Prashant Jain, one of the world’s longest-serving fund managers, has hung up his boots after 31 years in the business.

Since he started his career in 1991, Jain has established himself as a wealth creator and a staunch advocate of the ‘value’ philosophy. His true distinction has been his conviction, even in the face of recent unsupportive majority opinion.

His core belief is that ‘the markets in the long term are a slave to earnings.’ Jain has kept his funds closely tied to this investment philosophy with a focus on the long term even when the markets went overboard on momentum in the short term.

But Jain does not believe that value is against growth. In his own words, he has been an investor in most growing companies at various times in his career but the issue that has constantly nagged him was the price paid for growth. He considers himself a “seeker of value” – a less-risky approach to investing, although one that has periods of underperformance.

While the funds that Jain manages are back in the reckoning now, the past few years have proved to be quite challenging for his investing style. So, how did he achieve cult status?

Also read: India's largest equity mutual fund manager Prashant Jain calls it quits

The Early YearsA graduate of the Indian Institute of Management Bangalore, Jain started his career at SBI Caps in 1991, deputed to SBI Mutual Funds during a very bullish period of the Indian market. Economic reforms had just been introduced.

However, in 1992, the Harshad Mehta stock scam caused severe value destruction in the markets. A young Jain, who was not yet a fund manager, saw first-hand the kind of permanent damage that was possible if underlying value was missing from investments.

The time spent at SBI Mutual Fund provided the foundation for Jain’s grasp on both equity and debt research.

In 1993, Jain ended his stint at SBI MF to join the founding team of 20th Century Mutual Fund. It was here in January 1994 that Jain launched the Centurion Prudence Fund, which later became the HDFC Prudence Fund and is currently known as HDFC Balanced Advantage Fund – a 27-year-long journey that puts him in the list of the world’s longest-serving fund managers.

It was around this period that his core philosophy of buying rightly priced companies and emphasis on ‘value’ took shape and would go on to decisively shape Jain’s career.

From 1995 to 1997, the market remained sideways but the fund’s performance continued to suffer. Many people believe that this early failure laid the foundation of Jain’s ‘value’ approach and the challenges and learnings of these six years set the stage for his true potential to unfold.

The A-Ha! MomentAround 1997, access to the internet was expanding and people were getting into computing. There was a heady rally in IT stocks the world over. IT companies accounted for 40 percent of India’s market-capitalisation but contributed only 1 percent to the country's GDP.

The writing was on the wall for the few who chose to see it – and among them was Jain.

In late 1999, amid much flak, he exited every single IT stock held by his funds and moved into defensives, FMCG and consumer durables. When the crash came in early 2000 and the tech bubble burst following the Ketan Parekh scam, Jain was proven right. And this was when no other fund was left unscathed.

The Midas TouchIn 1999, Zurich India Mutual Fund took over 20th Century MF and Jain became the chief investment officer. Over the next few years, Jain not only made the right investments, he also expertly steered clear of incorrect and costly mistakes.

By September 2001, the market had pretty much bottomed out and Jain’s portfolio with its defensive positioning stood out. Some in the market say it was Jain’s skills that prompted the newly formed HDFC Mutual Fund to take over Zurich India Mutual Fund in early 2003, a move that paid off handsomely.

Around this time, Jain had the reputation of being a conservative, consistent and dependable fund manager.

Manoj Nagpal, the founder of Outlook Asia Capital, recalls that around 2003-2004, a majority of distributors gave 30-40 percent allocation to HDFC Equity (now renamed HDFC Flexicap Fund) and HDFC Top 200 (now renamed HDFC Top 100 Fund) in client portfolios.

“In 2003, there was a feeling among investors that if you wanted to invest in mutual funds, it had to be HDFC MF,” Nagpal said.

At about this time, another market rally was building up and from 2003 to 2008, Jain’s funds caught the entire infrastructure wave. Once again, to the chagrin of many, Jain had exited his infra investments before the 2008 crash and moved to cyclicals. In fact, HDFC Mutual Fund was the only Indian AMC that had not launched an infra fund at that time.

Challenges and the recoveryJain continued to ride the wave till 2017, never having been accused of any ethical misconduct. He is also known for investing his personal savings in his own funds – much before the regulator made it mandatory late last year. Relying on his convictions, process and foresight, Jain braved many storms, but testing times lay ahead.

After demonetisation in November 2016 and right up to the onset of the pandemic, the market saw a dizzy rise, with the Sensex topping the 40,000 mark. Though this was a phase that favoured the ‘growth’ style of investing, Jain stayed true to conviction and looked to focus on avoiding problem areas instead of investing in momentum stocks.

