly, the Cement sector has witnessed consolidation and market share gains by the six largest cement companies. The market share of the top-6 companies has increased by ~10 percent in the past 10 years (FY11-21) to 55.5 percent (Source: JM Financial).

Five sectors where we can witness the capex cycle playing off are a) Defence; b) Power; c) Railways; d) Water treatment and e) PLI-led Manufacturing.

Source: Union Budget

Source: Union Budget

Source: RBI

Source: RBI

In the Defence sector the Indian government is following the “Atmanirbhar Bharat” or Make in Indian theme. We have witnessed a surge in defence localisation orders. Historically, the defence sector depended a lot on imports from Russia, France and China for their requirement. In the case of aircraft, we believe Indian-made aircraft share will increase from ~18 percent (from existing fleets, which are dominated by these countries) to +40 percent of new orders over the next 1-2 decades. (Source: JM Financial)

PowerThe peak demand in April-May 2023 was ~220GW against 245GW of effective capacity available. There has been underinvestment in the power sector in the past. However, the government has increased its focus on adding capacity in the power sector in both thermal and renewable to meet the demand that can grow by at least 7-8 percent. (Source: Ministry of Power, JM view)

Capital outlay of Rs 2.4 trillion for the Indian Railways in the Union Budget 2023-24 which is 9 times the outlay made in 2013-14. This will be spent across segments that include line additions, gauge conversion, signaling and other rail infrastructures. (Source: Union Budget)

WaterWater opportunities are significant across segments with the government focus on Jal Jeevan Mission, Namami Gange, Water treatment, irrigation, amongst others. One of the company under our coverage has a stellar Book-to-bill of 4.6x. (Source: Company, JM Financial)

Electronics Manufacturing ServicesManufacturing undergoing a policy-driven structural shift. Organic Policy Initiatives like PLIs, Competitive taxation regimes for new manufacturing facilities (15 percent) and China+1 have been the key drivers of growth momentum in electronics manufacturing. While business opportunities are large as just the demand from import substitution can drive 25 percent+ Revenue growth, the key challenge is to manage growth constraints to scale up. The industry is expected to grow at 25 percent+ CAGR for the next 3-5 years. For e.g industry estimates suggest, the Indian non-consumer, industrial electronics have a market size of ~Rs 800 billion, but Indian companies make only ~Rs 100 billion. India has the advantage of low labour cost for the next 10-15 years. (Source: Company, Industry Estimates)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.