The market extended its recovery on the March 17 morning but traders were not sure how long would the index would manage to sustain the gains. Most traders anticipate a consolidation as volatility remains high.

At 10.33 am, the Nifty was up 104.80 points, or 0.62 percent, at 17,090.40. Nifty futures also climbed 87.95 points, or 0.5 percent, to 17,135.25.

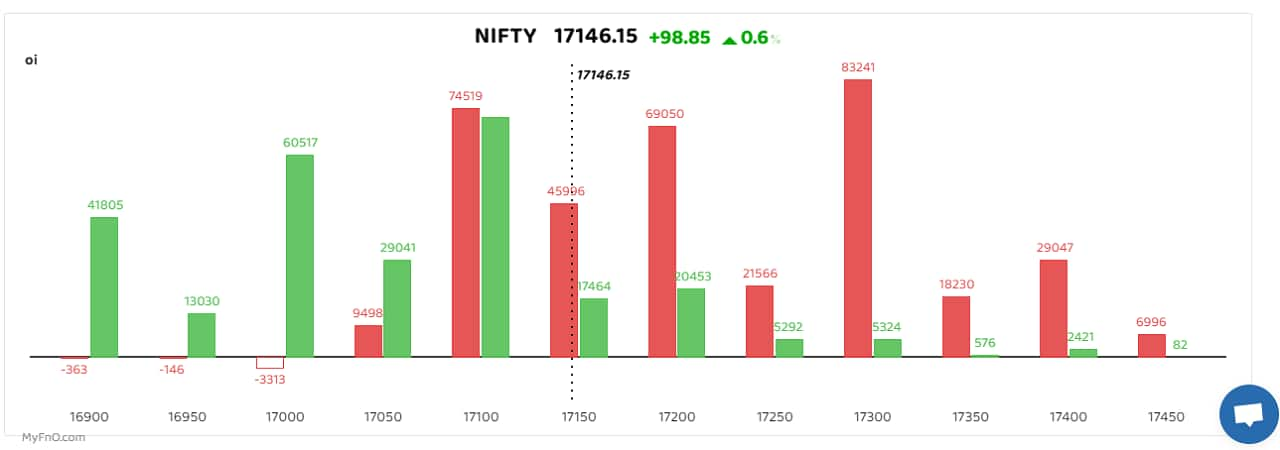

On the options front, maximum accumulation of put writers was seen at 17,100 and 17,000, which suggests that bulls were trying to sustain the recovery. Among call options, heavy writing was seen at 17,300 followed by 17,100 and 17,200, which indicates that the upside in the market will face multiple hurdles.

Despite the nascent recovery in the market, Navy Ramavat, Managing Director of Indira Securities, is waiting for a decisive close above 17,250 to consider it as a clear sign of a base formation at 16,800. He also said investors should keep their exposure in the market to 30 percent and wait until volatility subsides.

As for investors wanting to go short, Ramavat suggested adding fresh bets below 17,000 with a stop loss of 17,250.

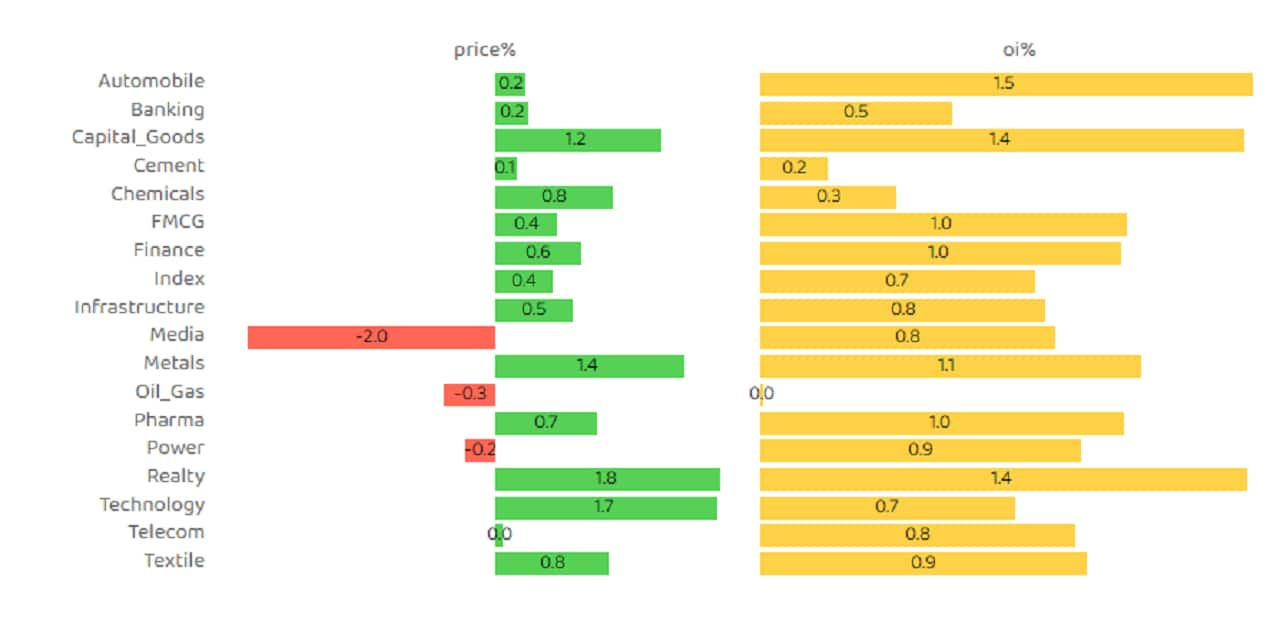

Most sectoral indices followed the Nifty to witness some recovery. A similar action was seen in the F&O segment, as most sectors saw additions of long positions, indicating that the overall recovery is broad-based.

Heavy long buildup was seen in Aurobindo Pharma as open interest rose 7 percent. Other stocks that witnessed long additions were LTIMindtree, DLF, Hindustan Aeronautics and National Aluminium Co. Long additions is a bullish sign which happens when price increases along with a rise in open interest and volumes.

Most metal counters, which saw sharp selling on the previous day, saw short covering, which is a bullish sign. These include Vedanta, Jindal Steel and Power and Hindalco Industries.

Also read: ZEEL calls report on repayment of $10 million to IndusInd Bank 'speculative', stock fallsOn the other hand, Zee Entertainment Entertainment saw a heavy buildup of short positions after the company called news reports on the repayment of $10 million to IndusInd Bank "speculative". The report of accompanying repaying the loan triggered a strong long buildup in the counter a day earlier.

Other stocks that saw a short build-up were Sun TV, Ambuja Cements and ITC. A short buildup is a bearish sign which happens when prices fall along with a rise in open interest and volumes.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.