Anticipating a slowdown in the consumption space, especially in the automobile sector, he was much ahead of the curve when he cut exposure in the consumer cyclical sector to zero in 2018. The sector, and especially the auto space, slowed down significantly in 2019. While he avoided accidents expertly, fund performance did take a beating during this time owing to a large exposure to public sector banks.

Once again, during the worst of the pandemic, HDFC Mutual Fund found itself overweight on corporate banks, capital spending sector and power companies and underweight on consumer staples. The subsequent lockdown impacted the sectors where Jain was overweight the most.

Two choices lay ahead – to take short-term corrective measures and cut losses by exiting or riding out the storm in the belief that the lockdown would be for a limited period. Jain chose to bite the bullet and stay put... and saw a big recovery in portfolios by mid-2021.

Conviction vs performanceOne of the highlights of Jain’s investment style is his willingness to stay put in his high-conviction yet non-performing investments during troubled times. Even when the strategy has been out of favour and the fund has underperformed, he remained steadfast in not deviating from his stated investment approach.

Early last year, I asked Jain what he would sacrifice first – performance or philosophy? His answer couldn’t have been clearer.

“One should not sacrifice investment principles just because you cannot achieve desired returns. No one has achieved anything meaningful without undergoing periods of underperformance in their career,” Jain said.

Roopa Venkatkrishnan, a director at Sapient Wealth Advisors & Brokers, recalls how Jain had shared his vision of the India growth story in the early 2000s. Even when the fund’s performance suffered, Venkatkrishnan said she remained invested in the schemes owing to the strength of Jain’s philosophy.

Fund performanceAt HDFC Mutual Fund, where he was chief investment officer, Jain has been managing three schemes with combined assets of about Rs 90,000 crore as of July 20, which is about 4.5 percent of the equity assets managed by all Indian mutual funds.

The three schemes managed by Jain have delivered alpha returns – exceeding benchmark returns – across all time frames, though they have been marred by periods of sharp underperformance.

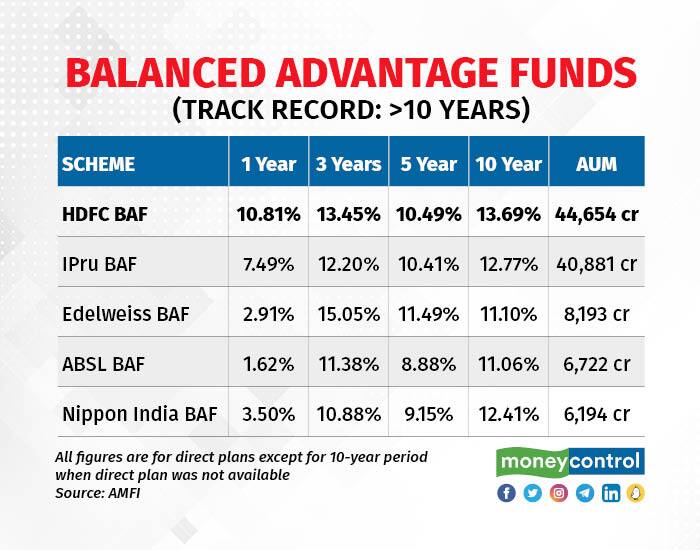

HDFC Balanced Advantage Fund, which was previously known as HDFC Prudence Fund, the third-largest scheme in India, has delivered an alpha of 6.3% over the past one year. Compared with other large funds with a similar track record over 10 years, the scheme has been a consistent outperformer over longer time periods as well. This is the only hybrid fund in India where the debt and equity portions are both overseen by the same fund manager.

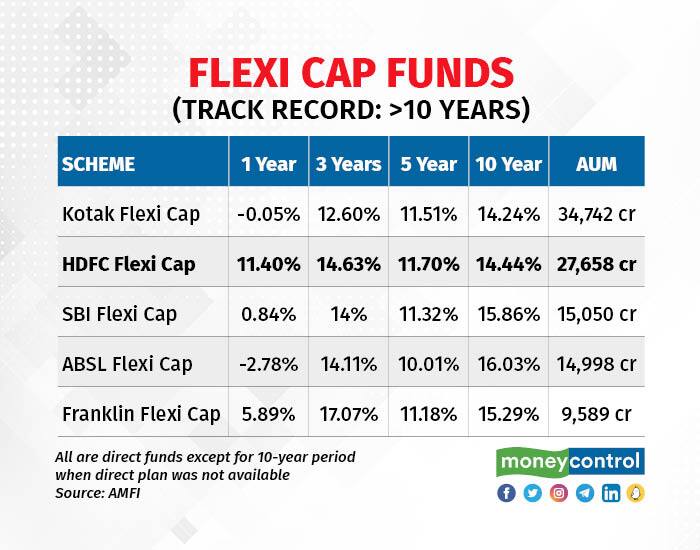

HDFC Flexi Cap Fund, previously known as HDFC Equity Fund, is a legacy scheme of Zurich India, which came into the HDFC MF fold after being acquired in 2003. The scheme started in January 1995 and has been a consistent performer. Compared to other large schemes in the category with a track record of over 10 years, HDFC Flexi Cap has managed to hold its own.

