Indian benchmark indices are trading in a range-bound manner amid consolidation following their recent all-time highs in the last trading session.

According to experts, the outlook on Nifty remains positive as long as it stays above 22,500, with targets set at 22,790/22,900. Caution or selling is advised only if 22,450 is breached.

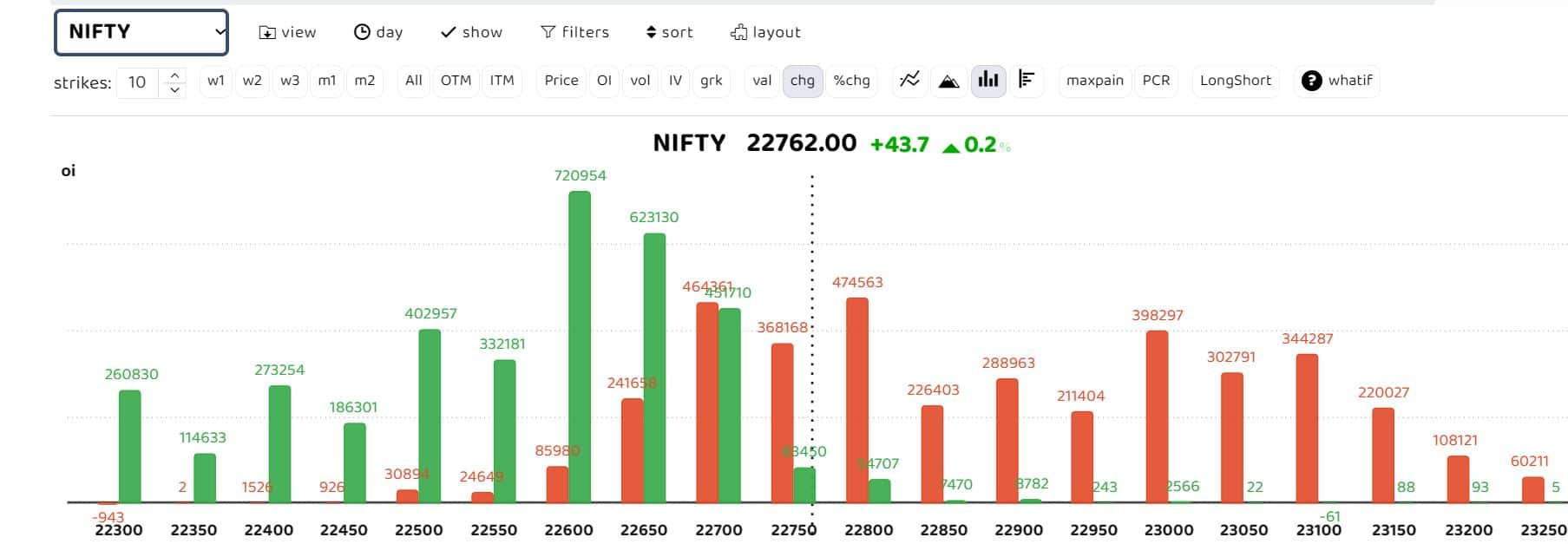

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers"On the technical front, analysis of the Nifty daily chart reveals that if prices breach the 22,700 level again, there is potential for an upward movement towards 22,900 and 23,000 in the near future, with immediate support seen at 22,500. Similarly, for the Bank Nifty, crossing the 49,600 level could lead to further gains, possibly reaching 50,000 and even 50,500, with 49,000 acting as immediate support, " said Mandar Bhojane- Research Analyst at Choice Broking.

Option writers are positioned in calls at 23,000 and puts at 22,500. Significant increases in Open Interest (OI) have been observed at 22,150/22,700 for puts and 22,800 for calls. 22,800 is currently a temporary hurdle.

"The approximate expiry range is expected to be within a range of +/-50 points from 22,700. Writers should exercise caution if the market moves above 22,825 or below 22,475. The market sentiment remains positive as long as it stays above 22,500, with targets set at 22,790/22,900. In the event of dips, support levels are identified as 22,560 and 22,500. Sell-offs should only be considered if the market breaches the 22,450 level, " said Akshay Bhagwat, Senior Vice president- Derivative research at JM financial.

Bank NiftySudeep Shah, DVP and Head of technical and derivative research at SBI Securities said: "49,000-48,900 will act as crucial support for the index and till 48,900 holds, index can continue its positive momentum upto 49,850-50,000 zone. Any sustainable move below the level of 48,900 will lead to selling pressure up to 48,300-48,400 level in the coming sessions."

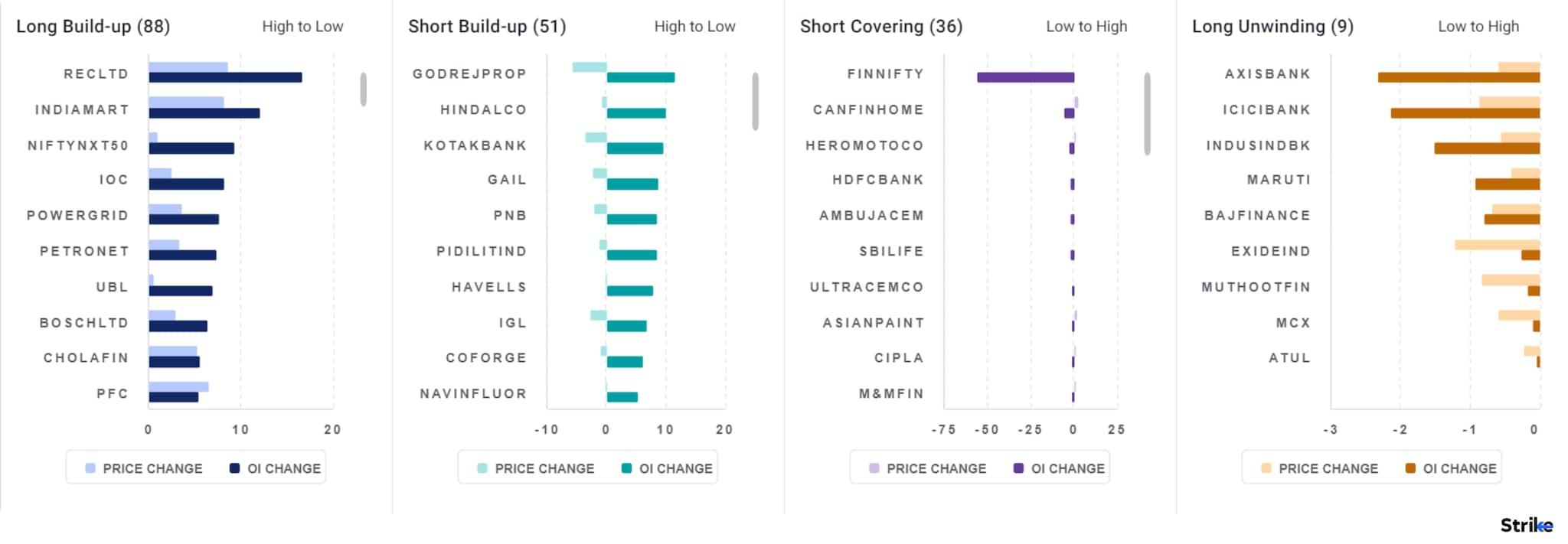

Among individual stocks, long build up is seen in REC Ltd, Indiamart, IOC and Power Grid. Short build up is observed in Hindalco, Godrej Properties and GAIL.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.