April 22, 2020 / 14:36 IST

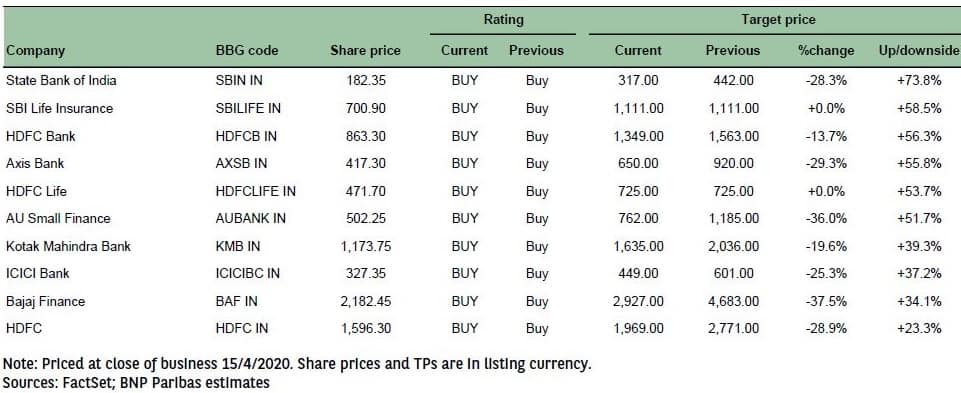

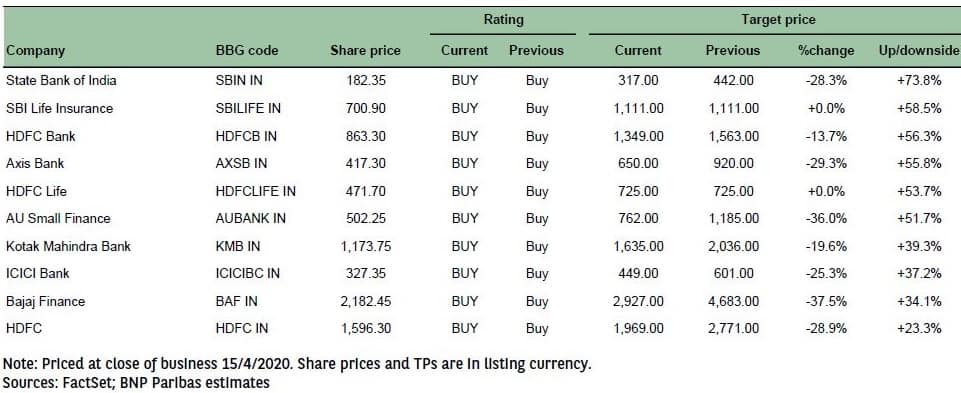

The coronavirus outbreak has hit India's financial sector hard and the lockdown is likely to have a severe near-term impact on banks and NBFCs, aggravating the issue of NPAs and liquidity squeeze.As per a report by brokerage firm BNP Paribas Securities, financials may see FY21E earnings cut of about 40 percent on an average.Since January 2020, Indian financials have corrected by 8-71 percent and underperformed the benchmark Nifty by 20 percent.To factor in the lockdown impact, BNP Paribas said it assumed lower credit offtake and significantly higher credit cost for FY21/FY22 leading to FY21E earnings cuts of 9-70 percent for financials it covers, with diversified financiers impacted the most.BNP Paribas expects credit growth of India's financial space to moderate year-on-year (YoY) in line with the economic slowdown for the most part of the quarter exacerbated by the national lockdown."We expect core margins to be slightly under pressure YoY as deposit growth of about 8 percent YoY for FY20, exceeded credit growth. We expect the credit costs for both private banks and PSBs to increase YoY, as they may make additional provisions for Q1FY21. Further, higher ageing provisions YoY should be offset by strong recoveries across the PSBs, in our view," said BNP Paribas.However, brokerages believe there is a solid upside for private banks going ahead, in comparison to NBFCs.BNP Paribas said the earnings impact due to a lockdown in April is already factored in the price for private banks and given the diversified loan book, higher capital adequacy and stable deposit franchise, it continues to prefer banks over NBFCs.The brokerage expects private banks to continue to do well against PSU banks and NBFCs, with a limited impact on NIMs and loan growth while asset quality should remain stable.Some other brokerages, including BOB Capital Markets (BOBCAPS)-a wholly-owned subsidiary of Bank of Baroda-also believe large private banks are best placed to weather the storm, due to a lower cost of funds, strong liability franchise, adequate capital and structurally fortified balance sheets.On the other hand, NBFCs could face several headwinds in the near-term.As per BNP Paribas, ALM mismatches, collection issues, concentrated exposure and a longer recovery time frame as compared to banks are major challenges for NBFCs.Fiscal stimulus, the extension of RBI forbearance, normal monsoon and results of the first half of FY21 will decide the course of India's financial sector.HDFC Bank, Kotak Mahindra Bank, Axis Bank and ICICI Bank are the top picks of BNP Paribas.

"Management commentary and industry checks indicate that despite an RBI forbearance on debt service for three months, credit cost should be impacted as some customers may still not be able to service loans. An extension of forbearance or a one-time restructuring could significantly lower the earnings impact," BNP Paribas said.

Story continues below Advertisement

India's financial space is experiencing acute liquidity crunch and despite RBI's recent measures to ensure adequate liquidity for banks and NBFCs, the pain is unlikely to fade away for them.

Extension of the nationwide lockdown will cause a delay in the recovery of credit offtake and a further increase in the credit costs which remains a major threat to India's financial space.

Brokerages say that the central bank will have to come out with measures at regular intervals to ensure NBFCs have adequate liquidity because a consistent shortage of along with negative carry on excessive cash on books and pressure on yields, will put pressure on the margins for NBFCs.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!