Bengaluru-based smallcase Technologies is paving the way for modern investors allowing them to choose from professionally tailored baskets of stocks that reflect an investing idea or strategy.

Currently, seven brokers have a collaboration with the company and are offering this platform. They include Kotak Securities, HDFC Securities, 5paisa, Edelweiss, Zerodha and Axis Securities.

How does smallcase work?

smallcase account allows an investor to buy and sell tradable securities based on the predefined combinations.

To use the platform, follow these steps:

-Go to smallcase website and click on login. You have to use cedentials provided by your broker to login. However, if you use any other broker other than mentioned above, you may not access the services.

-Once logged in, choose from the array of themes such as all-weather, smart beta, bargain buys among others.

-You will now be able to see stocks that form the portfolio, their proportion and the rationale behind their inclusion. You can customise the small case by adding or removing stocks.

-While some brokers allow you to create your personalised smallcase, others offer curated smallcases.

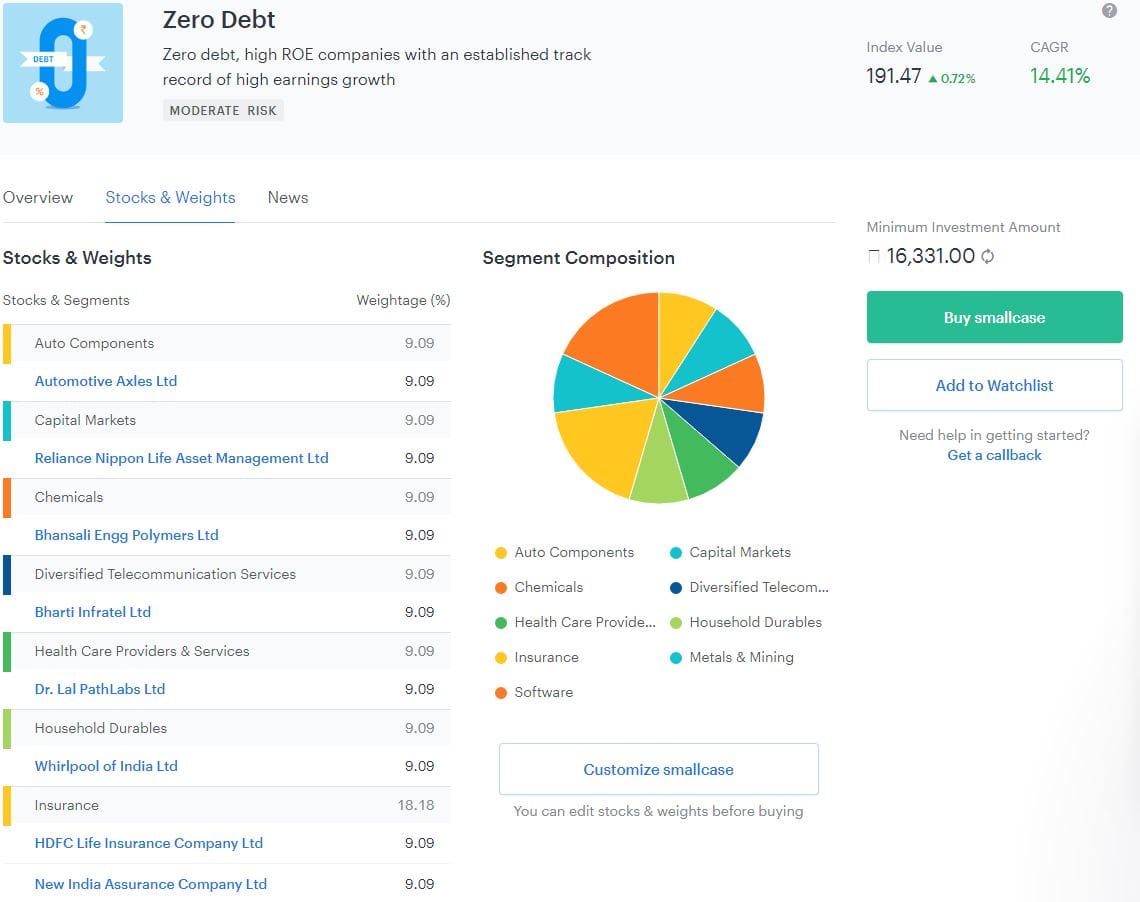

For example, in this smallcase, titled Zero Debt, companies with no debt burden and high ROE with an established track record of high earnings growth have been selected. Source: smallcase.com

-Once your smallcase selection is finalised, you will be prompted to the payment gateway. The price and weight of individual stocks will dictate the minimum amount you shall pay for the smallcase, viz. in the above example, the minimum amount is Rs 16,331.

-Once the payment is complete, the broker platform will place buy orders for all stocks, which will be executed immediately depending on liquidity.

-In case illiquidity leads to non-fulfilment of a few orders, the investor will be able to go back and 'repair' their order, then or later, upon which a fresh order will be placed. Repairing is required to ensure the portfolio matches the original theme.

Charges: For All Weather Investing and Smart Beta smallcases: Rs 50 + GST

For all other smallcases (thematic/sectoral/model-based, equity & gold smallcase): Rs 100 + GST (Source: Zerodha)

These are one-time fee for one smallcase. For further orders in the same smallcase, no extra charges will be applicable.

Though, the regular brokerage and other charges for buying and selling stocks will be deducted for every order.

Why you should go the smallcase route

-Investment in equity funds attracts expense ratio that includes fund management, distributor's commission and other expenses. This expense ratio is annually deducted from your investment in the equity fund and roughly equates to 1-1.5 percent of the investment.

In comparison, you only pay brokerage for smallcases (after the initial order). smallcases charges no extra investment fee.

-While investment in mutual funds gets you fund units, smallcase investment puts shares in your demat account. This is beneficial as the investors get tax free dividend directly in their bank accounts.

-smallcase enables you to invest in ideas rather than in stocks based on market capitalisation. For example, one can invest in companies that are working towards affordable housing projects if the focus of the government is on providing affordable housing to all. No equity fund is there that will provide such exposure.

-Redemption request with an equity mutual fund usually takes three working days to get processed. With smallcase, an investor can track investments in real-time during the market hours. Request for redemption is also placed in real time as adequate liquidity is one of the stock selection parameters used in smallcases. This, in turn, facilitates quicker redemptions.

Caution: It should be noted that the smallcase platform may not be suitable for a first time or new investor, as he or she may not be qualified enough to understand the risks associated with the product. It is advisable to consult a financial advisor before investing via this product.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!