Indian benchmark indices were trading marginally lower amid volatility. Around noon, the Nifty was down 40.20 points, or 0.17 percent, at 24,101.80.

According to experts, support for the Nifty is now seen at the 24,000 and 23,750-23,800 levels. On the higher side, immediate resistance for the Nifty is at the 24,175 level, with the next resistance at the 24,300 level.

At 12:48 hrs IST, the Sensex was down 120.20 points, or 0.15 percent, at 79,355.99. About 1,677 shares advanced, 1,687 shares declined, and 90 shares remained unchanged.

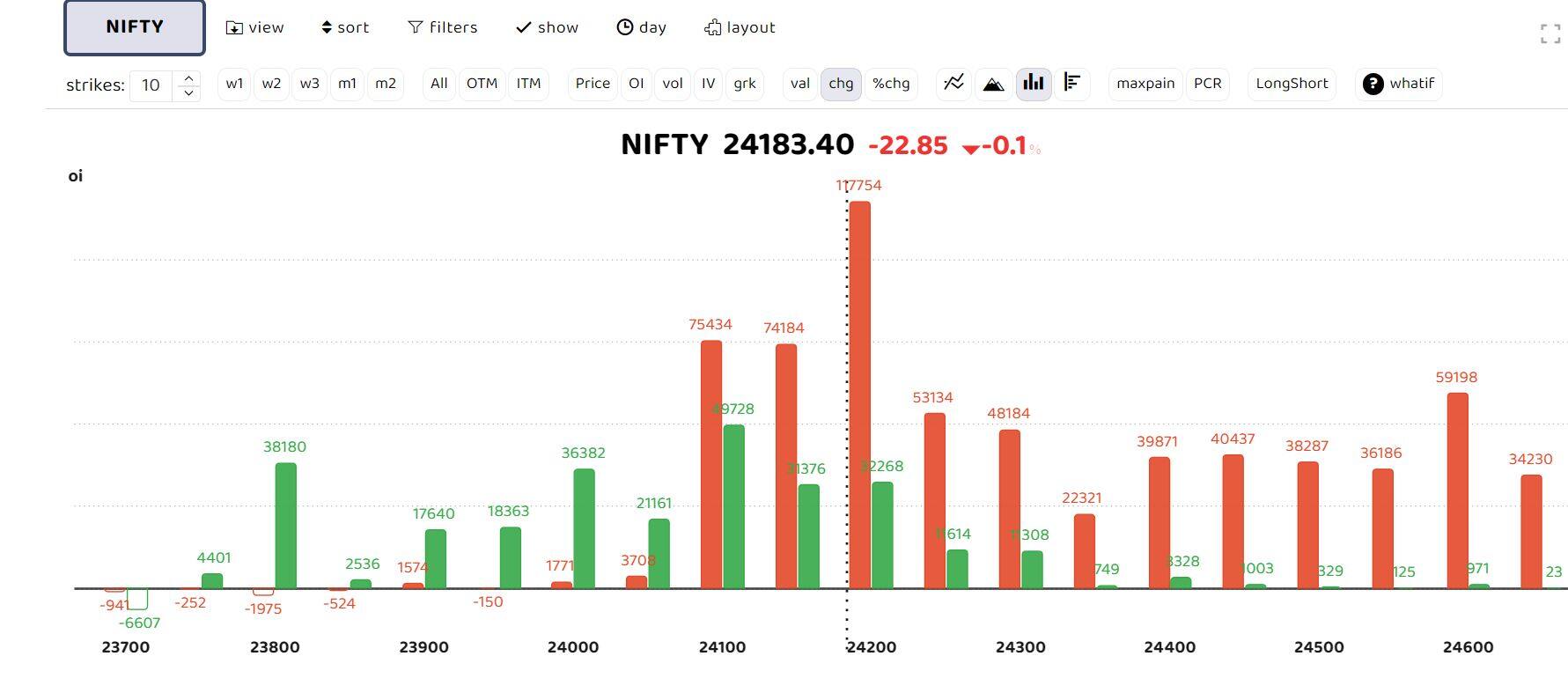

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers.

NiftyThe Nifty continues to trade with a positive bias, with supports placed at 23,985 and 23,800. "An inside bar candlestick pattern has formed on the daily charts, indicating that a move above the previous day's high of 24,174 or below the previous low of 23,985 will set up a trending move of another 100-150 points in that direction. Positional bias remains positive for 24,500," said Avani Bhatt, VP of Derivative Research at JM Financial.

Bank Nifty"Based on the chart, it is in a bullish trend; however, we can see bearish candles in the last few sessions, and OI data shows some abnormal activities in ITM calls," said derivatives trader Santosh Pasi.

Pasi notes that the maximum OI on the put side is at 50,000, and on the call side, it is at 53,000. Combining both price action and OI, we assume the range will be between 52,000 and 53,000 for tomorrow's expiry. "You may plan for non-directional strategies within the range of 52,000 and 53,000.

For the upcoming weeks, be ready for a sharp move, most likely to the lower side," he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.