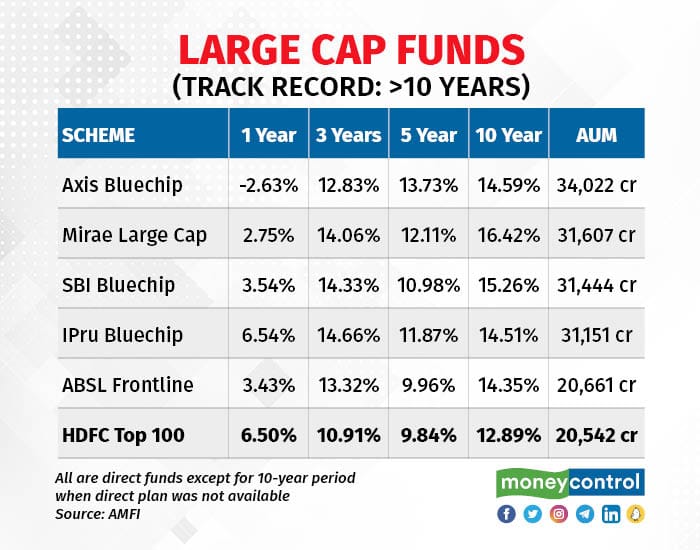

The large-cap scheme managed by Jain is the HDFC Top 100 Fund, formerly known as HDFC Top 200 Fund. This was a marquee scheme for the asset management company at the height of its dominance. Though the scheme has picked up pace once again, over longer periods, it has paid the price of the slump in value stocks.

Jain is known to friends and acquaintances as a simple, grounded and god-fearing individual. Like all geniuses, Jain too has some eccentricities.

He is known to be a loner who has seen a sizeable churn in his research team. The focus on his philosophy, some say, may have insulated him from new ideas.

He has also been criticised in some circles for not having taken active interest in grooming the next rung of fund managers at HDFC Mutual Fund.

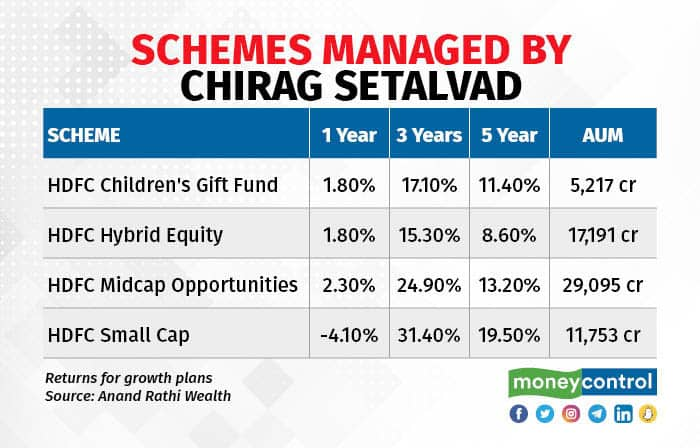

Succession planIt’s not that HDFC Mutual Fund will be short of star talent. Chirag Setalvad, another long-time loyalist, will be elevated to CIO-Equity, while Shobhit Mehrotra is set to take charge as CIO-Fixed Income.

Setalvad has spent 22 years in fund management and equity research and four years in investment banking. He manages over Rs 63,000 crore of assets across four funds: HDFC Midcap Opportunities, HDFC Hybrid Equity, HDFC Small Cap and HDFC Children’s Gift Fund.

Setalvad’s investment philosophy lays equal emphasis on managing portfolio risk and volatility. While the focus remains on good quality companies, he believes in maintaining a well-diversified portfolio. He follows a bottom-up stock-picking approach and identifies companies with reasonable growth prospects, sound financial strength, sustainable business models and good management quality. He buys stocks with a medium to long-term view and looks at buying companies trading at sensible valuations.

Mehrotra has over 25 years of experience and collectively manages over Rs 35,000 crore of assets across more than 20 debt funds.

The asset management company is spearheaded by investing veteran Navneet Munot, who joined as CEO in February 2021 after serving as CIO of SBI Mutual Fund for 12 years. While Munot may no longer be taking active investment calls, he will be sure to steady the team with his expertise and vision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.